Question

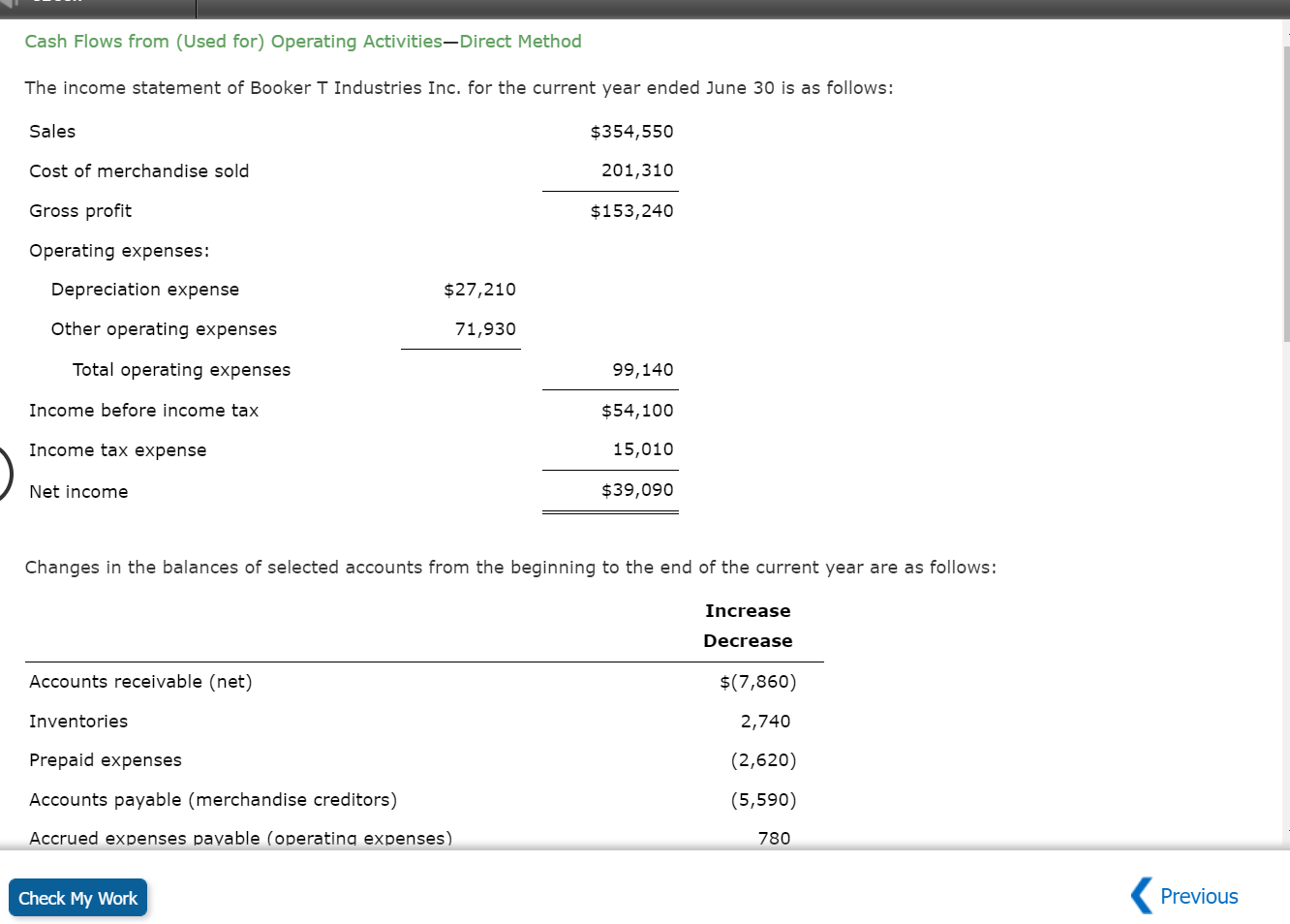

Cash Flows from (Used for) Operating ActivitiesDirect Method The income statement of Booker T Industries Inc. for the current year ended June 30 is as

