Question

Caspian Pty Ltd is a business that manufactures and sells water filters. The business was established in 2014 and has grown to a large proprietary

Caspian Pty Ltd is a business that manufactures and sells water filters. The business was established in 2014 and has grown to a large proprietary company with four owners: Olivia, Elliot, Alexandra and John. The business operates from a large factory in Melbourne and is registered for Goods and Services Tax (GST) with financial year end on 30 June. When it commenced its operations on 5 March 2014, Caspian was not able to purchase a building to manufacture water filters in and instead rented a factory. As the business has grown, the owners are considering purchasing the following assets as a package for $2,200,000 (GST Inclusive) on 1 July 2022:

| Asset | Fair value of asset |

| Land | $1,386,000 |

| Building | $808,500 |

| Equipment | $115,500 |

| Total | $2,310,000 |

Purchasing these assets would involve additional costs: legal fees of $5,500 (GST Inclusive) to register the land in business's name; $6,600 (GST Inclusive) to rewire the building; $4,840 (GST Inclusive) for a one year building insurance; $2,200 (GST Inclusive) to conduct a safety inspection of the equipment. To use the building, the business will need to incur $16,500 (GST Inclusive) to install a cooling/heating system.

The building is expected to have a useful life of 20 years and an estimated residual value of $200,000. The equipment is expected to have a useful life of 5 years and be used for 10,000 hours and an estimated residual value of $20,000. The equipment is expected to be used for 1,500 hours in year 1; 2,200 hours in year 2; 2,500 hours in year 3; 2,000 hours in year 4; and 1,800 hours in year 5. Caspian adopts the cost model to measure all existing non-current assets.

Because the business has seen a significant increase in demand for its products in recent months, the owners believe existing non-current assets should be valued higher and it would be more appropriate to change to the revaluation model of measuring non-current assets.

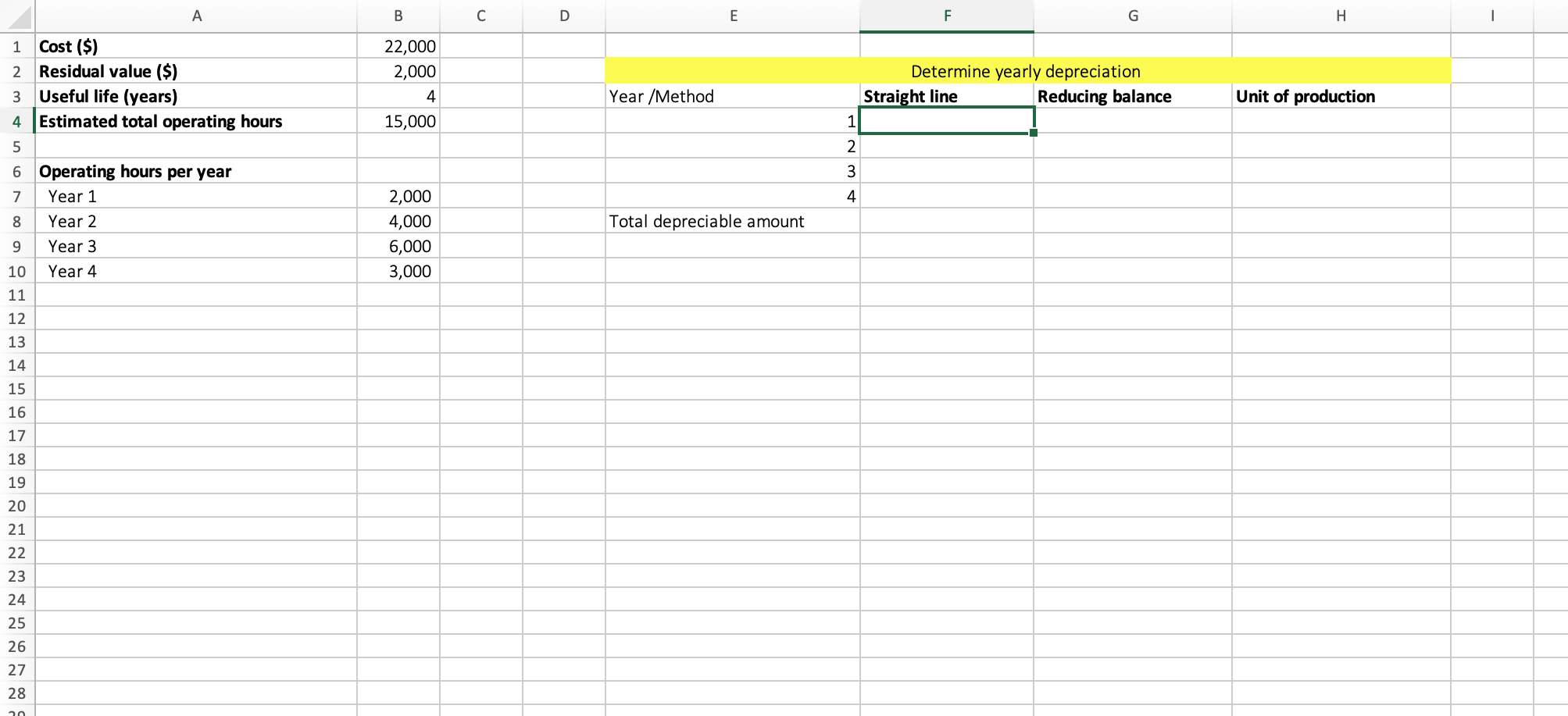

Question 2: Calculate the annual depreciation expense over the life of both the building and equipment using all 3 methods of depreciation (where possible), starting with year 1 ending 30 June 2023. For the building and equipment, select the method of depreciation you would advise the owners to use and justify your selection. To perform the above calculations, use "Template for Financial Modelling_PPE" provided in Week 3 folder. You must use formulas in Excel to obtain the answers. Take screen shots of your template that show the answers and Excel formulas that you used and insert them directly in question 2 answer.

Question 4: With reference to the Conceptual Framework, explain whether you agree with the owners on recording of warranties as an expense in the period the claims are made. If not, explain how warranties should be recorded and provide a double-entry to record a provision for warranties for the year ended 30 June 2022. With more people staying at home because of the pandemic, the business has seen a significant increase in demand for its products. This led the management to employ 1 additional staff for the 2021-2022 financial year. It was determined that new staff would earn gross salaries of $3,000 per fortnight with related deductions and on-costs: PAYG withholding1, employer superannuation guarantee2, payroll tax3, WorkCover of 2%, employee contribution to superannuation of $150 and employee contributions to insurance fees of $20.

Question 6: In terms of the methods of calculating bad debts, do you agree that the percentage of net credit sales method should be preferred because of its ease of calculation? Or do you think that the ageing method might be better in times when credit sales and receivables are increasing?

On 1 July 2022, Caspian signed an agreement with ABlock to supply and install 190 of its premium water filters in a newly built apartment block for a contract price of $60,610 (GST Inclusive). This amount also includes one free service of all 190 water filters 4 months from the date of installation. The standalone price of one premium water filter is $330 (GST Inclusive), the standalone price of installing one premium water filter is $77 (GST Inclusive) and the standalone price of servicing one premium filter is $55 (GST Inclusive). Half of 190 premium water filters were installed on 11 August 2022 and the remaining half was installed two weeks later. ABlock paid the full contract amount on 20 July 2022.

please give the answers for the following question

Thanks a lot

BELOW IS Template for Financial Modelling_PPE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started