Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CASH FLOW MANAGEMENT ACTIVITY RATIONALE The goal of this project is to (1) apply your knowledge to answer the questions in a professional manner and

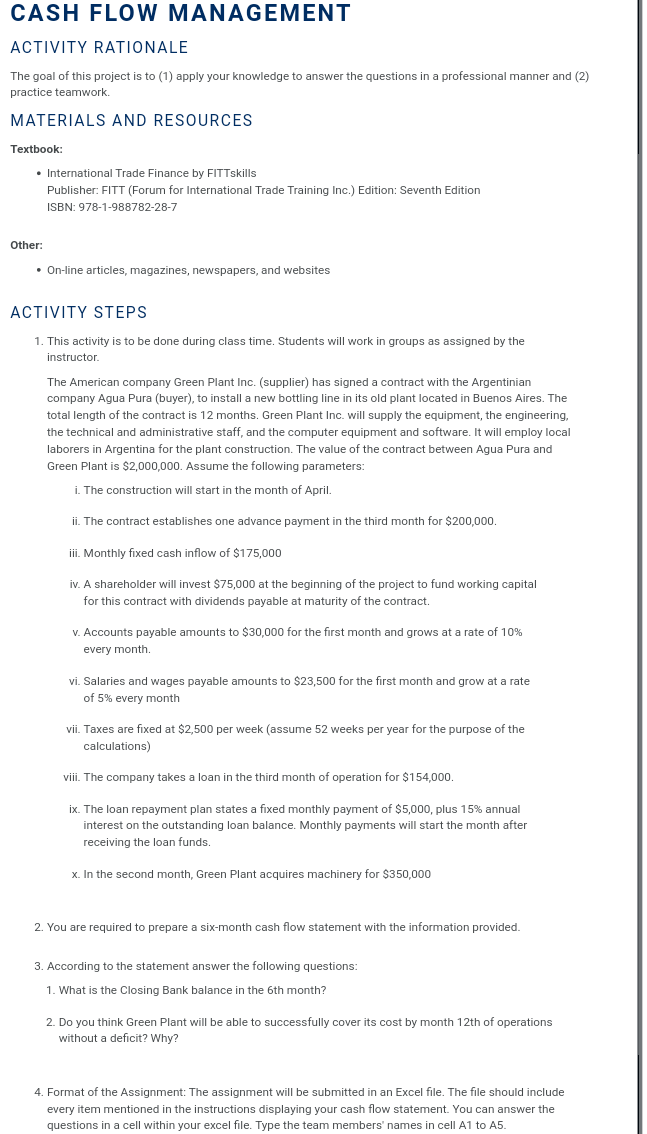

CASH FLOW MANAGEMENT ACTIVITY RATIONALE The goal of this project is to (1) apply your knowledge to answer the questions in a professional manner and (2) practice teamwork. MATERIALS AND RESOURCES Textbook International Trade Finance by FITTskills Publisher: FITT (Forum for International Trade Training Inc.) Edition: Seventh Edition ISBN: 978-1-988782-28-7 Other: On-line articles, magazines, newspapers, and websites ACTIVITY STEPS 1. This activity is to be done during class time. Students will work in groups as assigned by the instructor The American company Green Plant Inc. (supplier) has signed a contract with the Argentinian company Agua Pura (buyer), to install a new bottling line in its old plant located in Buenos Aires. The total length of the contract is 12 months. Green Plant Inc. will supply the equipment, the engineering, the technical and administrative staff, and the computer equipment and software. It will employ local laborers in Argentina for the plant construction. The value of the contract between Agua Pura and Green Plant is $2,000,000. Assume the following parameters: i. The construction will start in the month of April. ii. The contract establishes one advance payment in the third month for $200,000. iii. Monthly fixed cash inflow of $175,000 iv. A shareholder will invest $75,000 at the beginning of the project to fund working capital for this contract with dividends payable at maturity of the contract. V. Accounts payable amounts to $30,000 for the first month and grows at a rate of 10% every month. vi. Salaries and wages payable amounts to $23,500 for the first month and grow at a rate of 5% every month vii. Taxes are fixed at $2,500 per week (assume 52 weeks per year for the purpose of the calculations) viii. The company takes a loan in the third month of operation for $154,000. ix. The loan repayment plan states a fixed monthly payment of $5,000, plus 15% annual interest on the outstanding loan balance. Monthly payments will start the month after receiving the loan funds. x. In the onth, Green Plant acquires achinery for $350,000 2. You are required to prepare a six-month cash flow statement with the information provided. 3. According to the statement answer the following questions: 1. What is the Closing Bank balance in the 6th month? 2. Do you think Green Plant will be able to successfully cover its cost by month 12th of operations without a deficit? Why? 4. Format of the Assignment: The assignment will be submitted in an Excel file. The file should include every item mentioned in the instructions displaying your cash flow statement. You can answer the questions in a cell within your excel file. Type the team members' names in cell A1 to A5. CASH FLOW MANAGEMENT ACTIVITY RATIONALE The goal of this project is to (1) apply your knowledge to answer the questions in a professional manner and (2) practice teamwork. MATERIALS AND RESOURCES Textbook International Trade Finance by FITTskills Publisher: FITT (Forum for International Trade Training Inc.) Edition: Seventh Edition ISBN: 978-1-988782-28-7 Other: On-line articles, magazines, newspapers, and websites ACTIVITY STEPS 1. This activity is to be done during class time. Students will work in groups as assigned by the instructor The American company Green Plant Inc. (supplier) has signed a contract with the Argentinian company Agua Pura (buyer), to install a new bottling line in its old plant located in Buenos Aires. The total length of the contract is 12 months. Green Plant Inc. will supply the equipment, the engineering, the technical and administrative staff, and the computer equipment and software. It will employ local laborers in Argentina for the plant construction. The value of the contract between Agua Pura and Green Plant is $2,000,000. Assume the following parameters: i. The construction will start in the month of April. ii. The contract establishes one advance payment in the third month for $200,000. iii. Monthly fixed cash inflow of $175,000 iv. A shareholder will invest $75,000 at the beginning of the project to fund working capital for this contract with dividends payable at maturity of the contract. V. Accounts payable amounts to $30,000 for the first month and grows at a rate of 10% every month. vi. Salaries and wages payable amounts to $23,500 for the first month and grow at a rate of 5% every month vii. Taxes are fixed at $2,500 per week (assume 52 weeks per year for the purpose of the calculations) viii. The company takes a loan in the third month of operation for $154,000. ix. The loan repayment plan states a fixed monthly payment of $5,000, plus 15% annual interest on the outstanding loan balance. Monthly payments will start the month after receiving the loan funds. x. In the onth, Green Plant acquires achinery for $350,000 2. You are required to prepare a six-month cash flow statement with the information provided. 3. According to the statement answer the following questions: 1. What is the Closing Bank balance in the 6th month? 2. Do you think Green Plant will be able to successfully cover its cost by month 12th of operations without a deficit? Why? 4. Format of the Assignment: The assignment will be submitted in an Excel file. The file should include every item mentioned in the instructions displaying your cash flow statement. You can answer the questions in a cell within your excel file. Type the team members' names in cell A1 to A5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started