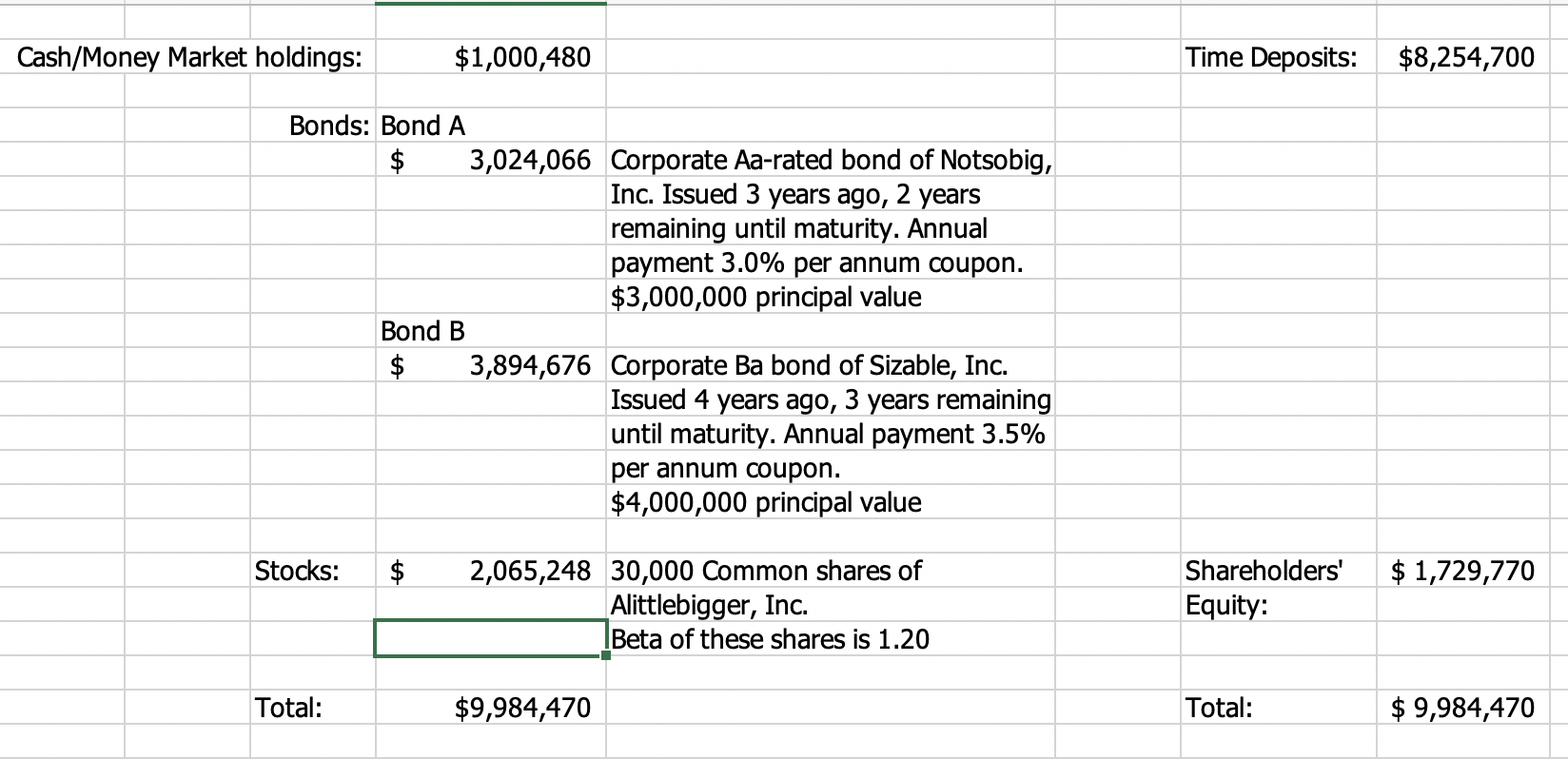

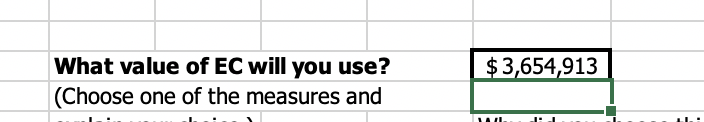

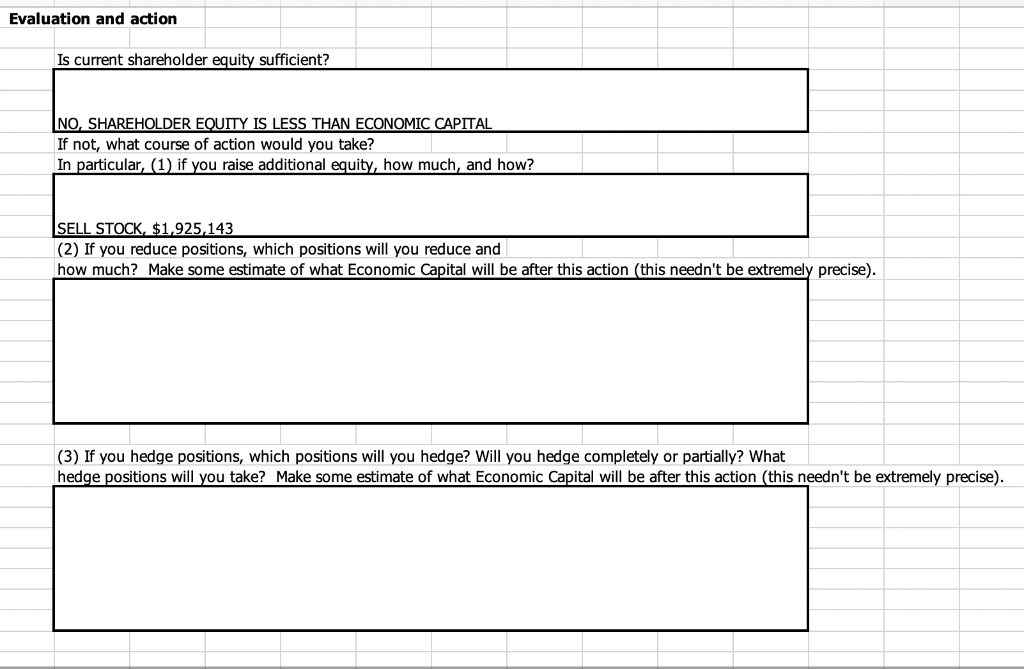

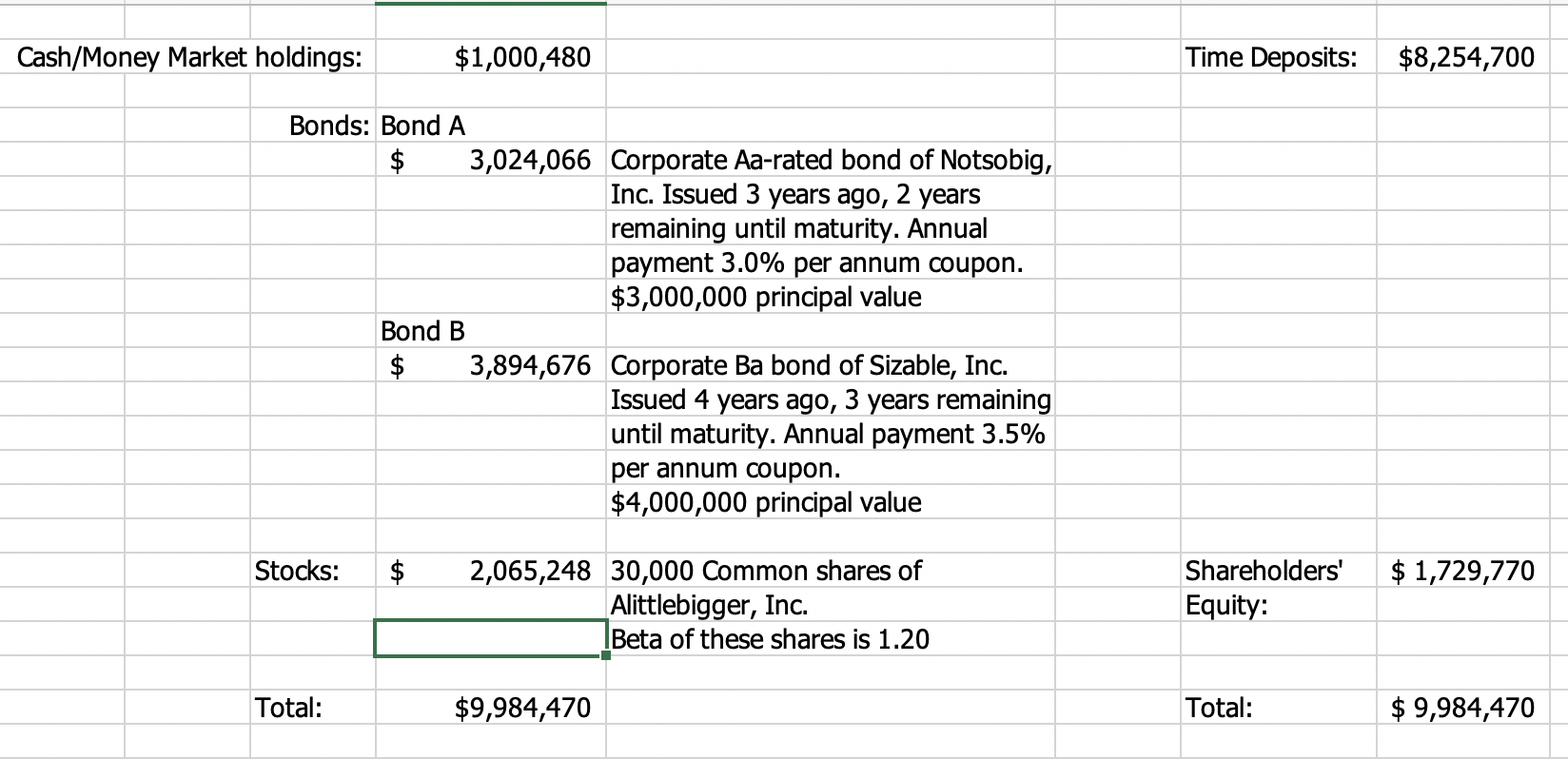

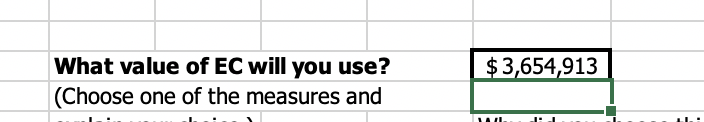

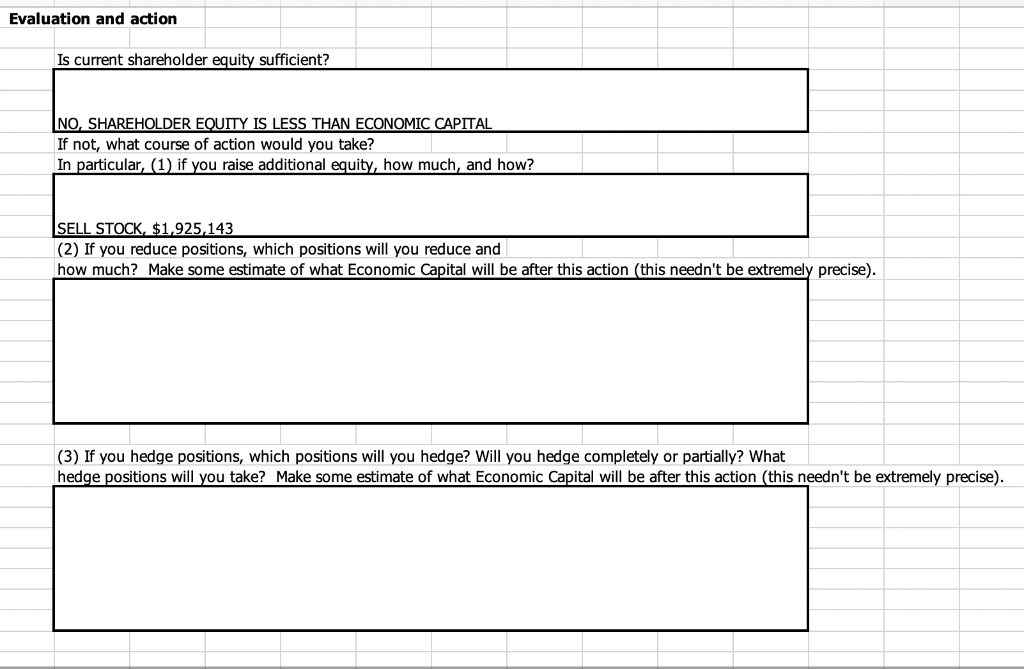

Cash/Money Market holdings: $1,000,480 Time Deposits: $8,254,700 $ Bonds: Bond A 3,024,066 Corporate Aa-rated bond of Notsobig, Inc. Issued 3 years ago, 2 years remaining until maturity. Annual payment 3.0% per annum coupon. $3,000,000 principal value Bond B $ 3,894,676 Corporate Ba bond of Sizable, Inc. Issued 4 years ago, 3 years remaining until maturity. Annual payment 3.5% per annum coupon. $4,000,000 principal value Stocks: $ $ 1,729,770 2,065,248 30,000 Common shares of