Answered step by step

Verified Expert Solution

Question

1 Approved Answer

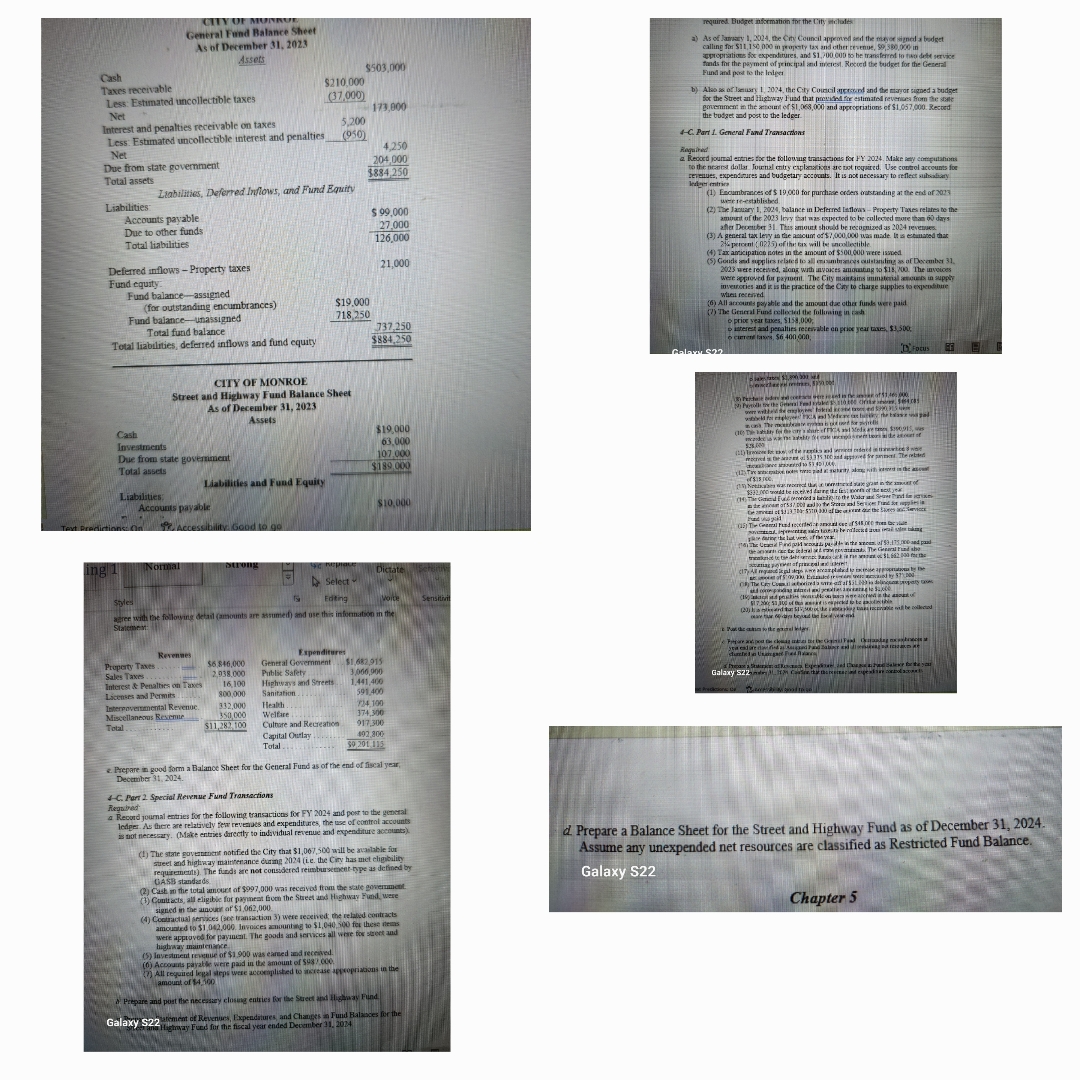

CashTaxes receivahleNeLess Estimated ncollectible taxesNet and nenaties receivable on taxesTes Estmated npolectible interest and penaltiesDue from state govermmentTotal assetsLiabilitiesAccounts pavableDue to other fundsTotal liabilitiesLaahilities Deferred

CashTaxes receivahleNeLess Estimated ncollectible taxesNet and nenaties receivable on taxesTes Estmated npolectible interest and penaltiesDue from state govermmentTotal assetsLiabilitiesAccounts pavableDue to other fundsTotal liabilitiesLaahilities Deferred Iulows. and Fund EauityFund cquityDeferred snlows Property taxesFund balanceassignedCIYO ce SheetTotal fund balanceIeestsentTotal liabiities, defered inflows and fund equityTotal assetsLiabilstiesDue froL State govermmenther LAssetsRevenmesPruperty TaNes.Accouus DavableLicenses asd Permspood form ambrancesCIIY OF MONROEStreet and Highway Fund Balance SheetAs of December Liabilitkes and Fund Equity$ SSSILASsetsQZamount of $WelfareGPer Speciel Revnue Fynd TransecionsHiryavs d SreetsSanitaton.SelectEdtng$$Teation$S JS$inSar umef and ose this infomation m theSExpenditurGental Gevenment$RDictateWote SenstirTatalDaance Shert for he General Fund as of rhe ent of Suesl uRermt umal eutries fr rhe following transacicns for FY and pest to the generatledges. As there are relatively tem revets and expendit es the e ot cati ot neresary. Make entries drety to indavitual reveue eThe stre eoyee C Cast m the total amcut af $ was receivod tam the sale ponemetEun the Suest and thghway ud eoviractsaa ces ee transactin wee ecwere apptUvod for payiacat The goads and sorces all we fox seeet andoe orS was eared nd receed.Prepare and pot tse necessry closung entties for the Steet ad Hwa Pindd Balabces or theGalaxy stmt ot Revenes, bxpendiues and Chages ud Haiay Fund fur the ficcal year ended December a As oflaay he Cit Council appemed sd the tosned budetpropratioms S expendinures, and SP to bhe marstered to tso deeFund and po to the lnleere Busget nfsemion tor the C Hteb Also ss orleury the Cty Cuicil mcesnd and te ayor sgDed a tudgetthe trodat ad post ta the ledeerC Pert L General Fand Trasacntto theod jural etes toc the tolloug trasaaos tor FY Mike aey cmutatioalee emtrieSoumbreces ofs CC for murchzge srdes dling a e twetahlisbedbudgetwere ved fx payenwaeu receedyahle a te anoot dz qther fund uee adTe Geneal Fund allet the fillaing in ahGalaxy rerest ad peealir eealle en prise year t Sd Prepare a Balance Sheet for the Street and Highway Fund as of December Assume any unexpended net resources are classified as Restricted Fund Balance.Galaxy SChapter i he Cey has mt eliibiliyrequinets Thr funds re not consudered reimtase

look at icture

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started