Question

Cash Flow Budget information Pretend that it's the end of 2023. We'll complete a cash flow budget for 2024 over the next couple of days.

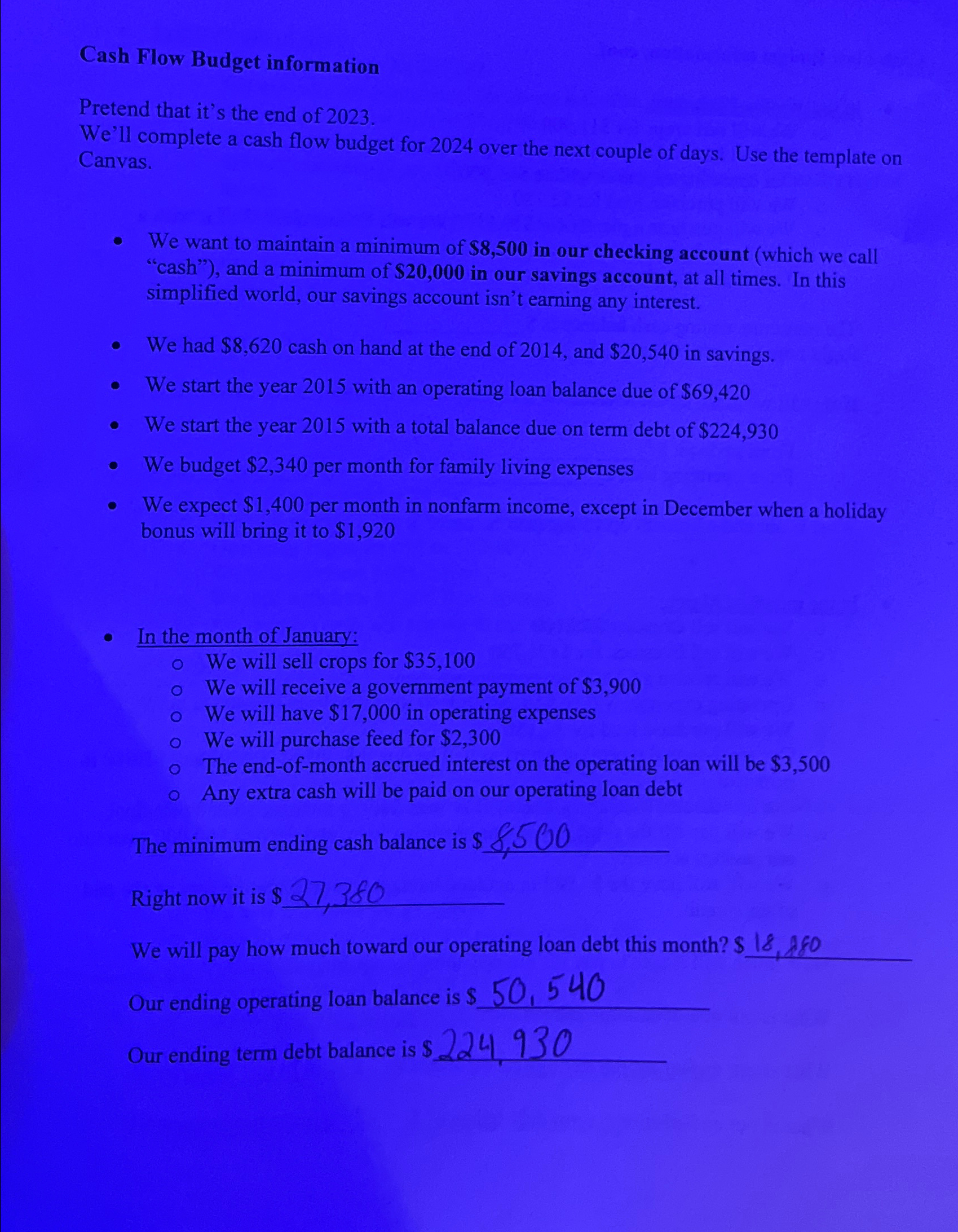

Cash Flow Budget information\ Pretend that it's the end of 2023.\ We'll complete a cash flow budget for 2024 over the next couple of days. Use the template on Canvas.\ We want to maintain a minimum of

$8,500in our checking account (which we call "cash"), and a minimum of

$20,000in our savings account, at all times. In this simplified world, our savings account isn't earning any interest.\ We had

$8,620cash on hand at the end of 2014 , and

$20,540in savings.\ We start the year 2015 with an operating loan balance due of

$69,420\ We start the year 2015 with a total balance due on term debt of

$224,930\ We budget

$2,340per month for family living expenses\ We expect

$1,400per month in nonfarm income, except in December when a holiday bonus will bring it to

$1,920\ In the month of January:\ We will sell crops for

$35,100\ We will receive a government payment of

$3,900\ We will have

$17,000in operating expenses\ We will purchase feed for

$2,300\ The end-of-month accrued interest on the operating loan will be

$3,500\ Any extra cash will be paid on our operating loan debt\ The minimum ending cash balance is

$8,500\ Right now it is

$27,380\ We will pay how much toward our operating loan debt this month?

$18,180\ Our ending operating loan balance is

$50,540\ Our ending term debt balance is

$224,930

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started