Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cash flows it is typical for Jane to plan, monitor, and assess her financial position using cash flows over a given period, typically a month.

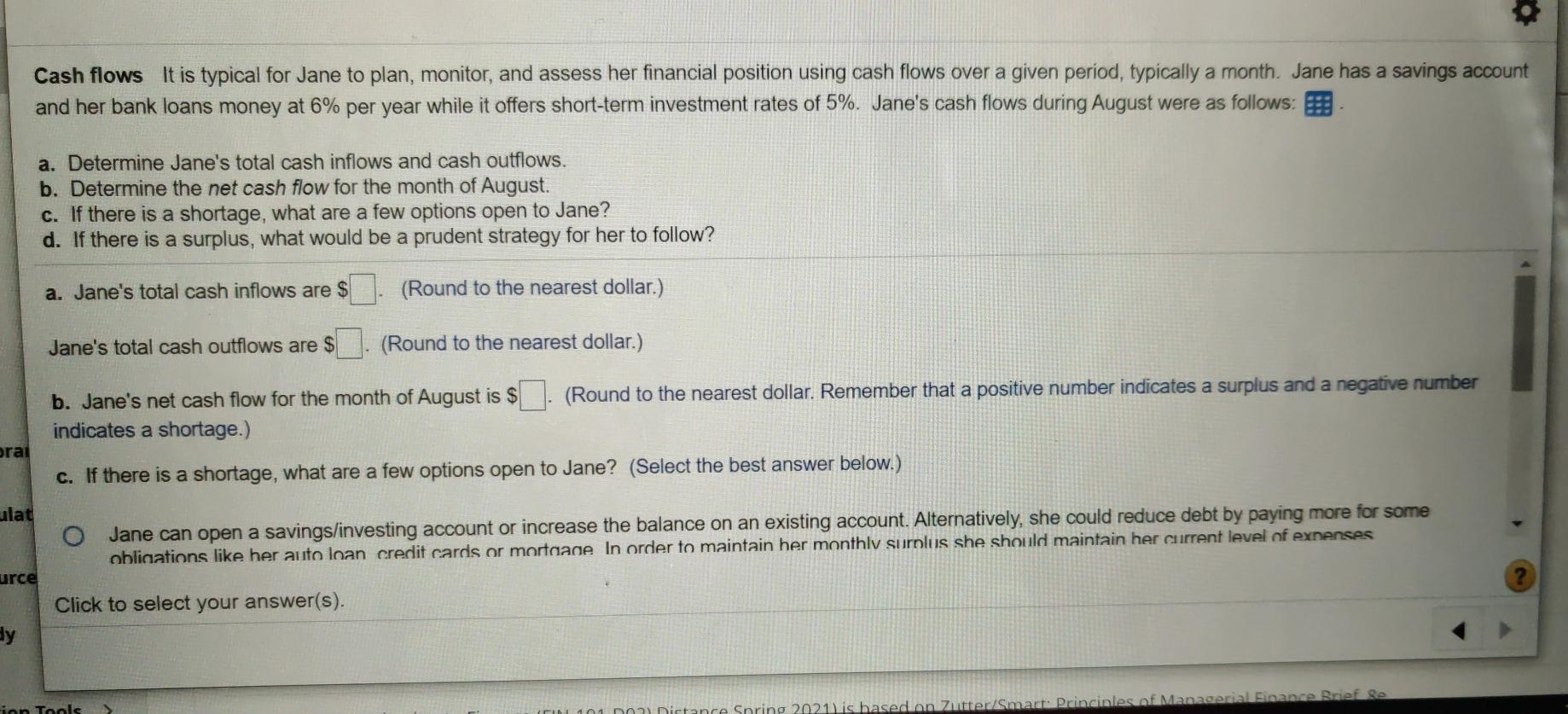

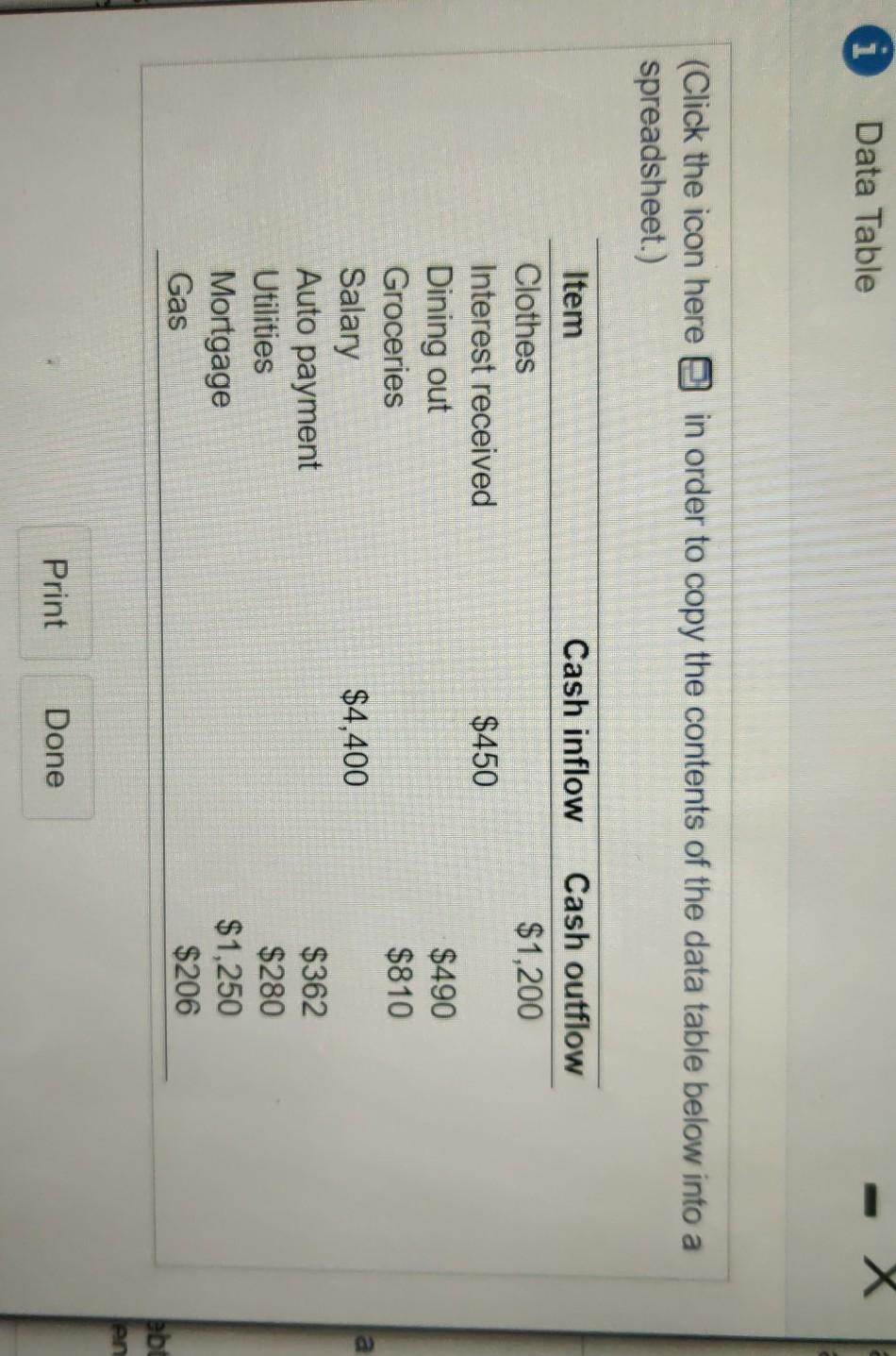

Cash flows it is typical for Jane to plan, monitor, and assess her financial position using cash flows over a given period, typically a month. Jane has a savings account and her bank loans money at 6% per year while it offers short-term investment rates of 5%. Jane's cash flows during August were as follows: a. Determine Jane's total cash inflows and cash outflows. b. Determine the net cash flow for the month of August. c. If there is a shortage, what are a few options open to Jane? d. If there is a surplus, what would be a prudent strategy for her to follow? a. Jane's total cash inflows are $ (Round to the nearest dollar.) Jane's total cash outflows are $ (Round to the nearest dollar.) (Round to the nearest dollar. Remember that a positive number indicates a surplus and a negative number b. Jane's net cash flow for the month of August is $ indicates a shortage.) brai c. If there is a shortage, what are a few options open to Jane? (Select the best answer below.) ulat O Jane can open a savings/investing account or increase the balance on an existing account. Alternatively, she could reduce debt by paying more for some obligations like her auto loan credit cards or mortgage In order to maintain her monthly surplus she should maintain her current level of exnenses urce Click to select your answer(s). By in Tools > Distance Snring 2021 is based on Zutter Smart Principles of Managerial Finance Raief se i Data Table - in order to copy the contents of the data table below into a (Click the icon here spreadsheet.) Cash inflow Cash outflow $1,200 $450 $490 $810 Item Clothes Interest received Dining out Groceries Salary Auto payment Utilities Mortgage Gas $4,400 $362 $280 $1,250 $206 en Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started