(cash budget from excel)

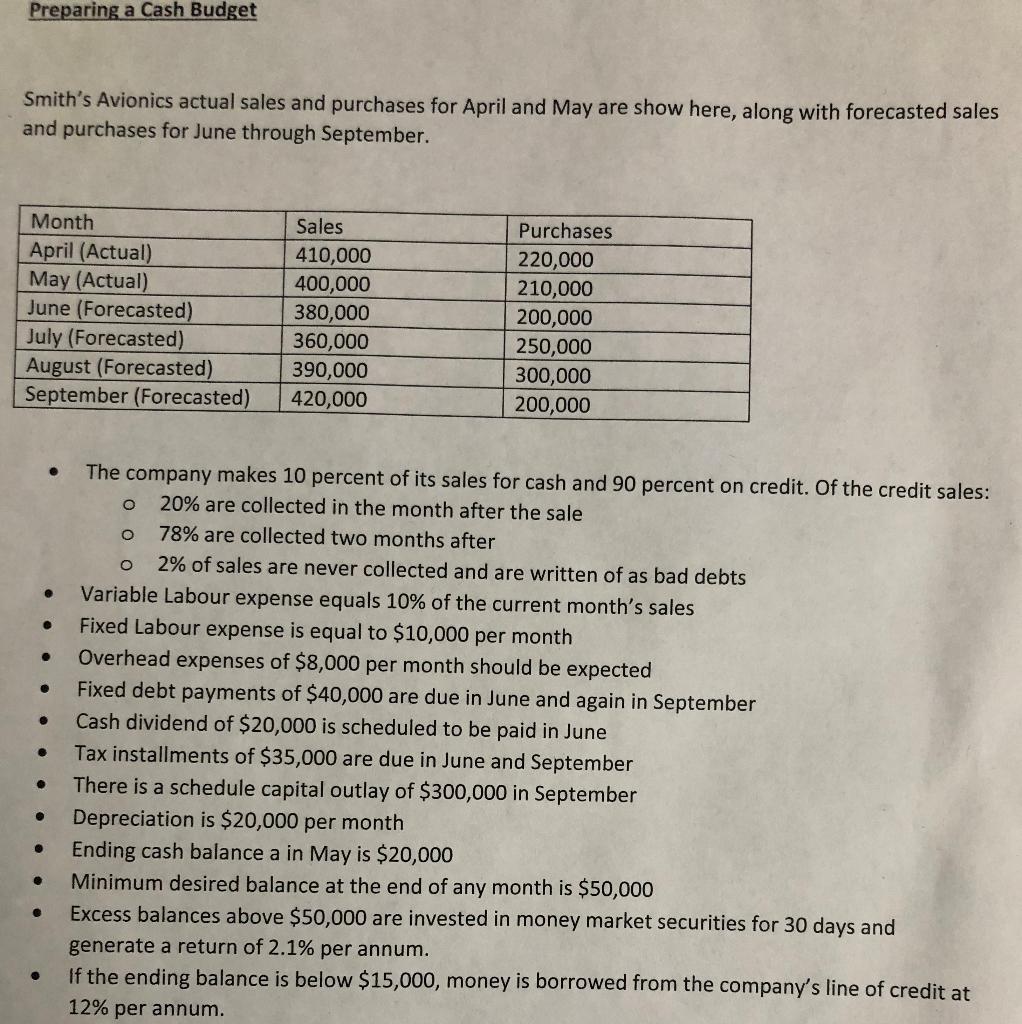

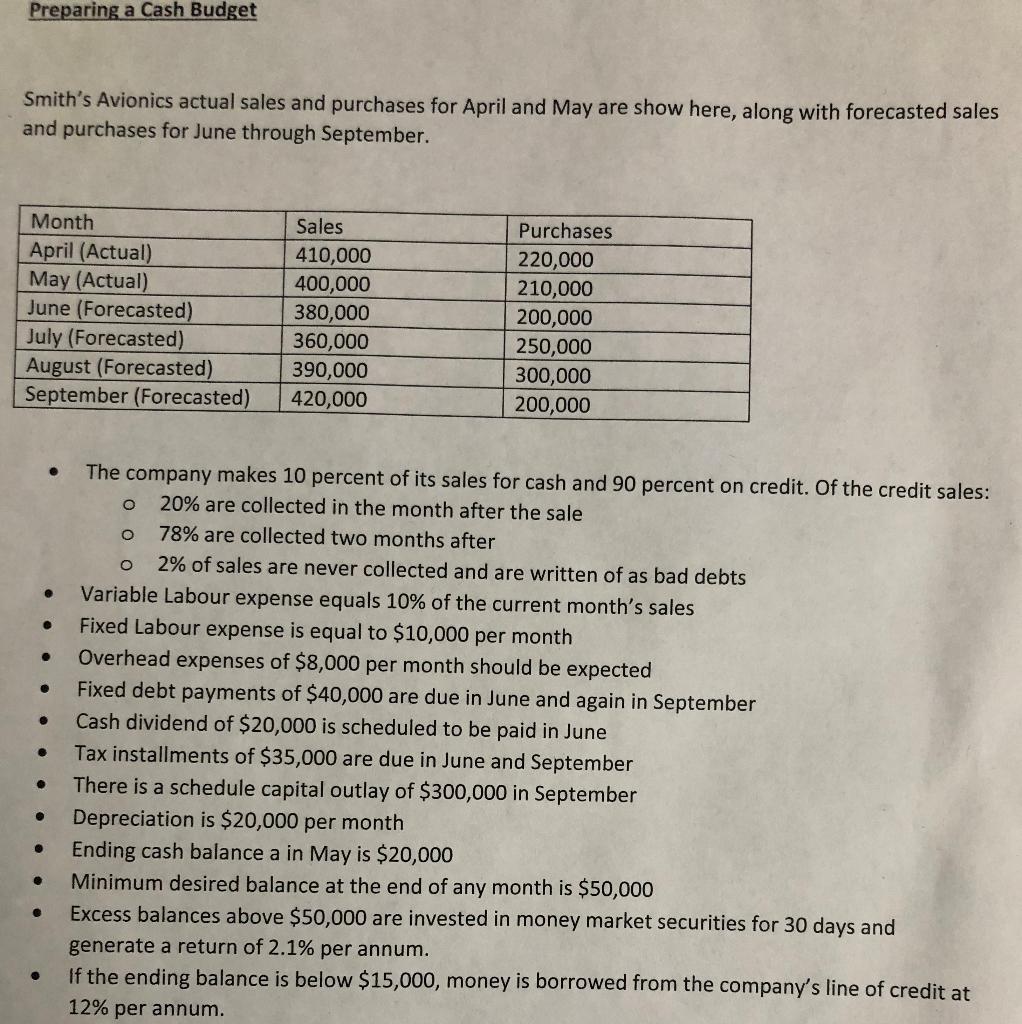

Smith's Avionics actual sales and purchases for April and May are show here, along with forecasted sales and purchases for June through September. - The company makes 10 percent of its sales for cash and 90 percent on credit. Of the credit sales: - 20% are collected in the month after the sale - 78% are collected two months after - 2% of sales are never collected and are written of as bad debts - Variable Labour expense equals 10% of the current month's sales - Fixed Labour expense is equal to $10,000 per month - Overhead expenses of $8,000 per month should be expected - Fixed debt payments of $40,000 are due in June and again in September - Cash dividend of $20,000 is scheduled to be paid in June - Tax installments of $35,000 are due in June and September - There is a schedule capital outlay of $300,000 in September - Depreciation is $20,000 per month - Ending cash balance a in May is $20,000 - Minimum desired balance at the end of any month is $50,000 - Excess balances above $50,000 are invested in money market securities for 30 days and generate a return of 2.1% per annum. - If the ending balance is below $15,000, money is borrowed from the company's line of credit at 12% per annum. Smith's Avionics actual sales and purchases for April and May are show here, along with forecasted sales and purchases for June through September. - The company makes 10 percent of its sales for cash and 90 percent on credit. Of the credit sales: - 20% are collected in the month after the sale - 78% are collected two months after - 2% of sales are never collected and are written of as bad debts - Variable Labour expense equals 10% of the current month's sales - Fixed Labour expense is equal to $10,000 per month - Overhead expenses of $8,000 per month should be expected - Fixed debt payments of $40,000 are due in June and again in September - Cash dividend of $20,000 is scheduled to be paid in June - Tax installments of $35,000 are due in June and September - There is a schedule capital outlay of $300,000 in September - Depreciation is $20,000 per month - Ending cash balance a in May is $20,000 - Minimum desired balance at the end of any month is $50,000 - Excess balances above $50,000 are invested in money market securities for 30 days and generate a return of 2.1% per annum. - If the ending balance is below $15,000, money is borrowed from the company's line of credit at 12% per annum