Answered step by step

Verified Expert Solution

Question

1 Approved Answer

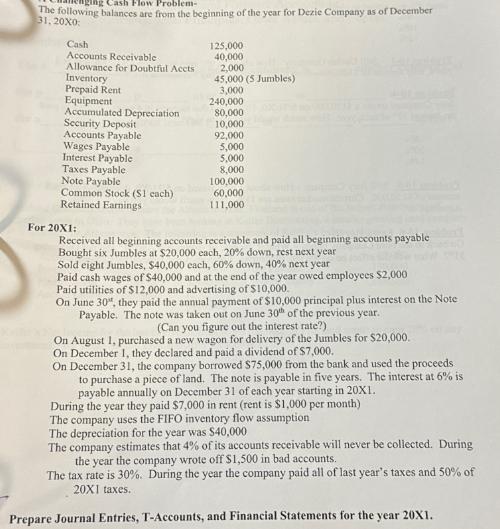

Cash Flow Problem- The following balances are from the beginning of the year for Dezie Company as of December 31, 20X0: Cash Accounts Receivable-

Cash Flow Problem- The following balances are from the beginning of the year for Dezie Company as of December 31, 20X0: Cash Accounts Receivable- 125,000 40,000 Allowance for Doubtful Accts 2,000 Inventory 45,000 (5 Jumbles) Prepaid Rent 3,000 Equipment 240,000 Accumulated Depreciation 80,000 Security Deposit 10,000 Accounts Payable 92,000 Wages Payable 5,000 Interest Payable 5,000 Taxes Payable 8,000 Note Payable 100,000 Common Stock ($1 each) 60,000 111,000) Retained Earnings For 20X1: Received all beginning accounts receivable and paid all beginning accounts payable Bought six Jumbles at $20,000 each, 20% down, rest next year Sold eight Jumbles, $40,000 each, 60% down, 40% next year Paid cash wages of $40,000 and at the end of the year owed employees $2,000 Paid utilities of $12,000 and advertising of $10,000. On June 30", they paid the annual payment of $10,000 principal plus interest on the Note Payable. The note was taken out on June 30th of the previous year. (Can you figure out the interest rate?) On August 1, purchased a new wagon for delivery of the Jumbles for $20,000. On December 1, they declared and paid a dividend of $7,000. On December 31, the company borrowed $75,000 from the bank and used the proceeds to purchase a piece of land. The note is payable in five years. The interest at 6% is payable annually on December 31 of each year starting in 20X1. During the year they paid $7,000 in rent (rent is $1,000 per month) The company uses the FIFO inventory flow assumption The depreciation for the year was $40,000 The company estimates that 4% of its accounts receivable will never be collected. During the year the company wrote off $1,500 in bad accounts. The tax rate is 30%. During the year the company paid all of last year's taxes and 50% of 20X1 taxes. Prepare Journal Entries, T-Accounts, and Financial Statements for the year 20X1.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started