Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cash column: Since the amount of cash in hand is always more than or equal to the payments, the total amount of receipt side should

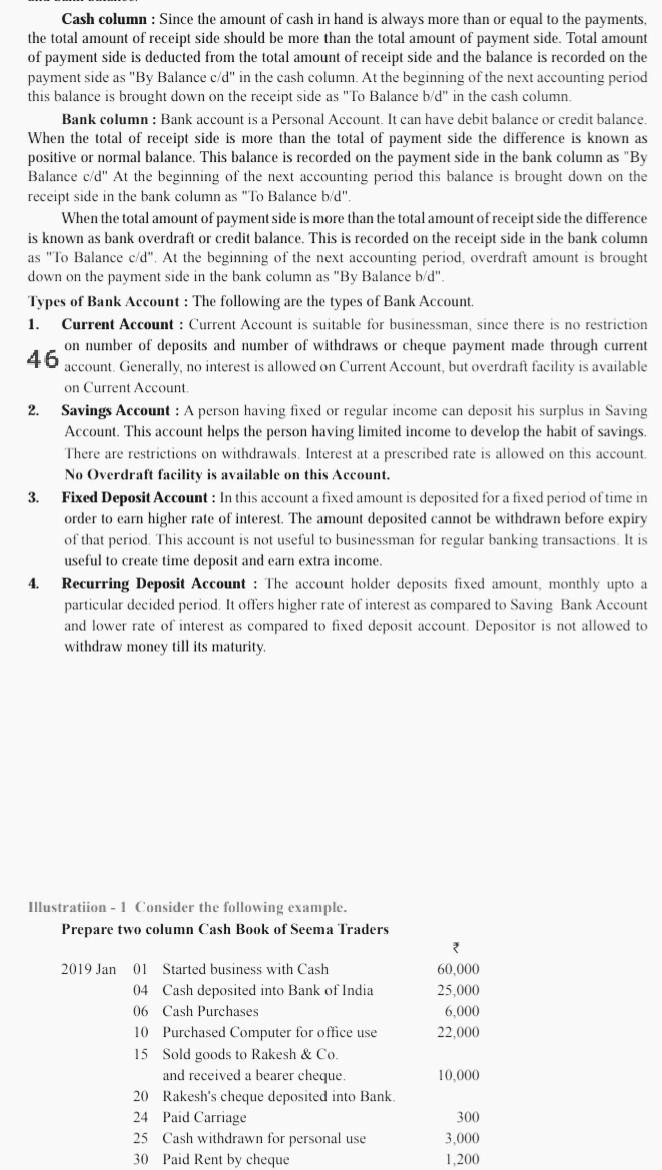

Cash column: Since the amount of cash in hand is always more than or equal to the payments, the total amount of receipt side should be more than the total amount of payment side. Total amount of payment side is deducted from the total amount of receipt side and the balance is recorded on the payment side as "By Balance c/d" in the cash column. At the beginning of the next accounting period this balance is brought down on the receipt side as "To Balance b/d" in the cash column Bank column: Bank account is a Personal Account. It can have debit balance or credit balance. When the total of receipt side is more than the total of payment side the difference is known as positive or normal balance. This balance is recorded on the payment side in the bank column as "By Balance c/d" At the beginning of the next accounting period this balance is brought down on the receipt side in the bank column as "To Balance b/d" When the total amount of payment side is more than the total amount of receipt side the difference is known as bank overdraft or credit balance. This is recorded on the receipt side in the bank column as "To Balance c/d". At the beginning of the next accounting period, overdraft amount is brought down on the payment side in the bank column as "By Balance b/d". Types of Bank Account : The following are the types of Bank Account 1. Current Account : Current Account is suitable for businessman, since there is no restriction on number of deposits and number of withdraws or cheque payment made through current 46 account. Generally, no interest is allowed on Current Account, but overdraft facility is available on Current Account 2. Savings Account: A person having fixed or regular income can deposit his surplus in Saving Account. This account helps the person having limited income to develop the habit of savings There are restrictions on withdrawals. Interest at a prescribed rate is allowed on this account. No Overdraft facility is available on this Account. 3. Fixed Deposit Account : In this account a fixed amount is deposited for a fixed period of time in order to earn higher rate of interest. The amount deposited cannot be withdrawn before expiry of that period. This account is not useful to businessman for regular banking transactions. It is useful to create time deposit and earn extra income. 4. Recurring Deposit Account : The account holder deposits fixed amount, monthly upto a particular decided period. It offers higher rate of interest as compared to Saving Bank Account and lower rate of interest as compared to fixed deposit account. Depositor is not allowed to withdraw money till its maturity. Illustration - 1 Consider the following example. Prepare two column Cash Book of Seema Traders 60.000 25,000 6.000 22.000 2019 Jan 01 Started business with Cash 04 Cash deposited into Bank of India 06 Cash Purchases 10 Purchased Computer for office use 15 Sold goods to Rakesh & Co. and received a bearer cheque. 20 Rakesh's cheque deposited into Bank 24 Paid Carriage 25 Cash withdrawn for personal use 30 Paid Rent by cheque 10,000 300 3,000 1.200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started