Alittlebigger, Inc. Beta of these shares is 1.20 Shareholders Equity: Total: $9,984,470 Total: $ 9,984,470 $3,654,913 What value of EC will you use? (Choose one of the measures and LAI Evaluation and action Is current shareholder equity sufficient? NO, SHAREHOLDER EQUITY IS LESS THAN ECONOMIC CAPITAL If not, what course of action would you take? In particular, (1) if you raise additional equity, how much, and how? SELL STOCK, $1,925,143 (2) If you reduce positions, which positions will you reduce and how much? Make some estimate of what Economic Capital will be after this action (this needn't be extremely precise). (3) If you hedge positions, which positions will you hedge? Will you hedge completely or partially? What hedge positions will you take? Make some estimate of what Economic Capital will be after this action (this needn't be extremely precise). Cash/Money Market holdings: $1,000,480 Time Deposits: $8,254,700 $ Bonds: Bond A 3,024,066 Corporate Aa-rated bond of Notsobig, Inc. Issued 3 years ago, 2 years remaining until maturity. Annual payment 3.0% per annum coupon. $3,000,000 principal value Bond B $ 3,894,676 Corporate Ba bond of Sizable, Inc. Issued 4 years ago, 3 years remaining until maturity. Annual payment 3.5% per annum coupon. $4,000,000 principal value Stocks: $ $ 1,729,770 2,065,248 30,000 Common shares of Alittlebigger, Inc. Beta of these shares is 1.20 Shareholders Equity: Total: $9,984,470 Total: $ 9,984,470 $3,654,913 What value of EC will you use? (Choose one of the measures and LAI Evaluation and action Is current shareholder equity sufficient? NO, SHAREHOLDER EQUITY IS LESS THAN ECONOMIC CAPITAL If not, what course of action would you take? In particular, (1) if you raise additional equity, how much, and how? SELL STOCK, $1,925,143 (2) If you reduce positions, which positions will you reduce and how much? Make some estimate of what Economic Capital will be after this action (this needn't be extremely precise). (3) If you hedge positions, which positions will you hedge? Will you hedge completely or partially? What hedge positions will you take? Make some estimate of what Economic Capital will be after this action (this needn't be extremely precise)