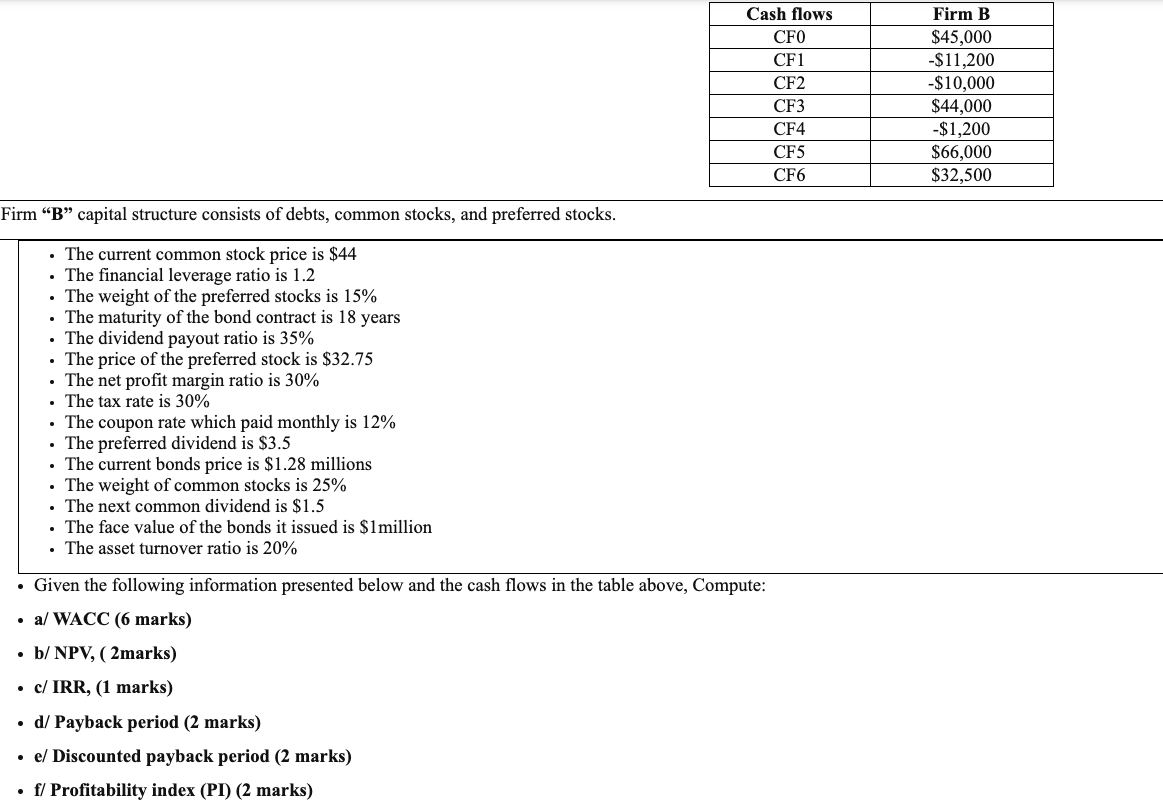

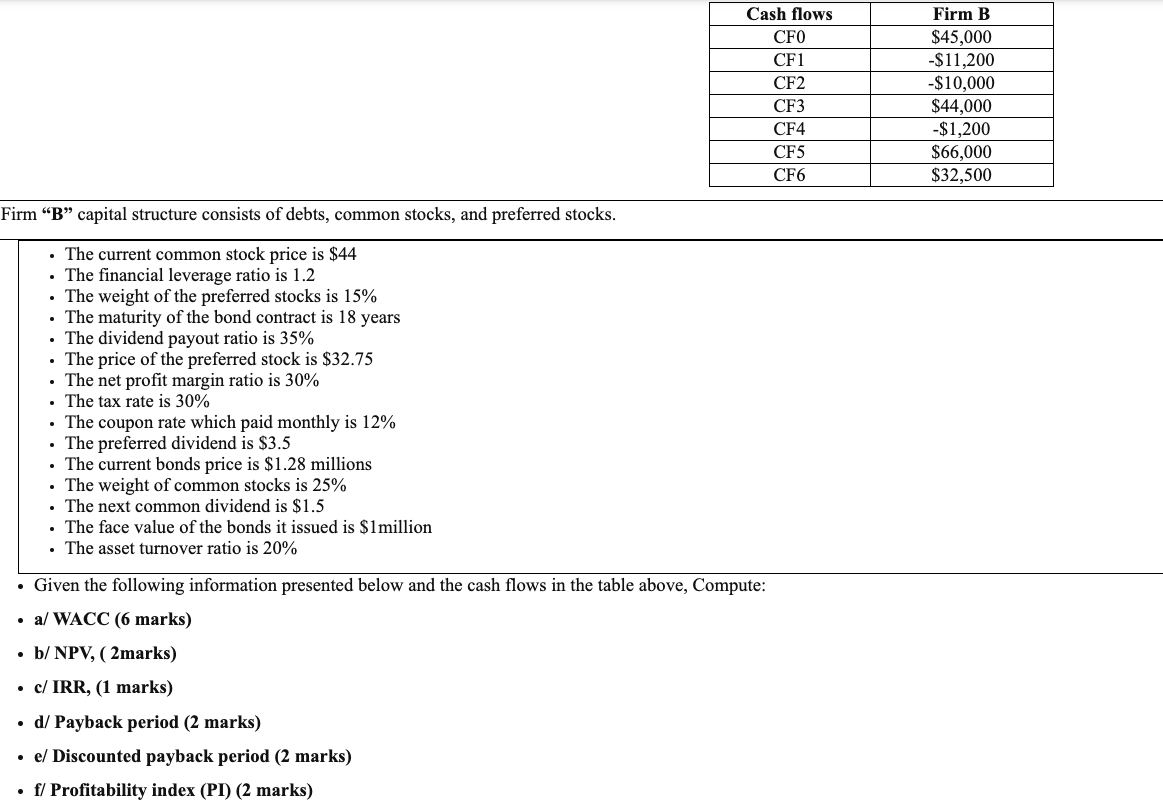

Cash flows CF0 CF1 CF2 CF3 CF4 CF5 CF6 Firm B $45,000 -$11,200 -$10,000 $44,000 -$1,200 $66,000 $32,500 Firm B capital structure consists of debts, common stocks, and preferred stocks. The current common stock price is $44 The financial leverage ratio is 1.2 The weight of the preferred stocks is 15% The maturity of the bond contract is 18 years The dividend payout ratio is 35% The price of the preferred stock is $32.75 The net profit margin ratio is 30% The tax rate is 30% The coupon rate which paid monthly is 12% The preferred dividend is $3.5 The current bonds price is $1.28 millions The weight of common stocks is 25% The next common dividend is $1.5 . The face value of the bonds it issued is $1million The asset turnover ratio is 20% . Given the following information presented below and the cash flows in the table above, Compute: a/ WACC (6 marks) b/NPV, ( 2marks) c/ IRR, (1 marks) . d/ Payback period (2 marks) e/ Discounted payback period (2 marks) f/ Profitability index (PI) (2 marks) Cash flows CF0 CF1 CF2 CF3 CF4 CF5 CF6 Firm B $45,000 -$11,200 -$10,000 $44,000 -$1,200 $66,000 $32,500 Firm B capital structure consists of debts, common stocks, and preferred stocks. The current common stock price is $44 The financial leverage ratio is 1.2 The weight of the preferred stocks is 15% The maturity of the bond contract is 18 years The dividend payout ratio is 35% The price of the preferred stock is $32.75 The net profit margin ratio is 30% The tax rate is 30% The coupon rate which paid monthly is 12% The preferred dividend is $3.5 The current bonds price is $1.28 millions The weight of common stocks is 25% The next common dividend is $1.5 . The face value of the bonds it issued is $1million The asset turnover ratio is 20% . Given the following information presented below and the cash flows in the table above, Compute: a/ WACC (6 marks) b/NPV, ( 2marks) c/ IRR, (1 marks) . d/ Payback period (2 marks) e/ Discounted payback period (2 marks) f/ Profitability index (PI) (2 marks)