Answered step by step

Verified Expert Solution

Question

1 Approved Answer

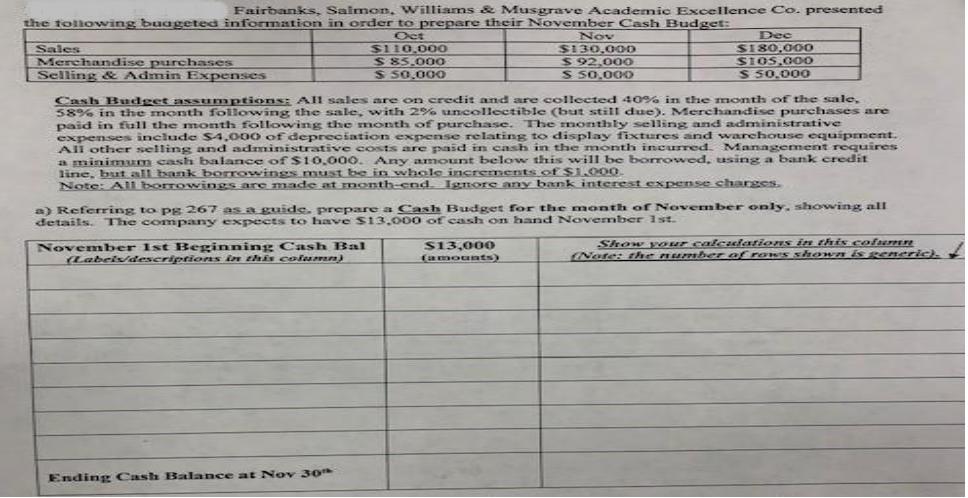

Fairbanks, Salmon, Williams & Musgrave Academic Excellence Co. presented the tollowing buageted information in order to prepare their November Cash Budget: Oct $4110.00O S

Fairbanks, Salmon, Williams & Musgrave Academic Excellence Co. presented the tollowing buageted information in order to prepare their November Cash Budget: Oct $4110.00O S 85.000 S SO. 000 Sales Merchandise purchases Selling & Admin Expenses Nov $130,00D 592.000 S S0.000 Dec S180,000 $105.0O S 50,000 Cash Budget assumptions: All sales are on credit and are collected 40% in the month of the sale, 58% in the month following the sale, with 2% uncollectible (but still due). Merchandise purchases are paid in fall the month following the month of purchase. expenses include $4.000 of depreciation expense relating to display fixtures and warchouse equipment. All other selling and administrative costs are paid in cash in the month incurred. Management requires a minimRRm cash balance of $10,00o. Any amount below this will be borrowed, using a bank credit line, but all bank borowings must be in whole increments of $L000 Note: All borrowings are made at month-end. Igmore any bank interest expense charges. The monthly selling and administrative a) Referring to pg 267 as a guide. prepare a Cash Budget for the month of November only, showing all details. The company expects to have S13,000 of cash on hand November 1st. November 1st Beginning Cash Bal (Labeldescriptios in this column) S13,000 (amounts) Show your calculations in this cofuPERE (Note: the numbher af roKS shown is generic). Ending Cash Balance at Nov 30

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer Cash Budget November 1st Beginning Cash Balance Add Cash Receipts November Sales October ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started