Answered step by step

Verified Expert Solution

Question

1 Approved Answer

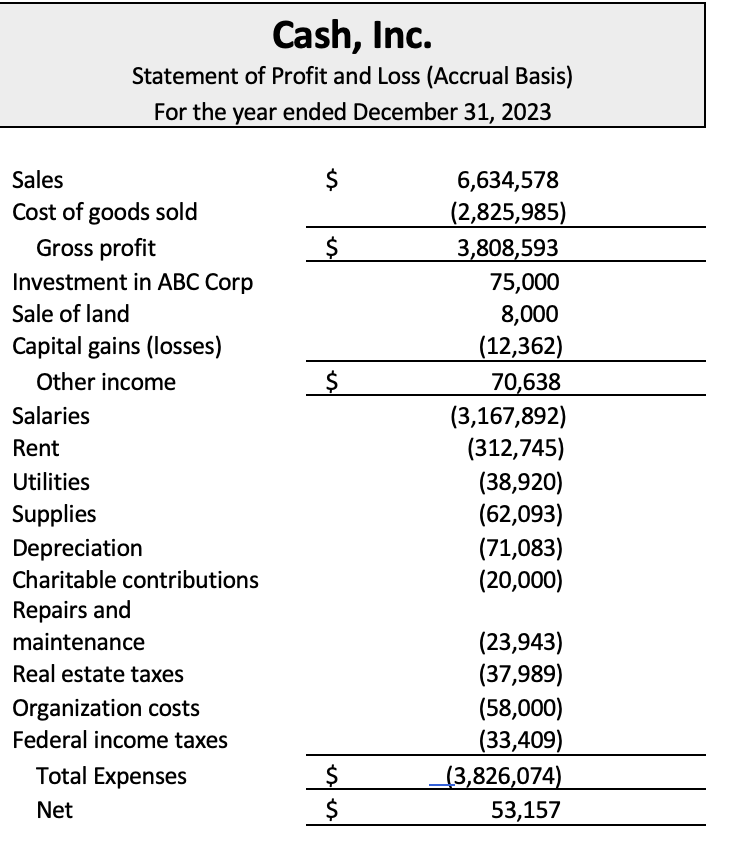

Cash, Inc. Statement of Profit and Loss (Accrual Basis) For the year ended December 31, 2023 Sales es $ 6,634,578 Cost of goods sold

