Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cash flows from a new factory are expected to be $3,000,000 per year every year for the next ten (10) years. If investors use 6.25%

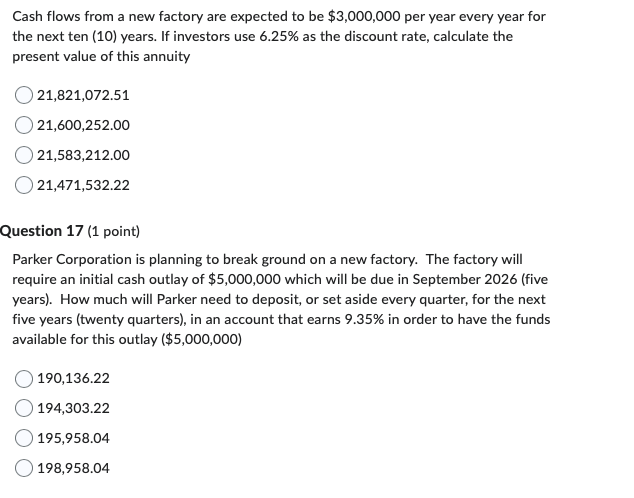

Cash flows from a new factory are expected to be $3,000,000 per year every year for the next ten (10) years. If investors use 6.25% as the discount rate, calculate the present value of this annuity 21,821,072.5121,600,252.0021,583,212.0021,471,532.22 Question 17 (1 point) Parker Corporation is planning to break ground on a new factory. The factory will require an initial cash outlay of $5,000,000 which will be due in September 2026 (five years). How much will Parker need to deposit, or set aside every quarter, for the next five years (twenty quarters), in an account that earns 9.35% in order to have the funds available for this outlay ($5,000,000) 190,136.22194,303.22195,958.04198,958.04

Cash flows from a new factory are expected to be $3,000,000 per year every year for the next ten (10) years. If investors use 6.25% as the discount rate, calculate the present value of this annuity 21,821,072.5121,600,252.0021,583,212.0021,471,532.22 Question 17 (1 point) Parker Corporation is planning to break ground on a new factory. The factory will require an initial cash outlay of $5,000,000 which will be due in September 2026 (five years). How much will Parker need to deposit, or set aside every quarter, for the next five years (twenty quarters), in an account that earns 9.35% in order to have the funds available for this outlay ($5,000,000) 190,136.22194,303.22195,958.04198,958.04 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started