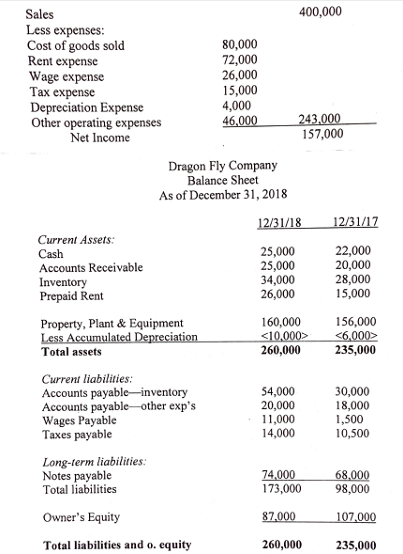

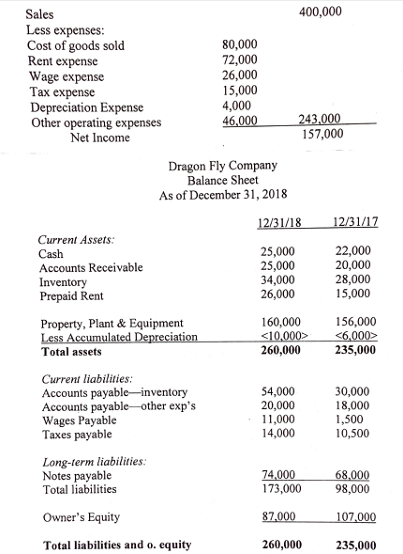

Cash collected from customers Show your work Cash paid for inventory Show your work: Cash paid for rent Show your work: Cash paid for wages Show your work: Cash paid for taxes Show your work Cash paid for OOE Show your work Sales 400,000 Less expenses: Cost of goods sold 80,000 Rent expense 72,000 Wage expense 26,000 Tax expense 15,000 Depreciation Expense 4,000 Other operating expenses 46,000 243,000 Net Income 157,000 Dragon Fly Company Balance Sheet As of December 31, 2018 12/31/18 12/31/17 Current Assets: Cash 25,000 22,000 Accounts Receivable 25,000 20,000 Inventory 34,000 28,000 Prepaid Rent 26,000 15,000 Property, Plant & Equipment 160,000 156,000 Less Accumulated Depreciation Total assets 260,000 235,000 Current liabilities: Accounts payable-inventory 54,000 30,000 Accounts payable-other exp's 20,000 18,000 Wages Payable 11,000 1,500 Taxes payable 14,000 10,500 Long-term liabilities: Notes payable 74,000 68,000 Total liabilities 173,000 98,000 Owner's Equity 87.000 107,000 Total liabilities and o. equity 260,000 235,000 Cash collected from customers Show your work Cash paid for inventory Show your work: Cash paid for rent Show your work: Cash paid for wages Show your work: Cash paid for taxes Show your work Cash paid for OOE Show your work Sales 400,000 Less expenses: Cost of goods sold 80,000 Rent expense 72,000 Wage expense 26,000 Tax expense 15,000 Depreciation Expense 4,000 Other operating expenses 46,000 243,000 Net Income 157,000 Dragon Fly Company Balance Sheet As of December 31, 2018 12/31/18 12/31/17 Current Assets: Cash 25,000 22,000 Accounts Receivable 25,000 20,000 Inventory 34,000 28,000 Prepaid Rent 26,000 15,000 Property, Plant & Equipment 160,000 156,000 Less Accumulated Depreciation Total assets 260,000 235,000 Current liabilities: Accounts payable-inventory 54,000 30,000 Accounts payable-other exp's 20,000 18,000 Wages Payable 11,000 1,500 Taxes payable 14,000 10,500 Long-term liabilities: Notes payable 74,000 68,000 Total liabilities 173,000 98,000 Owner's Equity 87.000 107,000 Total liabilities and o. equity 260,000 235,000