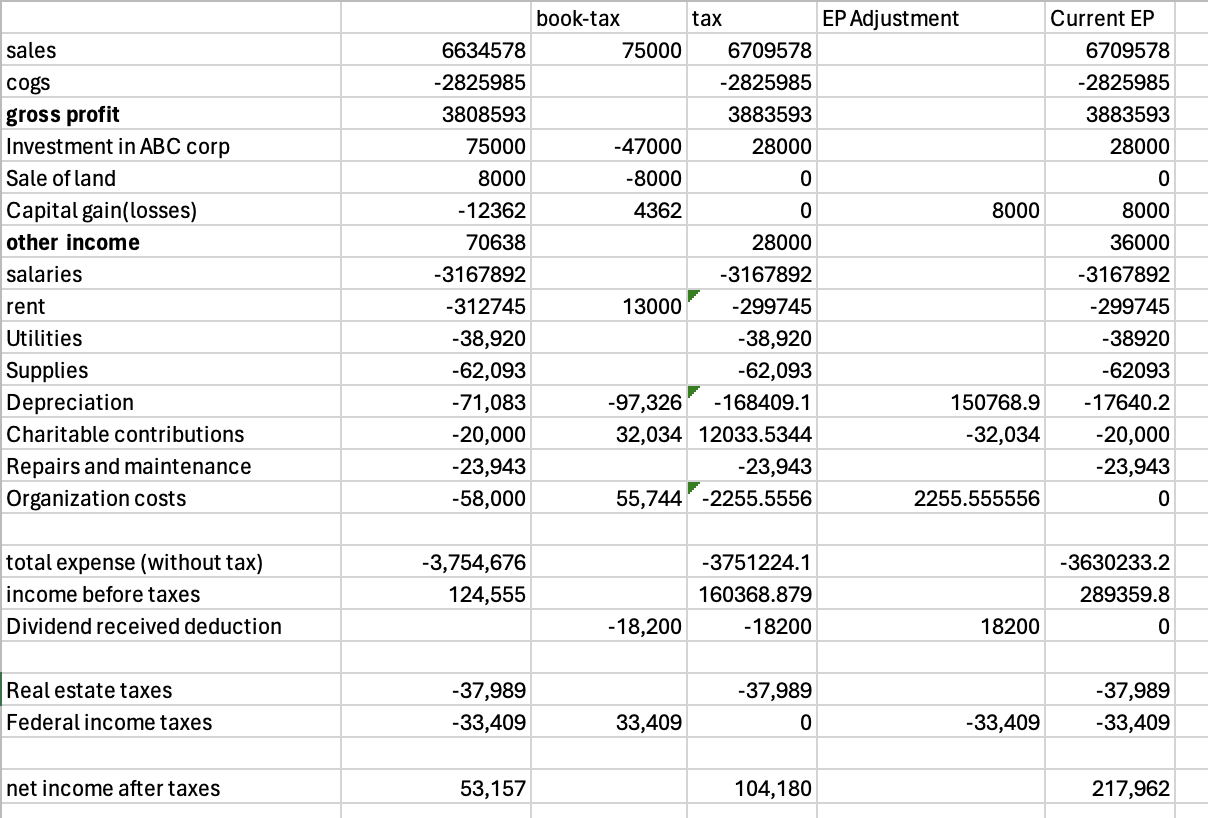

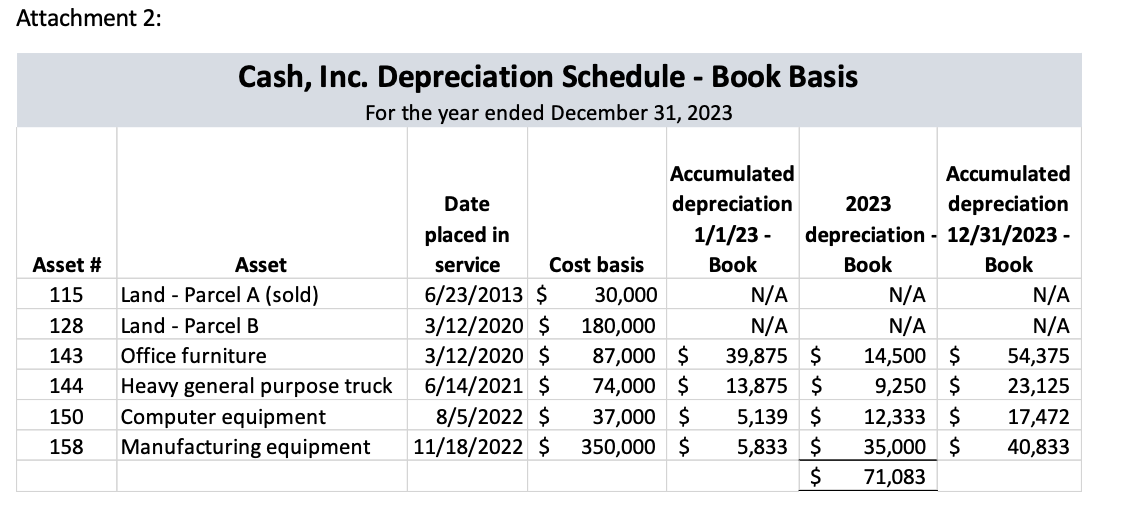

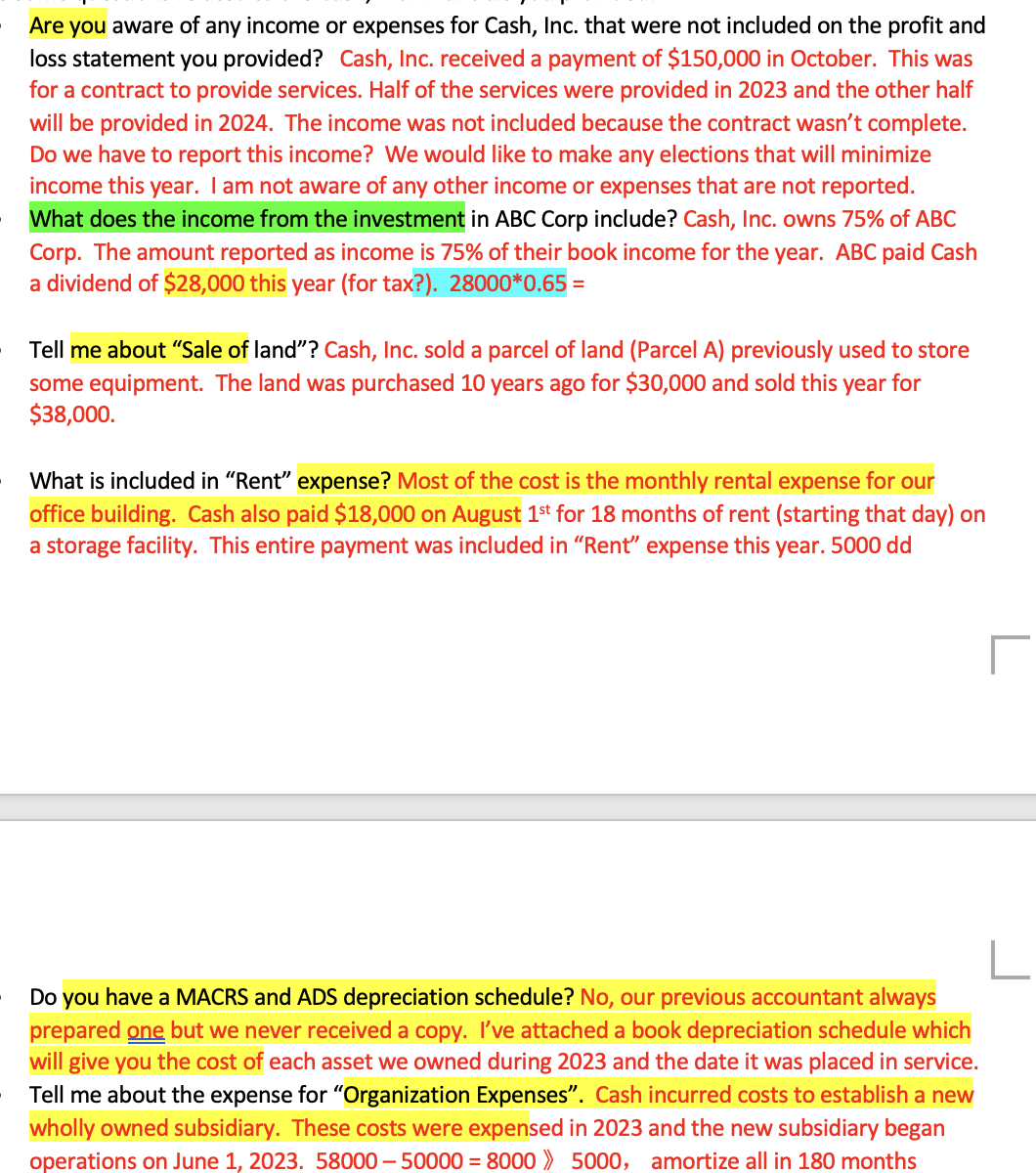

Cash, Inc. Statement of Profit and Loss (Accrual Basis) For the year ended December 31, 2023 Sales es $ 6,634,578 Cost of goods sold (2,825,985) Gross profit $ 3,808,593 Investment in ABC Corp 75,000 Sale of land 8,000 Capital gains (losses) (12,362) Other income $ 70,638 Salaries (3,167,892) Rent (312,745) Utilities (38,920) Supplies (62,093) Depreciation (71,083) Charitable contributions (20,000) Repairs and maintenance (23,943) Real estate taxes (37,989) Organization costs (58,000) Federal income taxes (33,409) Total Expenses $ (3,826,074) Net $ 53,157 book-tax tax EP Adjustment Current EP sales 6634578 75000 6709578 6709578 cogs -2825985 -2825985 gross profit 3808593 3883593 Investment in ABC corp 75000 -47000 28000 -2825985 3883593 28000 Sale of land 8000 -8000 0 0 Capital gain(losses) -12362 4362 0 8000 8000 other income 70638 28000 salaries -3167892 -3167892 36000 -3167892 rent -312745 13000 -299745 -299745 Utilities -38,920 -38,920 -38920 Supplies Depreciation Charitable contributions -62,093 -62,093 -62093 -71,083 -20,000 Repairs and maintenance -23,943 Organization costs -58,000 -97,326 -168409.1 32,034 12033.5344 -23,943 55,744 -2255.5556 150768.9 -17640.2 -32,034 -20,000 -23,943 2255.555556 0 total expense (without tax) -3,754,676 