Answered step by step

Verified Expert Solution

Question

1 Approved Answer

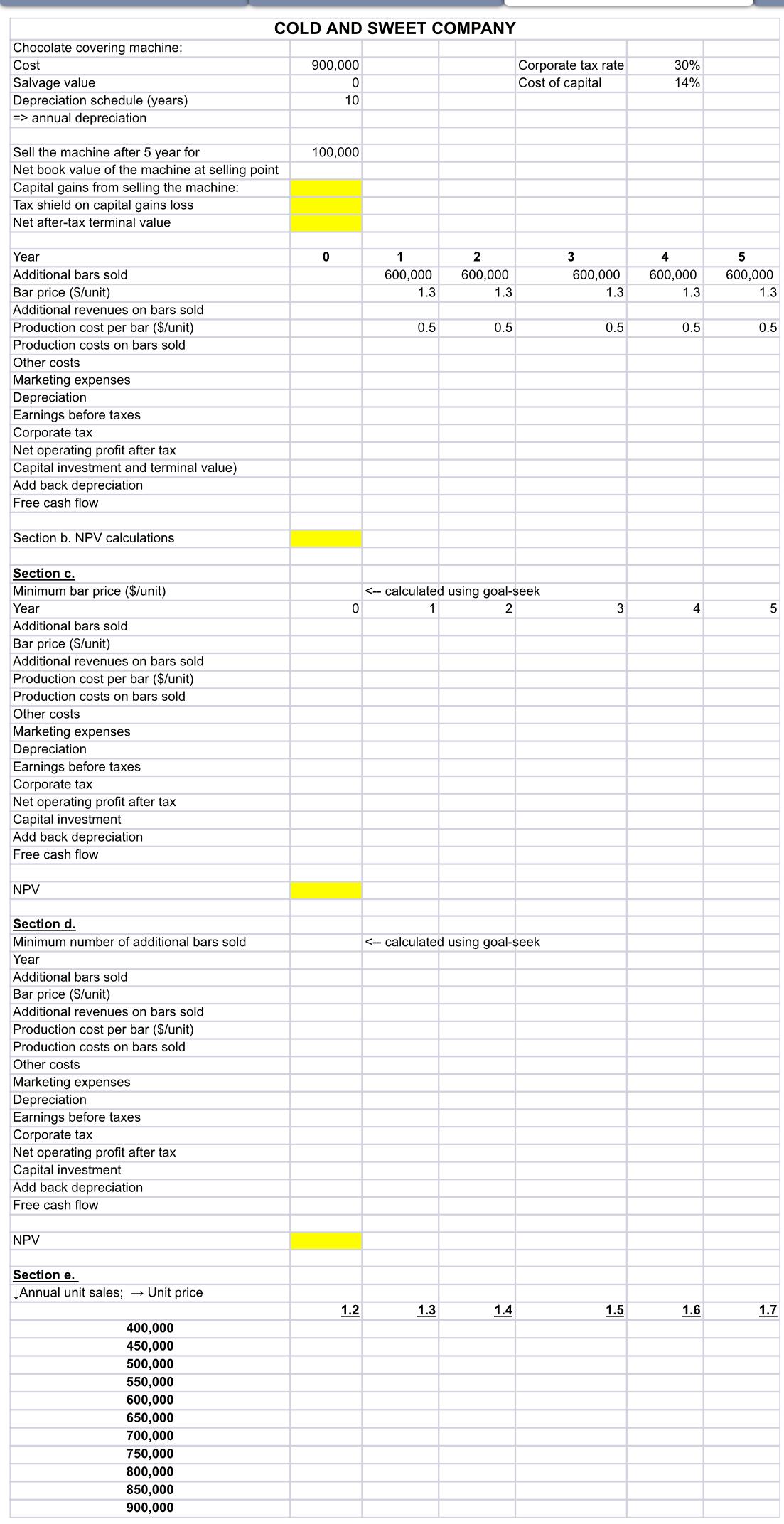

Cash - flow analysis ) The Cold and Sweet ( C&S ) company manufactures ice cream bars. The company is considering the purchase of a

Cashflow analysis The "Cold and Sweet" C&S company manufactures ice cream bars. The company is considering the purchase of a new machine that will top the bar with highquality chocolate. The cost of the machine is $ The machine will be depreciated over years to zero salvage value. However, the company intends to use the machine for only years. Management thinks that the sale price of the machine at the end of years will be $The machine can produce up to million ice cream bars annually. The marketing director of C&S believes that if the company will spend $ on advertising in the first year and another $ in each of the following years, the company will be able to sell bars for $ each. The cost of producing each bar is $ and other costs related to the new products are $ annually. C&Ss cost of capital is and the corporate tax rate is a What are the capital gainslosses from selling the machine after years?b What is the NPV of the project if the marketing director's projections are correct?c What is the minimum price that the company should charge for each bar if the project is to be profitable? Assume that the price of the bar does not affect sales.d The C&S Marketing Vice President suggested canceling the advertising campaign. In his opinion, the company sales will not be reduced significantly due to the cancellation. What is the minimum

COLD AND SWEET COMPANY 900,000 0 Corporate tax rate Cost of capital 30% 14% 10 Chocolate covering machine: Cost Salvage value Depreciation schedule (years) => annual depreciation Sell the machine after 5 year for Net book value of the machine at selling point Capital gains from selling the machine: Tax shield on capital gains loss Net after-tax terminal value Year Additional bars sold Bar price ($/unit) Additional revenues on bars sold Production cost per bar ($/unit) Production costs on bars sold Other costs Marketing expenses Depreciation Earnings before taxes Corporate tax Net operating profit after tax Capital investment and terminal value) Add back depreciation Free cash flow Section b. NPV calculations Section c. Minimum bar price ($/unit) Year Additional bars sold Bar price ($/unit) Additional revenues on bars sold Production cost per bar ($/unit) Production costs on bars sold Other costs Marketing expenses Depreciation Earnings before taxes Corporate tax Net operating profit after tax Capital investment Add back depreciation Free cash flow 100,000 0 1 2 600,000 600,000 1.3 1.3 3 5 600,000 1.3 600,000 600,000 1.3 1.3 0.5 0.5 0.5 0.5 0.5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started