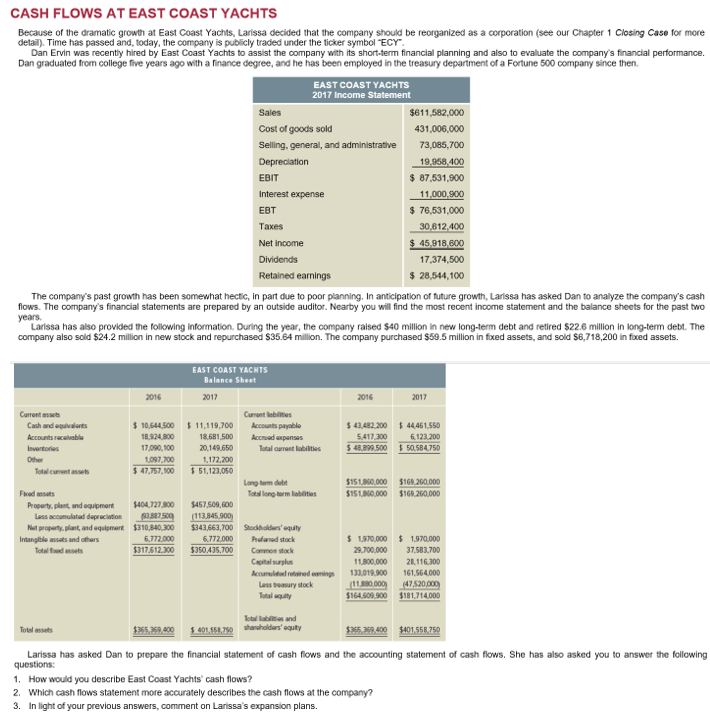

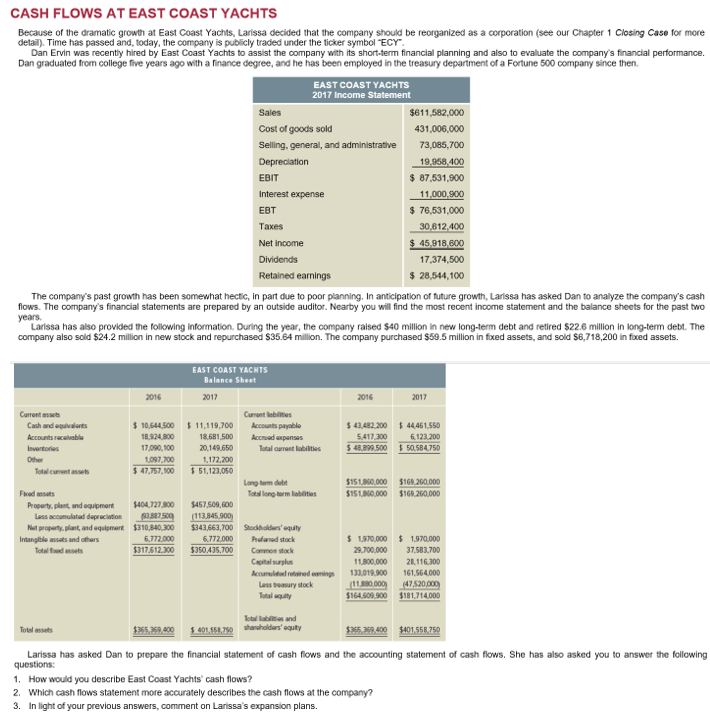

CASH FLOWS AT EAST COAST YACHTS Because of the dramatic growth at East Coast Yachts, Larissa decided that the company should be reorganized as a corporation (see our Chapter 1 Closing Case for more detail). Time has passed and, today, the company is publicly traded under the ticker symbol ECY Dan Ervin was recently hired by East Coast Yachts to assist the company with its short-term financial planning and also to evaluate the company's financial performance. Dan graduated from college five years ago with a finance degree, and he has been employed in the treasury department of a Fortune 500 company since then. EAST COAST YACHTS 2017 Income Statement $611,582,000 431,006,000 73,085,700 19.958.400 87,531,800 11.000,900 76,531.000 30,812,400 $ ,800 7 374,500 28,544,100 Cost of goods sold Selling, general, and administrative EBIT Interest expense EBT Taxes Net income Dividends Retained earnings 45,918 The company's past growh has been somewhat hectic, in part due to poor planning. In anticipation of future growth, Larissa has asked Dan to analyze the company's cash flows. The company's financial statements are prepared by an outside auditor. Nearby you will find the most recent income statement and the balance sheets for the past two years Larissa has also provided the following information. During the year, the company raised $40 million in new long-term debt and retired $22.6 million in long-term debt. The company also sold $24.2 million in new stock and repurchased $35.64 miltion. The company purchased $59.5 million in fxed assets, and sold $6,718,200 in foxed assets EAST COAST YACHTS Balance Sheet 2016 2017 2016 2017 Curre assets Cuant lebilites 10,644 500 11,119,700 Accounts payable 18,924,800 7,00,0020,149650 Total aarneet labilities 43,482,200 44461,550 6123.200 48.899500 50584750 Cash and equvlants 8,681,500 ACad axpensas 5.417.300 097,700 1,172,200 tacanent assets 47,57,00 51,12300 151,860.000 $169.260.000 $151,860.000 $169,260.000 Property, plant, and oquipment $404 727,800 $457,509,600 Nut proporty, plant, and equipment $310,840,300 $343,663,700 Stocsholders' equity 1,970,000 $1,970.000 29,700,000 37,583.700 11,800,000 2,116.300 Acomultd roained ings 133.01,900 161,564000 6.772.000 612 300 6.772000 Pfarned stock 35,700 Common stock Intangible assets and others Lass teasury stock $164,609.900 $181,714000 shanaholdars equity Totel asset Larissa has asked Dan to prepare the financial statement of cash flows and the accounting statement of cash flows. She has also asked you to answer the following questions: 1. How would you describe East Coast Yachts' cash flows? 2. Which cash flows statement more accurately describes the cash flows at the company? 3. In light of your previous answers, comment on Larissa's expansion plans