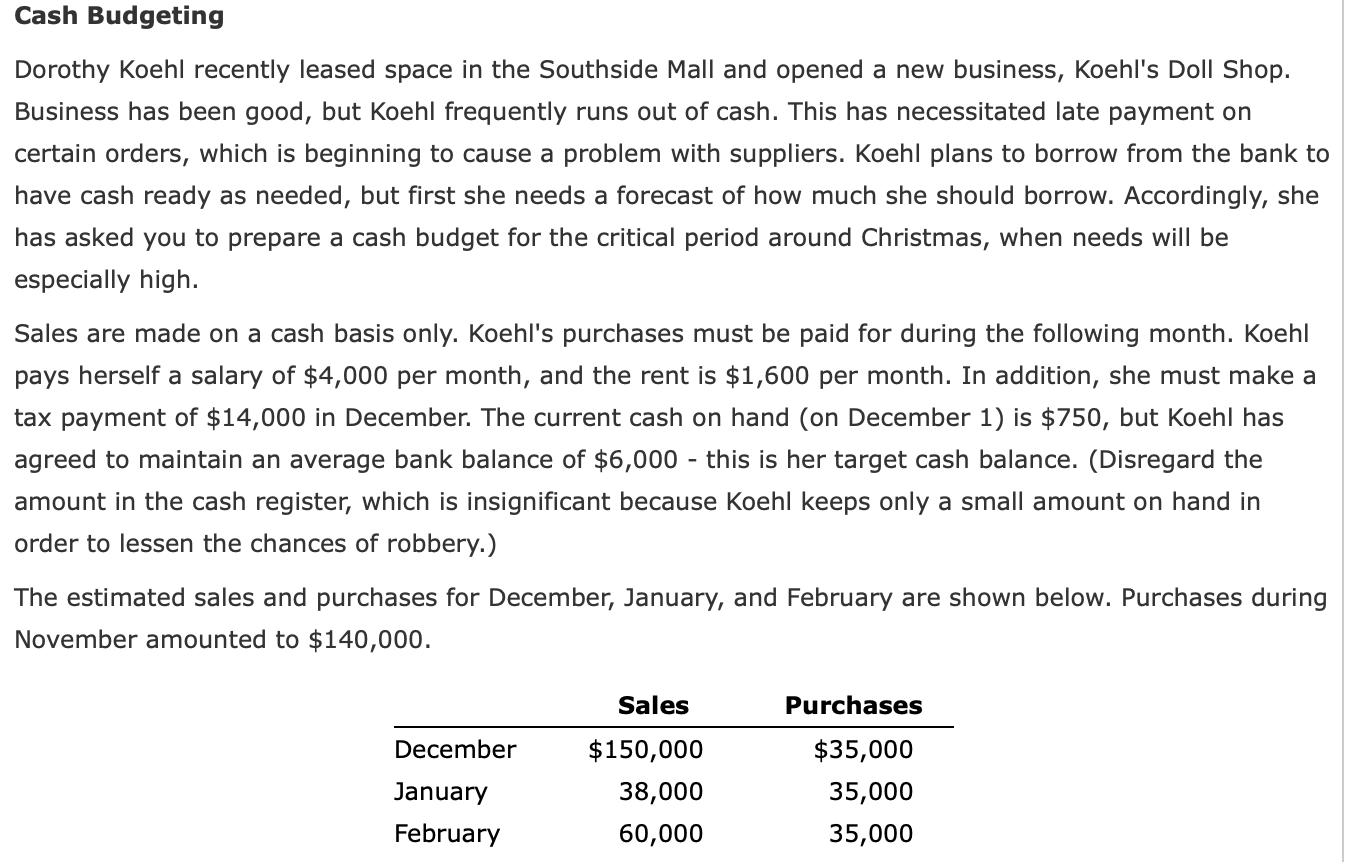

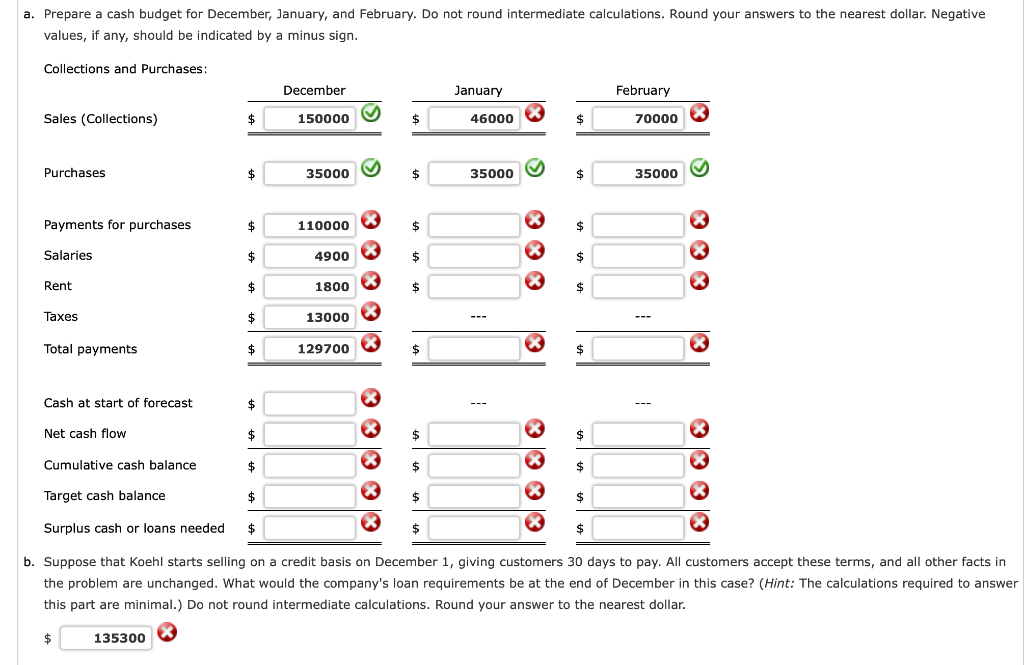

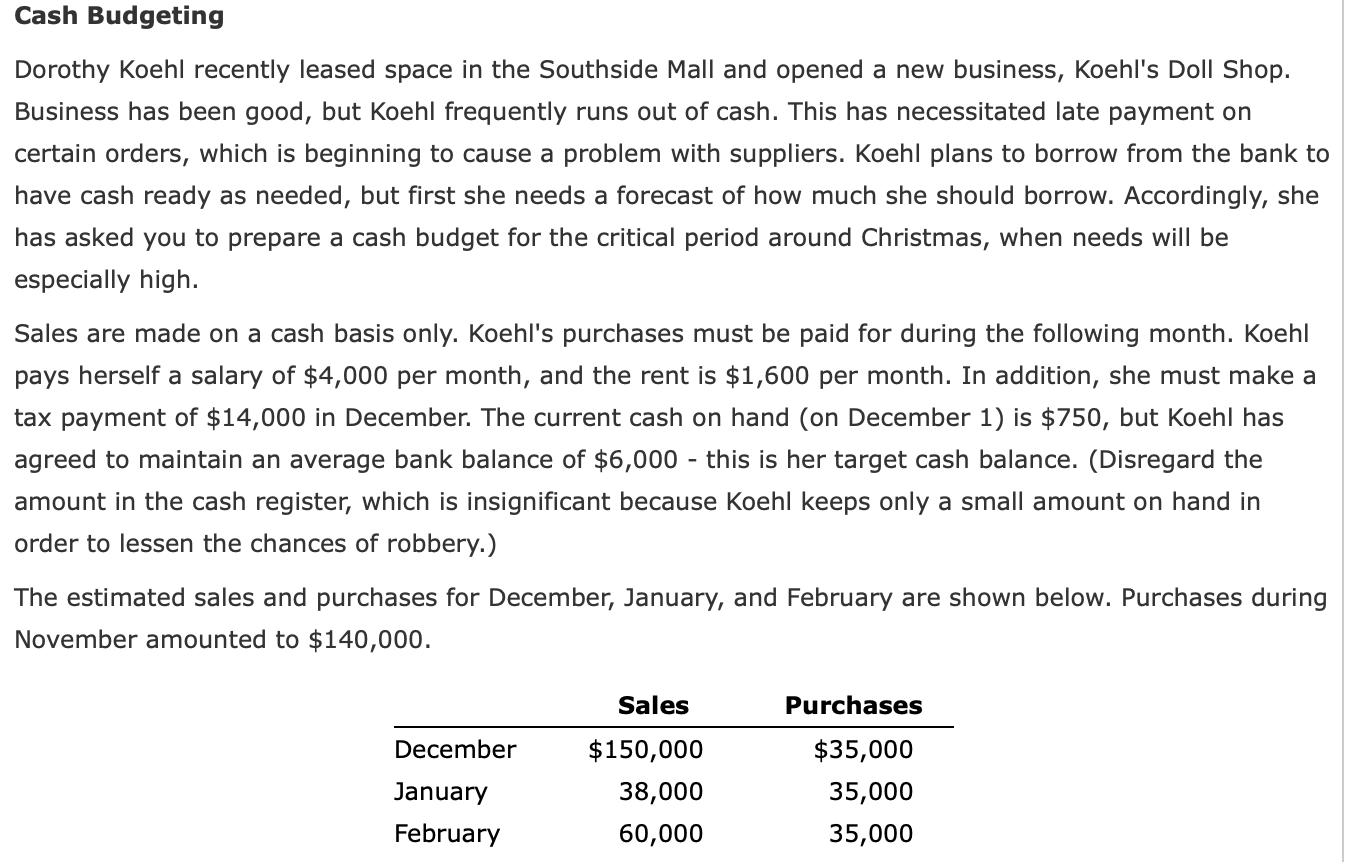

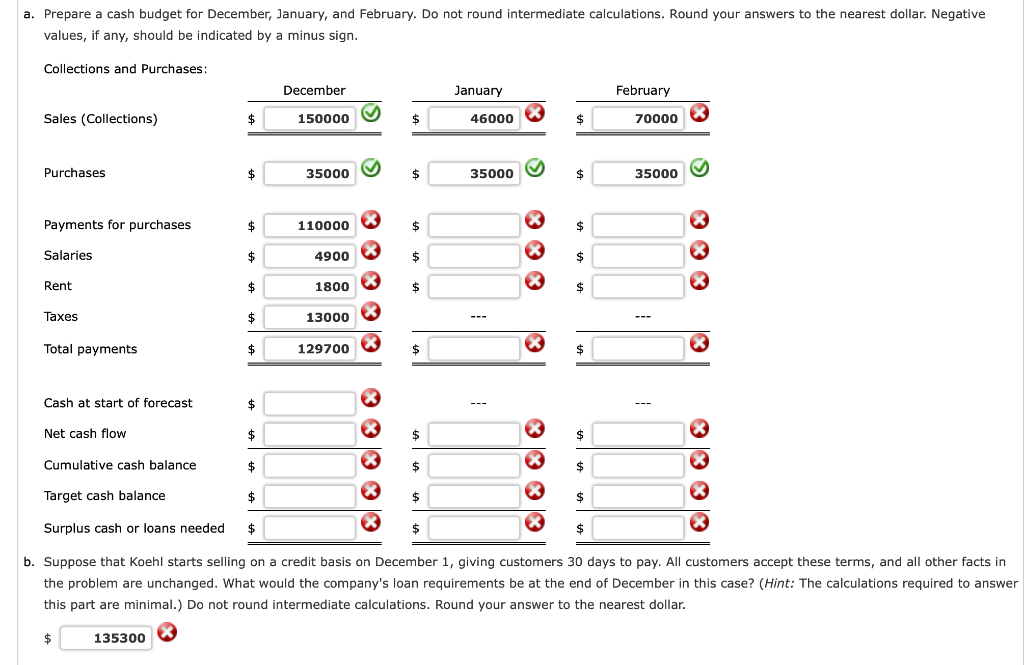

Cash Budgeting Dorothy Koehl recently leased space in the Southside Mall and opened a new business, Koehl's Doll Shop. Business has been good, but Koehl frequently runs out of cash. This has necessitated late payment on certain orders, which is beginning to cause a problem with suppliers. Koehl plans to borrow from the bank to have cash ready as needed, but first she needs a forecast of how much she should borrow. Accordingly, she has asked you to prepare a cash budget for the critical period around Christmas, when needs will be especially high. Sales are made on a cash basis only. Koehl's purchases must be paid for during the following month. Koehl pays herself a salary