Answered step by step

Verified Expert Solution

Question

1 Approved Answer

cash flow problems Present value problems. a. Shayne Inc, is expected to pay an annual dividend each year of $5.40 per share of common stock.

cash flow problems

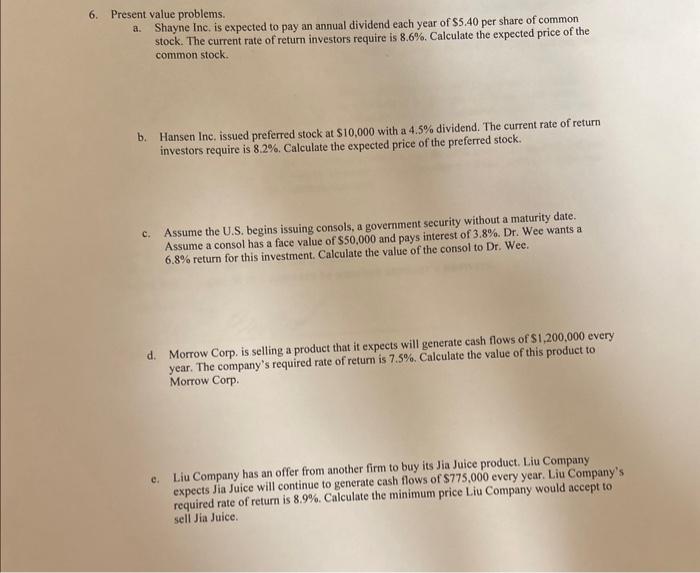

Present value problems. a. Shayne Inc, is expected to pay an annual dividend each year of $5.40 per share of common stock. The current rate of return investors require is 8.6%. Calculate the expected price of the common stock. b. Hansen Inc. issued preferred stock at $10,000 with a 4.5% dividend. The current rate of return investors require is 8.2%. Calculate the expected price of the preferred stock. c. Assume the U.S. begins issuing consols, a government security without a maturity date. Assume a consol has a face value of $50.000 and pays interest of 3.8%. Dr. Wee wants a 6.8% return for this investment. Calculate the value of the consol to Dr. Wee. d. Morrow Corp. is selling a product that it expects will generate cash flows of $1,200,000 every year. The company's required rate of retum is 7.5%. Calculate the value of this product to Morrow Corp. e. Liu Company has an offer from another firm to buy its Jia Juice product. Liu Company expects Jia Juice will continue to generate cash flows of $775.000 every year. Liu Company's required rate of return is 8.9%. Calculate the minimum price Liu Company would accept to sell Jia Juice

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started