Answered step by step

Verified Expert Solution

Question

1 Approved Answer

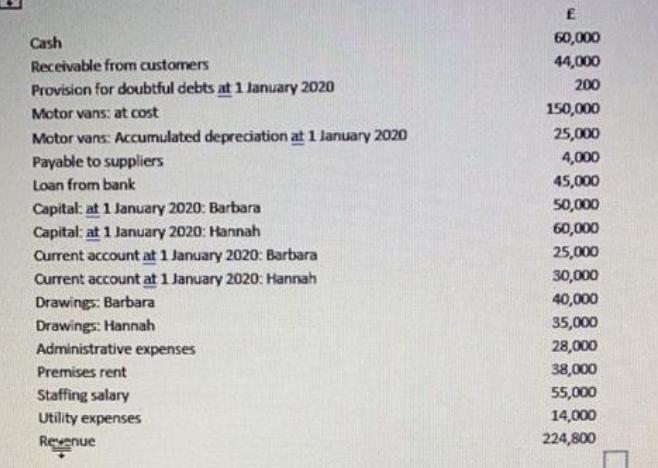

Cash Receivable from customers Provision for doubtful debts at 1 January 2020 Motor vans: at cost Motor vans: Accumulated depreciation at 1 January 2020

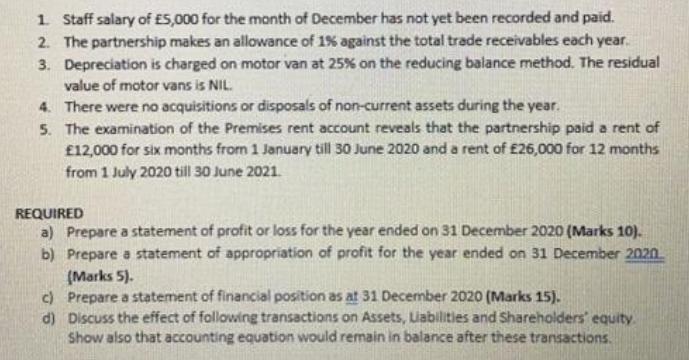

Cash Receivable from customers Provision for doubtful debts at 1 January 2020 Motor vans: at cost Motor vans: Accumulated depreciation at 1 January 2020 Payable to suppliers Loan from bank Capital: at 1 January 2020: Barbara Capital: at 1 January 2020: Hannah Current account at 1 January 2020: Barbara Current account at 1 January 2020: Hannah Drawings: Barbara Drawings: Hannah Administrative expenses Premises rent Staffing salary Utility expenses Revenue E 60,000 44,000 200 150,000 25,000 4,000 45,000 50,000 60,000 25,000 30,000 40,000 35,000 28,000 38,000 55,000 14,000 224,800 1. Staff salary of 5,000 for the month of December has not yet been recorded and paid. 2. The partnership makes an allowance of 1% against the total trade receivables each year. 3. Depreciation is charged on motor van at 25% on the reducing balance method. The residual value of motor vans is NIL. 4. There were no acquisitions or disposals of non-current assets during the year. 5. The examination of the Premises rent account reveals that the partnership paid a rent of 12,000 for six months from 1 January till 30 June 2020 and a rent of 26,000 for 12 months from 1 July 2020 till 30 June 2021. REQUIRED a) Prepare a statement of profit or loss for the year ended on 31 December 2020 (Marks 10). b) Prepare a statement of appropriation of profit for the year ended on 31 December 2020 (Marks 5). c) Prepare a statement of financial position as at 31 December 2020 (Marks 15). d) Discuss the effect of following transactions on Assets, Liabilities and Shareholders' equity. Show also that accounting equation would remain in balance after these transactions.

Step by Step Solution

★★★★★

3.37 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

a Statement of profit or loss for the year ended on 31 December 2020 Revenue 224800 Cost of sales 13...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started