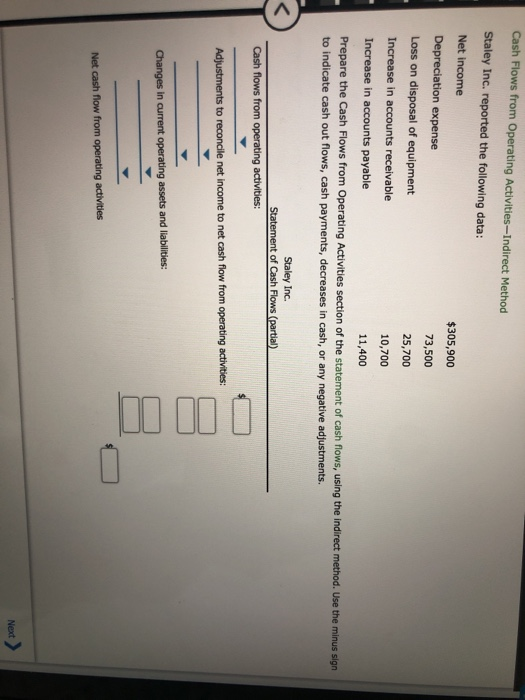

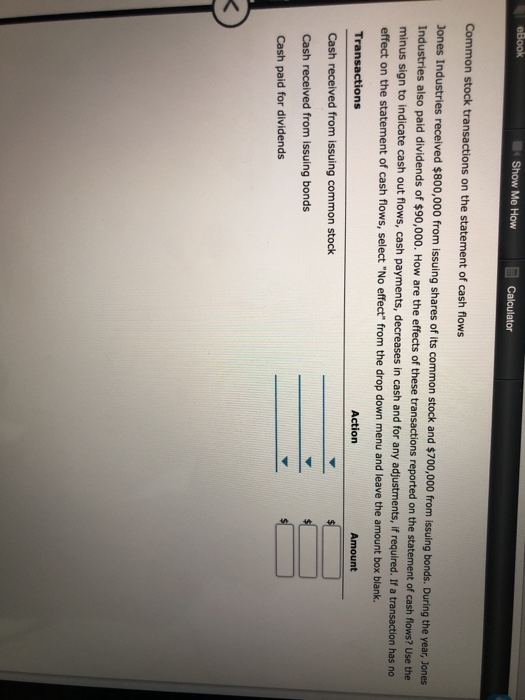

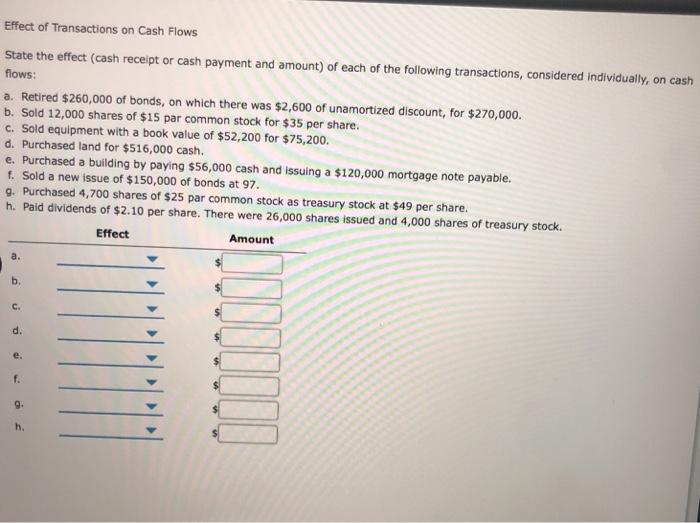

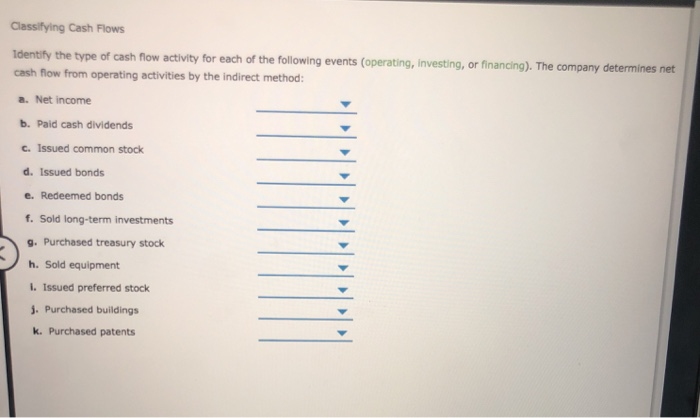

Cash Flows from Operating Activities-Indirect Method Staley Inc. reported the following data: Net income Depreciation expense Loss on disposal of equipment Increase in accounts receivable Increase in accounts payable Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash out flows, cash payments, decreases in cash, or any negative adjustments. $305,900 73,500 25,700 10,700 11,400 Staley Inc. Cash flows from operating activities: Adjustments to reconcile net income to net cash flow from operating activities: Net cash flow from operating activities Next Show Me How Calculator Common stock transactions on the statement of cash flows ones Industries received $800,000 from issuing shares of its common stock and $700,000 from issuing bonds. During the year, Jones Industries also paid dividends of $90,000 minus sign to indicate cash out flows, cash payments, decreases in cash and for any adjustments, if required. If a transaction has no effect on the statement of cash flows, select "No effect" from the drop down menu and leave the amount box blank. . How are the ffects of these transactions reported on the statement of cash flows? Use the Transactions Action Amount Cash received from issuing common stock Cash received from issuing bonds Cash paid for dividends Effect of Transactions on Cash Flows State the effect (cash receipt or cash payment and amount) of each of the following transactions, considered individually, on cash flows a. Retired $260,000 of bonds, on which there was $2,600 of unamortized discount, for $270,000. b. Sold 12,000 shares of $15 par common stock for $35 per share. c. Sold equipment with a book value of $52,200 for $75,200 d. Purchased land for $516,000 cash e. Purchased a building by paying $56,000 cash and issuing a $120,000 mortgage note payable f. Sold a new issue of $150,000 of bonds at 97. g. Purchased 4,700 shares of $25 par common stock as treasury stock at $49 per share. h. Paid dividends of $2.10 per share. There were 26,000 shares issued and 4,000 shares of treasury stock. Effect Amount a. b. c. d. 9. Classifying Cash Flows activity for each of the following events (operating, Investing, or financing). The company determines net cash flow from operating activities by the indirect method: a. Net income b. Paid cash dividends c. Issued common stock d. Issued bonds e. Redeemed bonds f. Sold long-term investments 9.Purchased treasury stock h. Sold equipment i. Issued preferred stock j. Purchased buildings k. Purchased patents