Answered step by step

Verified Expert Solution

Question

1 Approved Answer

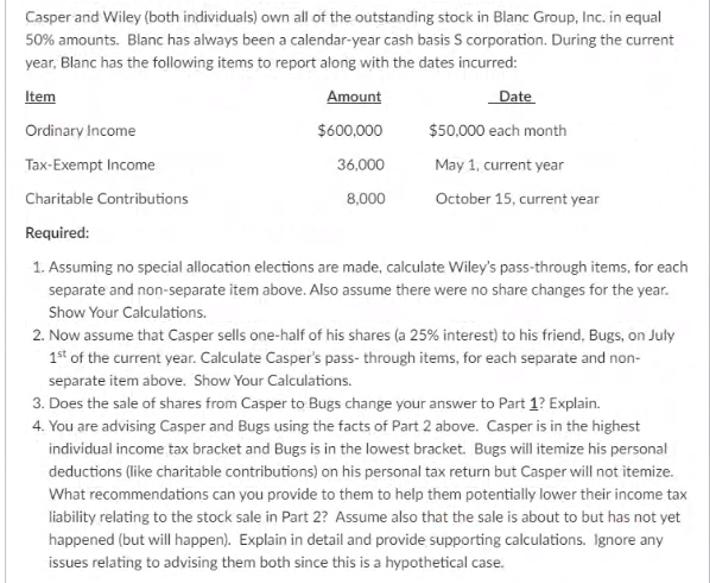

Casper and Wiley (both individuals) own all of the outstanding stock in Blanc Group, Inc. in equal 50% amounts. Blanc has always been a

Casper and Wiley (both individuals) own all of the outstanding stock in Blanc Group, Inc. in equal 50% amounts. Blanc has always been a calendar-year cash basis S corporation. During the current year, Blanc has the following items to report along with the dates incurred: Item Amount Date Ordinary Income $600,000 $50,000 each month Tax-Exempt Income 36.000 May 1, current year Charitable Contributions 8,000 October 15, current year Required: 1. Assuming no special allocation elections are made, calculate Wiley's pass-through items, for each separate and non-separate item above. Also assume there were no share changes for the year. Show Your Calculations. 2. Now assume that Casper sells one-half of his shares (a 25% interest) to his friend, Bugs, on July 1st of the current year. Calculate Casper's pass- through items, for each separate and non- separate item above. Show Your Calculations. 3. Does the sale of shares from Casper to Bugs change your answer to Part 1? Explain. 4. You are advising Casper and Bugs using the facts of Part 2 above. Casper is in the highest individual income tax bracket and Bugs is in the lowest bracket. Bugs will itemize his personal deductions (like charitable contributions) on his personal tax return but Casper will not itemize. What recommendations can you provide to them to help them potentially lower their income tax liability relating to the stock sale in Part 2? Assume also that the sale is about to but has not yet happened (but will happen). Explain in detail and provide supporting calculations. Ignore any issues relating to advising them both since this is a hypothetical case.

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

ANSWERS 1 Passthrough items Ordinary Income 300000 TaxExempt Income 18000 Charitable Contributions 4...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started