of $4,000 per month, and the rent is $1,600 per month. In addition, she must make a tax payment of $14,000 in December. The current cash on hand (on December 1) is $750, but Koehl has agreed to maintain an average bank balance of $6,000 - this is her target cash balance. (Disregard the amount in the cash register, which is insignificant because Koehl keeps only a small amount on hand in order to lessen the chances of robbery.) The estimated sales and purchases for December, January, and February are shown below. Purchases during November amounted to $140,000. Sales Purchases December January February $150,000 38,000 60,000 $35,000 35,000 35,000 a. Prepare a cash budget for December, January, and February. Do not round intermediate calculations. Round your answers to the nearest dollar. Negative values, if any, should be indicated by a minus sign. Collections and Purchases: December January February Sales Collections) $ 150000 46000 $ 70000 Purchases $ 35000 $ 35000 $ 35000 9 Payments for purchases X $ 110000 $ $ Salaries 4900 $ $ X $ Rent $ 1800 X * * $ $ Taxes $ 13000 Total payments $ 129700 $ 8 $ 3 Cash at start of forecast $ Net cash flow $ X $ $ Cumulative cash balance $ X $ X $ x Target cash balance $ $ $ $ Surplus cash or loans needed $ X $ $ b. Suppose that Koehl starts selling on a credit basis on December 1, giving customers 30 days to pay. All customers accept these terms, and all other facts in , . the problem are unchanged. What would the company's loan requirements be at the end of December in this case? (Hint: The calculations required to answer this part are minimal.) Do not round intermediate calculations. Round your answer to the nearest dollar. $ 135300