Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jay, Johnson and Jan are partners of Triple J Company. On February 1, 2020, the partners decided to liquidate the company because of heavy

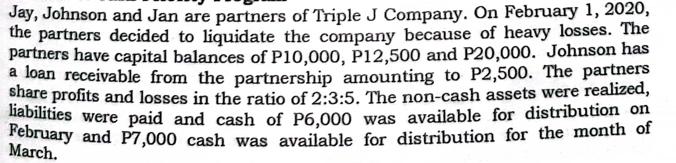

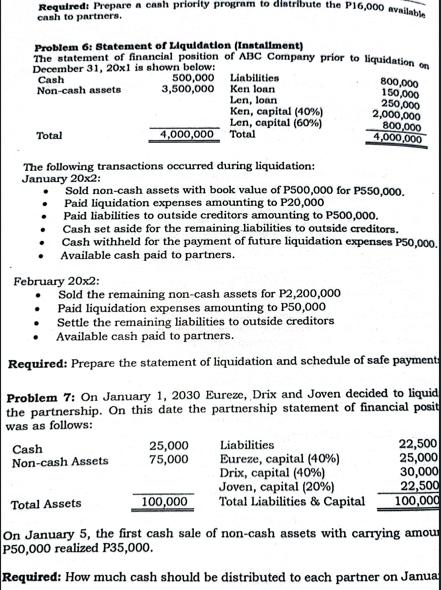

Jay, Johnson and Jan are partners of Triple J Company. On February 1, 2020, the partners decided to liquidate the company because of heavy losses. The partners have capital balances of P10,000, P12,500 and P20,000. Johnson has a loan receivable from the partnership amounting to P2,500. The partners share profits and losses in the ratio of 2:3:5. The non-cash assets were realized, liabilities were paid and cash of P6,000 was available for distribution on February and P7,000 cash was available for distribution for the month of March. Required: Prepare a cash priority program to distribute the P16,000 available cash to partners. Problem 6: Statement of Liquidation (Installment) The statement of financial position of ABC Company prior to liquidation on December 31, 20x1 is shown below: Cash Non-cash assets 500,000 3,500,000 Total . The following transactions occurred during liquidation: January 20x2: February 20x2: Liabilities Ken loan Len, loan. Ken, capital (40%) Len, capital (60%) 4,000,000 Total Sold non-cash assets with book value of P500,000 for P550,000. Paid liquidation expenses amounting to P20,000 Paid liabilities to outside creditors amounting to P500,000. Cash set aside for the remaining liabilities to outside creditors. Cash withheld for the payment of future liquidation expenses P50,000. Available cash paid to partners. Cash Non-cash Assets Sold the remaining non-cash assets for P2,200,000 Paid liquidation expenses amounting to P50,000 Settle the remaining liabilities to outside creditors Available cash paid to partners. Required: Prepare the statement of liquidation and schedule of safe payments Problem 7: On January 1, 2030 Eureze, Drix and Joven decided to liquid the partnership. On this date the partnership statement of financial posit was as follows: Total Assets 800,000 150,000 250,000 2,000,000 800,000 4,000,000 25,000 75,000 Liabilities. Eureze, capital (40%) Drix, capital (40%) Joven, capital (20%) Total Liabilities & Capital 22,500 25,000 30,000 22,500 100,000 100,000 On January 5, the first cash sale of non-cash assets with carrying amour P50,000 realized P35,000. Required: How much cash should be distributed to each partner on Janua

Step by Step Solution

★★★★★

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Problem 6 Statement of Liquidation Installment Statement of Financial Position before Liquidation De...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started