Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cash Flow (ANSWER ALL TRUE FALSE AND STATEMENT PLEASE!) Understanding the concept of cash flows and the difference between cash flows and let Income Is

Cash Flow (ANSWER ALL TRUE FALSE AND STATEMENT PLEASE!)

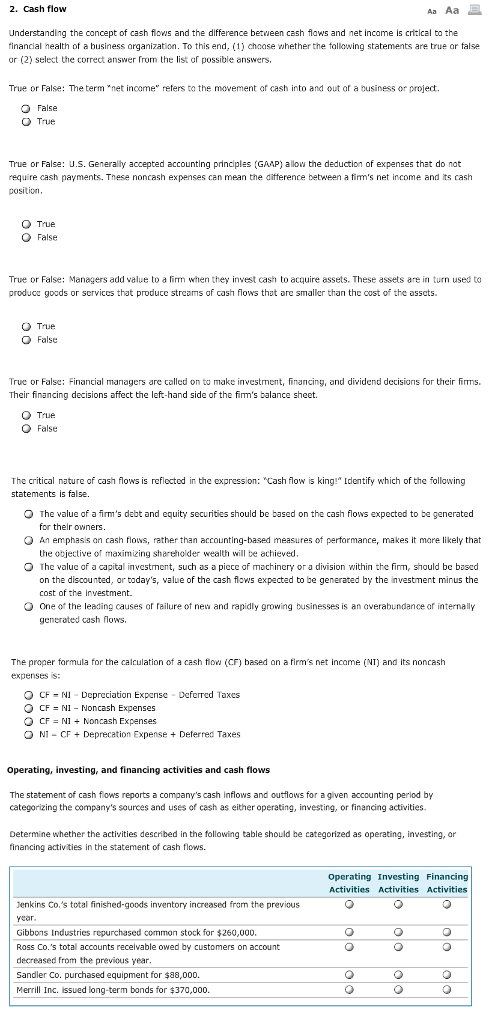

Understanding the concept of cash flows and the difference between cash flows and let Income Is critical to the financial health of a business organization. To this end, (1) choose whether the following statements are true nr false or (2) select the correct answer from the list of possible answers. True or False: The term "net income" refers to the movement of cash into and out or a business or project. False True True or False: U.S. Generally accepted accounting principles (GAAP) allow the deduction of expenses that do not require cash payments. These noncash expenses ran mean the difference between a firm's net income and its rash position. True False True or False: Manners add value to a firm when they invest cash to acquire assets. These assets at in turn used to produce goods or services that produce streams of cash flows that are smaller than the cost of the assets. True False True or False: Financial manager are called on to make investment, financing, and dividend decisions for their firms. Their financing decisions affect the left-hand side of the firm's balance sheet. True False The critical nature of cash flows is reflected in the express on: "Cash flow is king" Identify which of the following statements is false. The value of a firm's debt and equity securities should be based on the cash flows expected to be generated for their owners. An emphasis on rash flows, rather than accounting-based measures of performance, makes It more likely that the Objective of maximizing wealth will be achieved. the value of a capital investment, such so a piece of machinery or a division within the firm, should be based on the discounted. or today's, value of the cash flows expected to be generated by the investment minus the cost of the investment. One of the leasing causes or failure of new and rapidly growing Businesses is an overabundance of internally generated cash flows. The proper formula for the calculation of a cash flow (CF) based on a firm's net Income (NT) and Its noncash expenses is: CF=N1 Depreciation Expense Deferred Taxes CF = N1 - Noncash Expenses CF = N1 + Noncash Expenses N1 - CF + Depredation Expense + Deterred Taxes Operating, investing, and financing activities and cash flows The statement of cash flows reports a company's cash inflows and outflows for a given accounting period by categorizing the company's sources and uses of cash as either operating, investing, or financing activities Determine whether the activities described in the following table should be categorized as operating, investing, or financing activities in the statement of cash flowsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started