Answered step by step

Verified Expert Solution

Question

1 Approved Answer

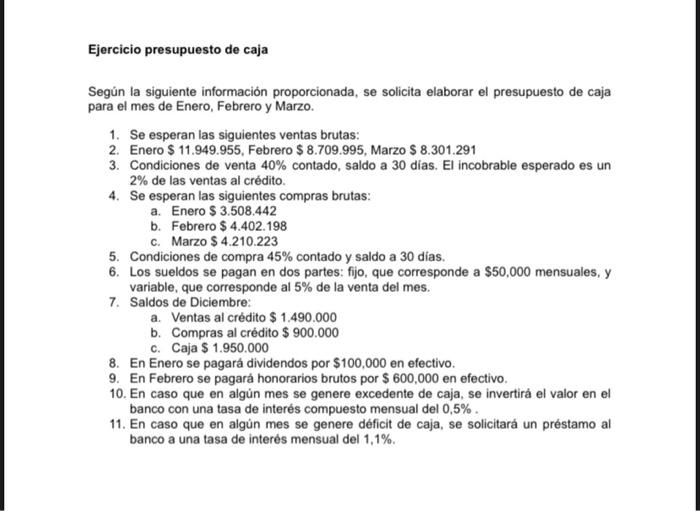

Cash budget exercise According to the following information provided, it is requested to prepare the cash budget for the months of January, February and March.

Cash budget exercise

According to the following information provided, it is requested to prepare the cash budget for the months of January, February and March.

The following gross sales are expected:

2. January $11,949,955, February $8,709,995, March $8,301,291

3. Conditions of sale 40% cash, balance at 30 days. The expected uncollectible is a

2% of credit sales.

4. The following gross purchases are expected:

a. January $3,508,442

b. February $4,402,198

c.

March $4,210,223

5. Purchase conditions 45% cash and balance at 30 days.

6. Salaries are paid in two parts: fixed, which corresponds to $50,000 per month, and variable, which corresponds to 5% of the month's sales.

7. December balances:

a. Credit sales $1,490,000

b. Credit purchases $ 900,000

Cash $1,950,000

8. Dividends of $100,000 in cash will be paid in January.

9. In February, gross fees of $600,000 will be paid in cash.

10. In the event that a cash surplus is generated in any month, the value will be invested in the bank with a compound monthly interest rate of 0.5%.

11. In the event that a cash deficit is generated in any month, a loan will be requested from the bank at a monthly interest rate of 1.1%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started