Answered step by step

Verified Expert Solution

Question

1 Approved Answer

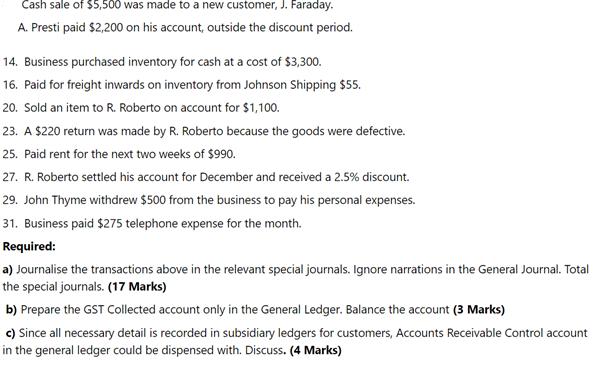

Cash sale of $5,500 was made to a new customer, J. Faraday. A. Presti paid $2,200 on his account, outside the discount period. 14.

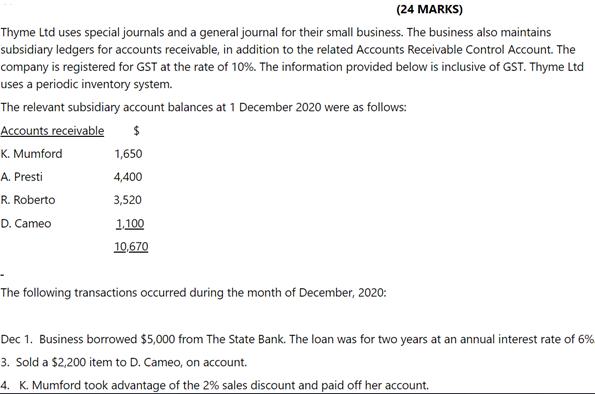

Cash sale of $5,500 was made to a new customer, J. Faraday. A. Presti paid $2,200 on his account, outside the discount period. 14. Business purchased inventory for cash at a cost of $3,300. 16. Paid for freight inwards on inventory from Johnson Shipping $55. 20. Sold an item to R. Roberto on account for $1,100. 23. A $220 return was made by R. Roberto because the goods were defective. 25. Paid rent for the next two weeks of $990. 27. R. Roberto settled his account for December and received a 2.5% discount. 29. John Thyme withdrew $500 from the business to pay his personal expenses. 31. Business paid $275 telephone expense for the month. Required: a) Journalise the transactions above in the relevant special journals. Ignore narrations in the General Journal. Total the special journals. (17 Marks) b) Prepare the GST Collected account only in the General Ledger. Balance the account (3 Marks) c) Since all necessary detail is recorded in subsidiary ledgers for customers, Accounts Receivable Control account in the general ledger could be dispensed with. Discuss. (4 Marks) (24 MARKS) Thyme Ltd uses special journals and a general journal for their small business. The business also maintains subsidiary ledgers for accounts receivable, in addition to the related Accounts Receivable Control Account. The company is registered for GST at the rate of 10%. The information provided below is inclusive of GST. Thyme Ltd uses a periodic inventory system. The relevant subsidiary account balances at 1 December 2020 were as follows: Accounts receivable $ 1,650 4,400 3,520 1,100 10,670 K. Mumford A. Presti R. Roberto D. Cameo The following transactions occurred during the month of December, 2020: Dec 1. Business borrowed $5,000 from The State Bank. The loan was for two years at an annual interest rate of 6% 3. Sold a $2,200 item to D. Cameo, on account. 4. K. Mumford took advantage of the 2% sales discount and paid off her account.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Journalizing the transactions in the relevant special journals Sales Journal Date Account Description Amount GST Total 1 J Faraday Cash Sale 5000 50...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started