Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Caspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the equipment necessary to produce

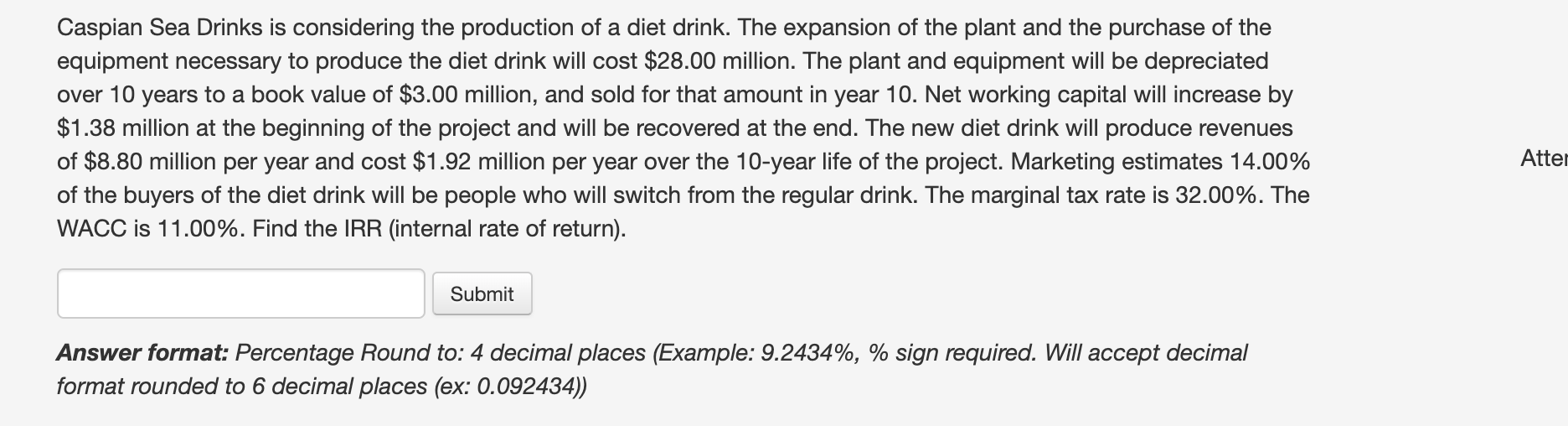

Caspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the

equipment necessary to produce the diet drink will cost $ million. The plant and equipment will be depreciated

over years to a book value of $ million, and sold for that amount in year Net working capital will increase by

$ million at the beginning of the project and will be recovered at the end. The new diet drink will produce revenues

of $ million per year and cost $ million per year over the year life of the project. Marketing estimates

of the buyers of the diet drink will be people who will switch from the regular drink. The marginal tax rate is The

WACC is Find the IRR internal rate of return

Answer format: Percentage Round to: decimal places Example: sign required. Will accept decimal

format rounded to decimal places ex:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started