Answered step by step

Verified Expert Solution

Question

1 Approved Answer

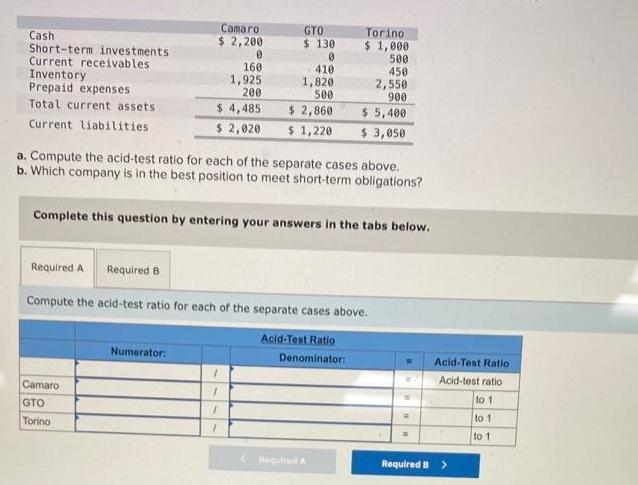

Cash Short-term investments Current receivables Inventory Prepaid expenses Total current assets Current liabilities Camaro $ 2,200 0 160 1,925 200 $ 4,485 $ 2,020

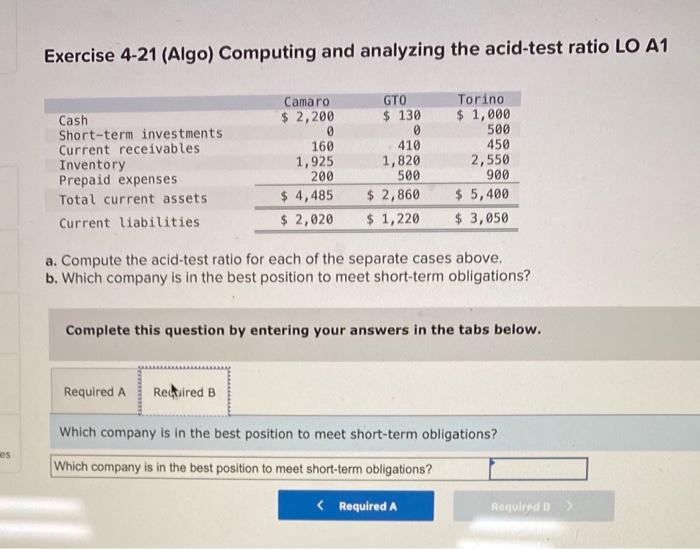

Cash Short-term investments Current receivables Inventory Prepaid expenses Total current assets Current liabilities Camaro $ 2,200 0 160 1,925 200 $ 4,485 $ 2,020 Camaro GTO Torino Numerator: GTO $ 130 0 a. Compute the acid-test ratio for each of the separate cases above. b. Which company is in the best position to meet short-term obligations? 410 1,820 500 $ 2,860 $1,220 Complete this question by entering your answers in the tabs below. Required A Required B Compute the acid-test ratio for each of the separate cases above. Acid-Test Ratio 1 I 1 Torino $ 1,000 500 450 2,550 900 $ 5,400 $ 3,050 Denominator: W Acid-Test Ratio Acid-test ratio to 1 to 1 to 1 Required B > es Exercise 4-21 (Algo) Computing and analyzing the acid-test ratio LO A1 Cash Short-term investments Current receivables Inventory Prepaid expenses Total current assets Current liabilities Camaro $ 2,200 Required A 0 160 Required B 1,925 200 $ 4,485 $ 2,020 GTO $ 130 0 Torino $1,000 500 450 a. Compute the acid-test ratio for each of the separate cases above. b. Which company is in the best position to meet short-term obligations? 410 1,820 2,550 500 900 $ 2,860 $ 5,400 $ 1,220 $ 3,050 Complete this question by entering your answers in the tabs below. Which company is in the best position to meet short-term obligations? Which company is in the best position to meet short-term obligations? < Required A Required D

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Here are the detailed calculations for each part of the question a Compute the acidtest ratio for ea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started