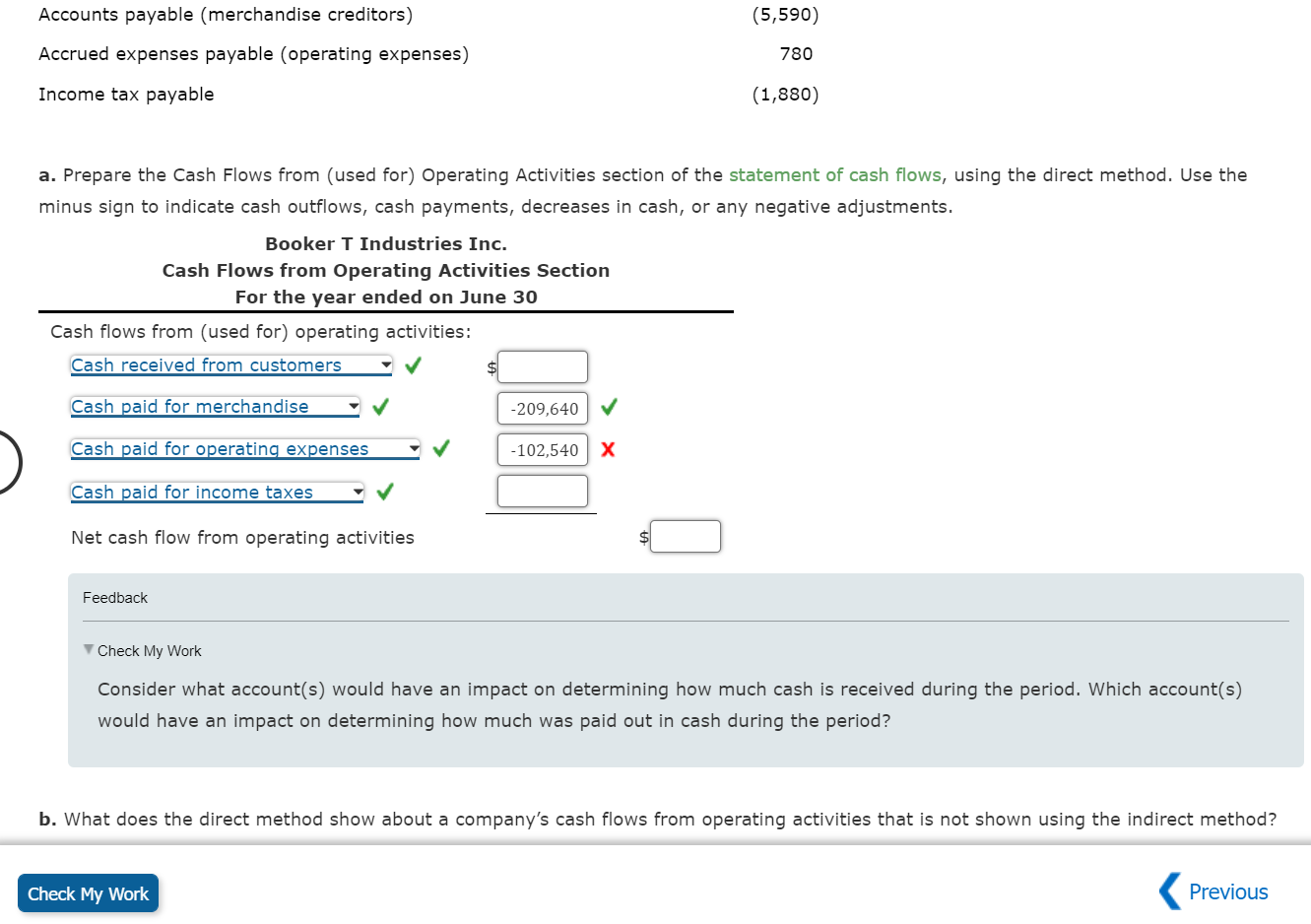

Cash Flows from (Used for) Operating ActivitiesDirect Method The income statement of Booker T Industries Inc. for the current year ended June 30 is as follows: Sales $354,550 Cost of merchandise sold 201,310 Gross profit $153,240 Operating expenses: Depreciation expense $27,210 Other operating expenses 71,930 Total operating expenses 99,140 Income before income tax $54,100 Income tax expense 15,010 Net income $39,090 Changes in the balances of selected accounts from the beginning to the end of the current year are as follows: Increase Decrease Accounts receivable (net) $(7,860) Inventories 2,740 Prepaid expenses (2,620) Accounts payable (merchandise creditors) (5,590) Accrued expenses payable (operating expenses) 780 Income tax payable (1,880) Question Content Area a. Prepare the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the direct method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Booker T Industries Inc. Cash Flows from Operating Activities Section For the year ended on June 30 Cash flows from (used for) operating activities:

Cash Flows from (Used for) Operating ActivitiesDirect Method The income statement of Booker T Industries Inc. for the current year ended June 30 is as follows: Sales $354,550 Cost of merchandise sold 201,310 Gross profit $153,240 Operating expenses: Depreciation expense $27,210 Other operating expenses 71,930 Total operating expenses 99,140 Income before income tax $54,100 Income tax expense 15,010 Net income $39,090 Changes in the balances of selected accounts from the beginning to the end of the current year are as follows: Increase Decrease Accounts receivable (net) $(7,860) Inventories 2,740 Prepaid expenses (2,620) Accounts payable (merchandise creditors) (5,590) Accrued expenses payable (operating expenses) 780 Income tax payable (1,880) Question Content Area a. Prepare the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the direct method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Booker T Industries Inc. Cash Flows from Operating Activities Section For the year ended on June 30 Cash flows from (used for) operating activities:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started