Question

(Cash conversion cycle) Historical data for the firm's sales, accounts receivable, inventories, and accounts payable for the Crimson Mfg. Company follow: .a. Calculate Crimson's days

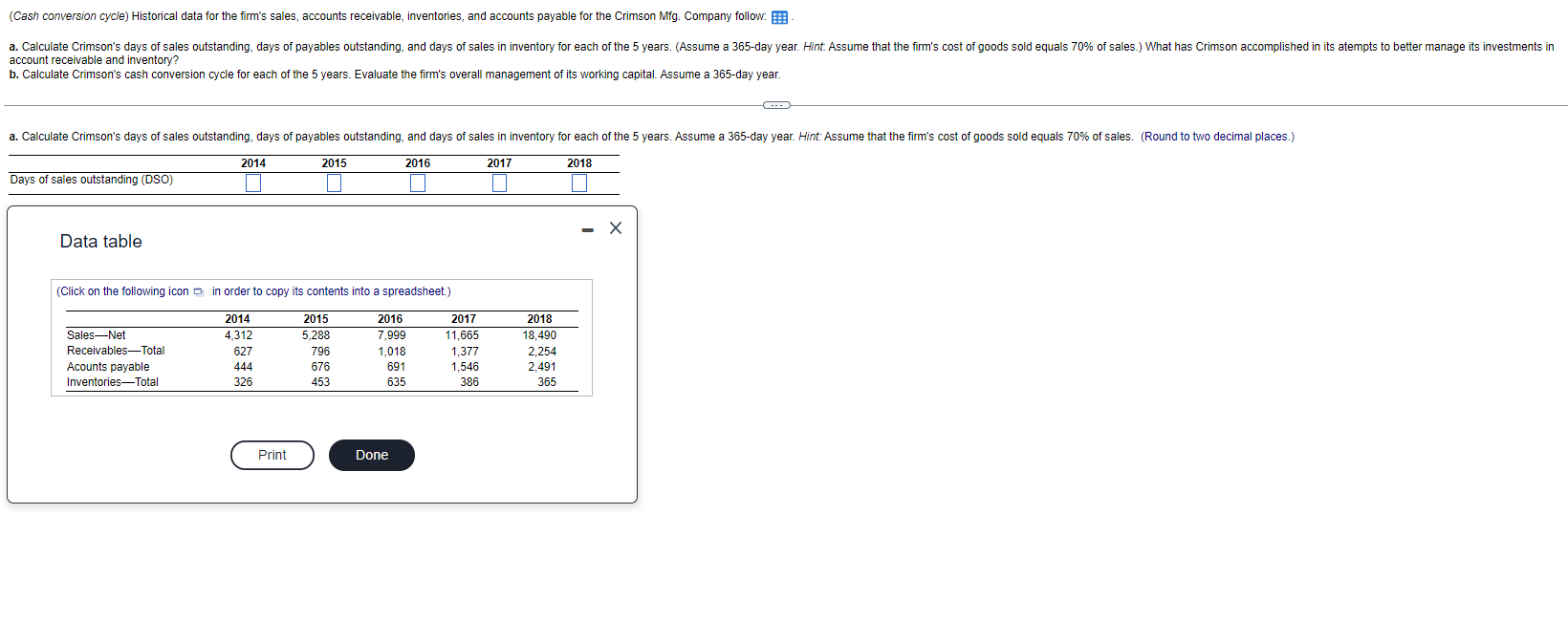

(Cash conversion cycle)

Historical data for the firm's sales, accounts receivable, inventories, and accounts payable for the Crimson Mfg. Company follow:

.a. Calculate Crimson's days of sales outstanding, days of payables outstanding, and days of sales in inventory for each of the 5 years. (Assume a 365-day year.Hint:Assume that the firm's cost of goods sold equals 70% of sales.) What has Crimson accomplished in its attempts to better manage its investments in account receivable and inventory?

b. Calculate Crimson's cash conversion cycle for each of the 5 years. Evaluate the firm's overall management of its working capital. Assume a 365-day year.

Question content area bottom

Part 1

a. Calculate Crimson's days of sales outstanding, days of payables outstanding, and days of sales in inventory for each of the 5 years. Assume a 365-day year. Hint: Assume that the firm's cost of goods sold equals 70% of sales.(Round to two decimal places.)

| 2014 | 2015 | 2016 | 2017 | 2018 | |

| Days of sales outstanding (DSO) | enter your response here | enter your response here | enter your response here | enter your response here | enter your response here |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started