income before taxes 124,555 -3751224.1 160368.879 -3630233.2 289359.8 Dividend received deduction -18,200 -18200 18200 0 Real estate taxes -37,989 -37,989 -37,989 Federal income taxes -33,409 33,409 0 -33,409 -33,409 net income after taxes 53,157 104,180 217,962 Attachment 2: Cash, Inc. Depreciation Schedule - Book Basis For the year ended December 31, 2023 Accumulated Accumulated Date placed in depreciation 2023 depreciation 1/1/23 - depreciation 12/31/2023 - Asset # Asset service Cost basis Book Book Book 115 Land Parcel A (sold) 6/23/2013 $ 30,000 N/A N/A N/A 128 Land Parcel B 3/12/2020 $ 180,000 N/A N/A N/A 143 Office furniture 3/12/2020 $ 87,000 $ 39,875 $ 14,500 $ 54,375 144 Heavy general purpose truck 6/14/2021 $ 74,000 $ 13,875 $ 9,250 $ 23,125 150 Computer equipment 8/5/2022 $ 37,000 $ 5,139 $ 12,333 $ 17,472 158 Manufacturing equipment 11/18/2022 $ 350,000 $ 5,833 $ 35,000 $ 40,833 $ 71,083 Are you aware of any income or expenses for Cash, Inc. that were not included on the profit and loss statement you provided? Cash, Inc. received a payment of $150,000 in October. This was for a contract to provide services. Half of the services were provided in 2023 and the other half will be provided in 2024. The income was not included because the contract wasn't complete. Do we have to report this income? We would like to make any elections that will minimize income this year. I am not aware of any other income or expenses that are not reported. What does the income from the investment in ABC Corp include? Cash, Inc. owns 75% of ABC Corp. The amount reported as income is 75% of their book income for the year. ABC paid Cash a dividend of $28,000 this year (for tax?). 28000*0.65 = Tell me about "Sale of land"? Cash, Inc. sold a parcel of land (Parcel A) previously used to store some equipment. The land was purchased 10 years ago for $30,000 and sold this year for $38,000. What is included in "Rent" expense? Most of the cost is the monthly rental expense for our office building. Cash also paid $18,000 on August 1st for 18 months of rent (starting that day) on a storage facility. This entire payment was included in "Rent" expense this year. 5000 dd Do you have a MACRS and ADS depreciation schedule? No, our previous accountant always prepared one but we never received a copy. I've attached a book depreciation schedule which will give you the cost of each asset we owned during 2023 and the date it was placed in service. Tell me about the expense for "Organization Expenses". Cash incurred costs to establish a new wholly owned subsidiary. These costs were expensed in 2023 and the new subsidiary began operations on June 1, 2023. 58000-50000 = 8000 5000, amortize all in 180 months

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started