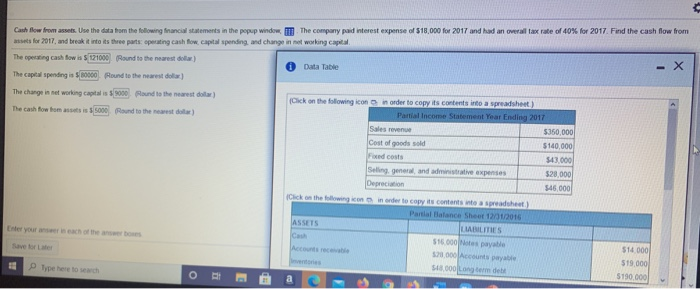

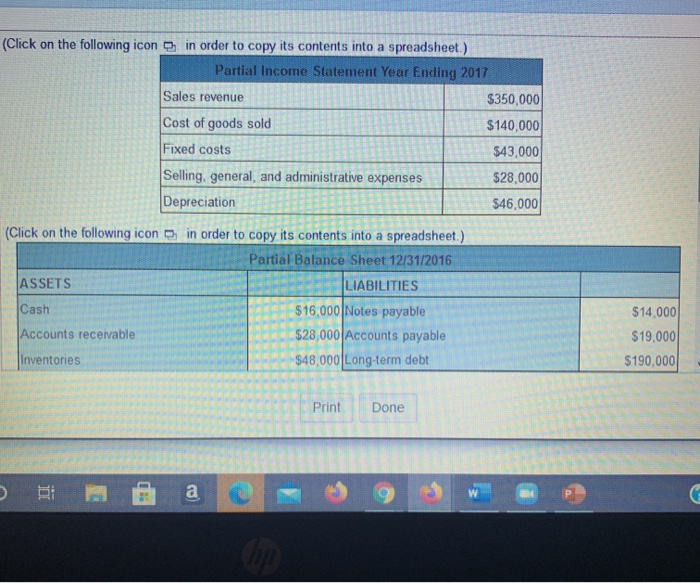

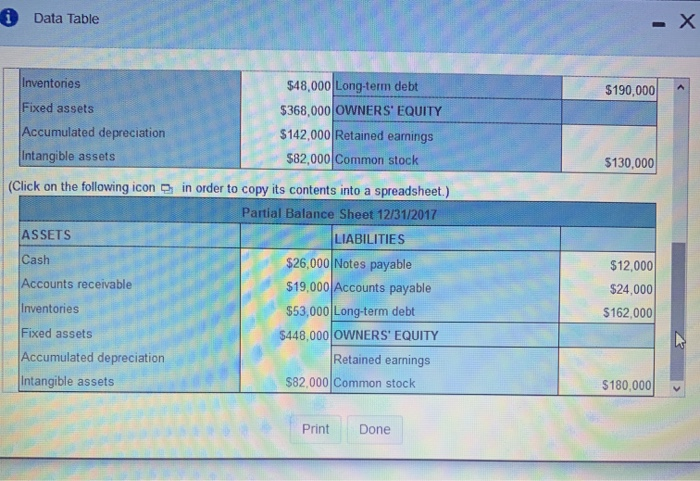

Cash flow from assets. Use the data from the following financial statements in the popup window The company paid interest expense of $18,000 for 2017 and had an overall tax rate of 40% for 2017. Find the cash flow from sets for 2017, and break it into its three parts operating cash flow capital spending and change in the working capital - X The operating cash low is 5121000 Round to the nearest dollar) Data Table The capital spending is 10000 Pound to the nearest dollar The change in networking capital is 39000 Pound to the nearest dollar) (Click on the following icon in order to copy its contents into a spreadsheet) The cash fow to set is 5000 Round to the newest dolar) Partial Income Statement Year Ending 2017 Sales revenue $350,000 Cost of goods sold $140,000 Fixed costs $43.000 Selling general and administrative expenses 528,000 Depreciation $45.000 Click on the wing on in order to copy its contents into a spreadsheet Partlal Balance Sheet 123/2016 ASSETS LANILITIES C 516000 Notes payable 514 000 Saver 52000 Accounts $19.000 53000 Longe det $190.000 Type here to O E (Click on the following icon in order to copy its contents into a spreadsheet.) Partial Income Statement Year Ending 2017 Sales revenue $350,000 Cost of goods sold $140,000 Fixed costs $43,000 Selling, general, and administrative expenses $28,000 Depreciation $46,000 (Click on the following icon in order to copy its contents into a spreadsheet.) Partial Balance Sheet 12/31/2016 ASSETS Cash LIABILITIES $16.000 Notes payable $28,000 Accounts payable $48,000 Long-term debt Accounts receivable $14,000 $19,000 $190,000 Inventories Print Done a i Data Table Inventories $190,000 Fixed assets Accumulated depreciation Intangible assets $48,000 Long-term debt $368,000 OWNERS' EQUITY $142,000 Retained earings $82,000 Common stock $130,000 (Click on the following icon in order to copy its contents into a spreadsheet.) Partial Balance Sheet 12/31/2017 ASSETS LIABILITIES Cash Accounts receivable $12,000 $24,000 $162,000 Inventories $26,000 Notes payable $19,000 Accounts payable $53,000 Long-term debt $448,000 OWNERS' EQUITY Retained earnings $82,000 Common stock Fixed assets Accumulated depreciation Intangible assets $180,000 Print Done