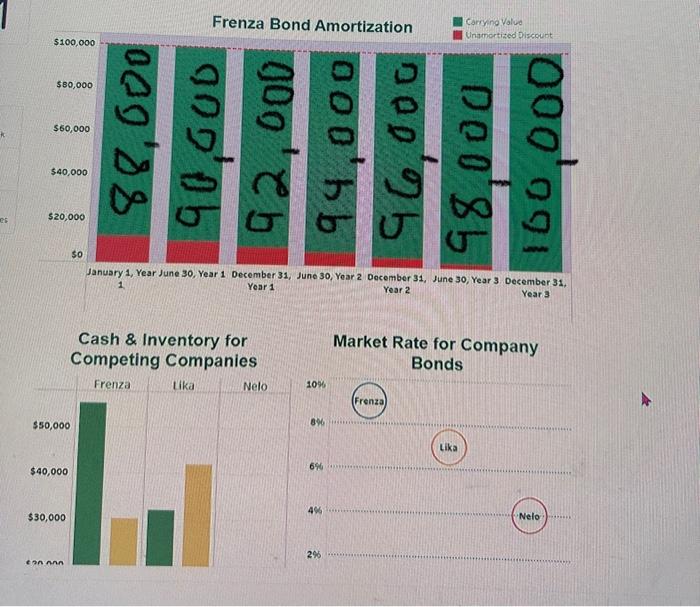

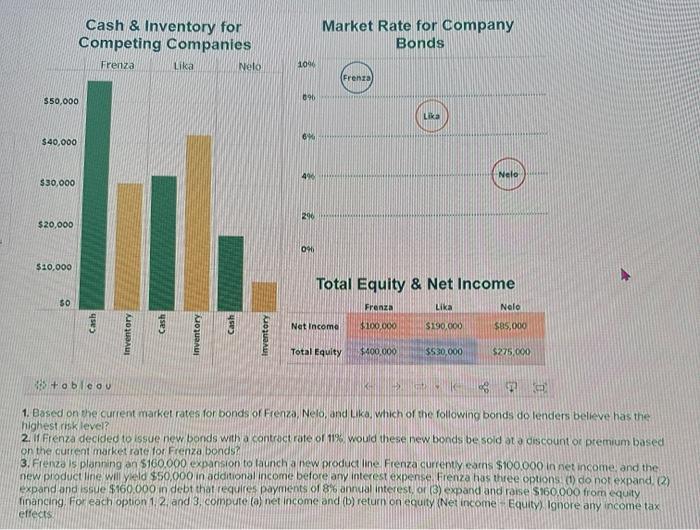

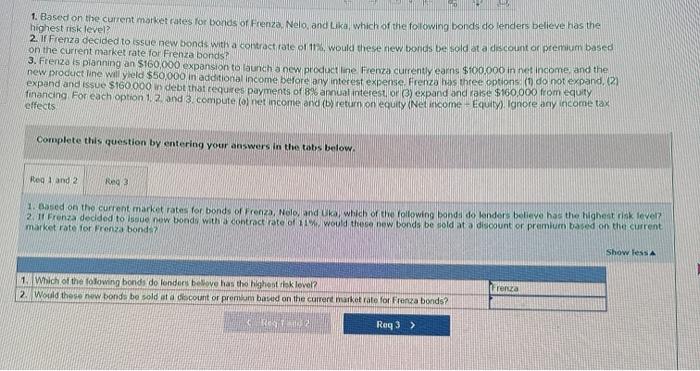

Cash \& Inventory for Competing Companies Cash \& Inventory for Combetina Comnanies os Total Equity \& Net Income 1. Based on the current market rates for bonds of Frenza. Nelo, and Lika. which of the following bonds do lenders believe has the highest risk level? 2. If Frenza decided to issue new bonds with a controct rate or 119 would these new bonds be soid at a discountor ptemium based on the cuirent marketrate for Frenza bonds? 3. Frenzo is planning an $160.000 expansion to taunch a new product line Frenza currenty earns $100000 in net income and the new product line willy. \$50,000 in additional income before any interest expense. Frenza has thee options. (1) do not expand (2) expand and issue \$160.000 in debt that requires payments of 8% annul interest, or (3) expand and raise $160.000 from equity financing. For each option 1,2,and 3. compute (a) net income and (b) return on equity (Net income Equity). Ignore any income tax effects. 1. Based on the current morket cates for bonds of Frenza, Nelo, and Lika, which of the following bonds do lenders believe has the highest risk level? 2. If Frenza decided to issue new bonds with a contract rate of 113 , would these niew bonds be sold at a daccount or premium based on the current market rate for Frenza bonds? 3. Frenza ts pianning an $160,000 expansion to launch a new product line Frenza currenty eains $100,000 in net income, and the new procuct line wil y.eld $50,000 in additional income beforejany interest expense. Frenza has three options: (t) do not expand, (2) expand and issue $160000 in debt that tequies payments of 8% amual interest, or (3) expand and rarse \$160,000 from equity financing For each option 1.2 and 3 . compute (o) net income and (b) returm on equity (Net income-Equity) Ignore any income tas. effects Complete this question by entering your answers in the tobs below. 1. Based on the current market rates for bonds of frenza, Nolo. and Uka, which of the following bands do lendars believe has the highest risk iever? 2. II Frenza decided to iseue new bonds with a contract rate of 11 \% would thece new bonds be sold at a discount or premium based on the current market rate for Frenza bonds