Question

Cash Flow Hedge: Call Options On June 1, 2023, Capital Foods forecasts that it will purchase 5,000,000 bushels of oats in 3 months for use

Cash Flow Hedge: Call Options

On June 1, 2023, Capital Foods forecasts that it will purchase 5,000,000 bushels of oats in 3 months for use in the manufacture of its snack products. To hedge against rising costs, Capital Foods buys 5,000,000 call options expiring September 1, 2023 for oats, with a strike price of $3.50/bushel. The options cost $0.178/bushel. The spot price on June 1 is $3.60/ bushel. Management designates the intrinsic value of the options as the hedge, and the options qualify as a cash flow hedge of the forecasted purchase. Option time value is straight-line amortized to income. Capital Foods records all income effects of the inventory and the hedge in cost of goods sold. On June 30, 2023, Capital Foods year-end, the spot price for oats is $3.54/bushel and the options are selling for $0.11/bushel. On September 1, 2023, the spot price for oats is $3.58/bushel and Capital Foods sells the options for their intrinsic value of $0.08/bushel. On September 4, 2023, Capital Foods purchases 5,000,000 bushels of oats at the spot price of $3.57/bushel. It sells products containing the oats on October 2, 2023.

Required

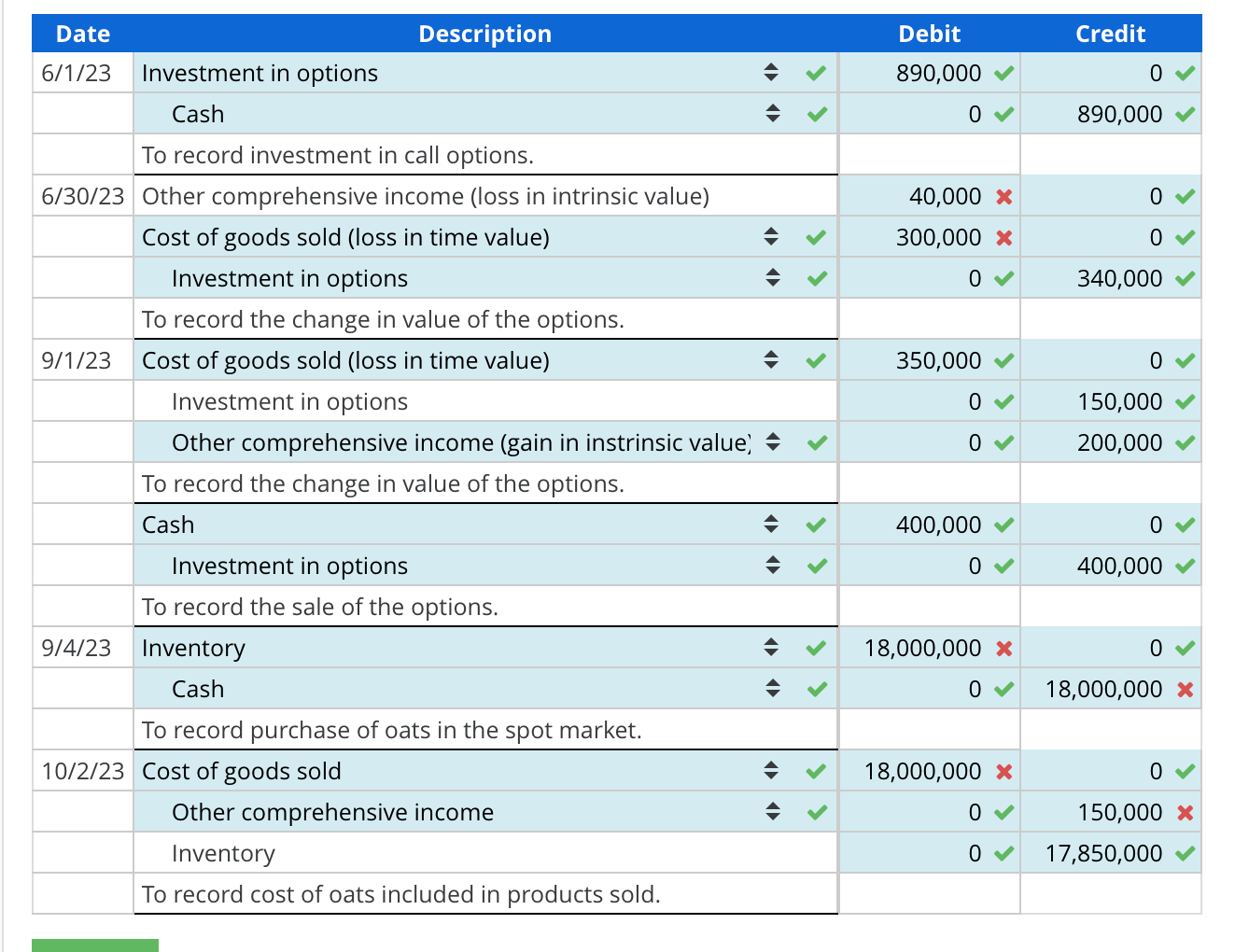

Prepare entries to record the above events, including the June 30, 2023, adjusting entry.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started