Answered step by step

Verified Expert Solution

Question

1 Approved Answer

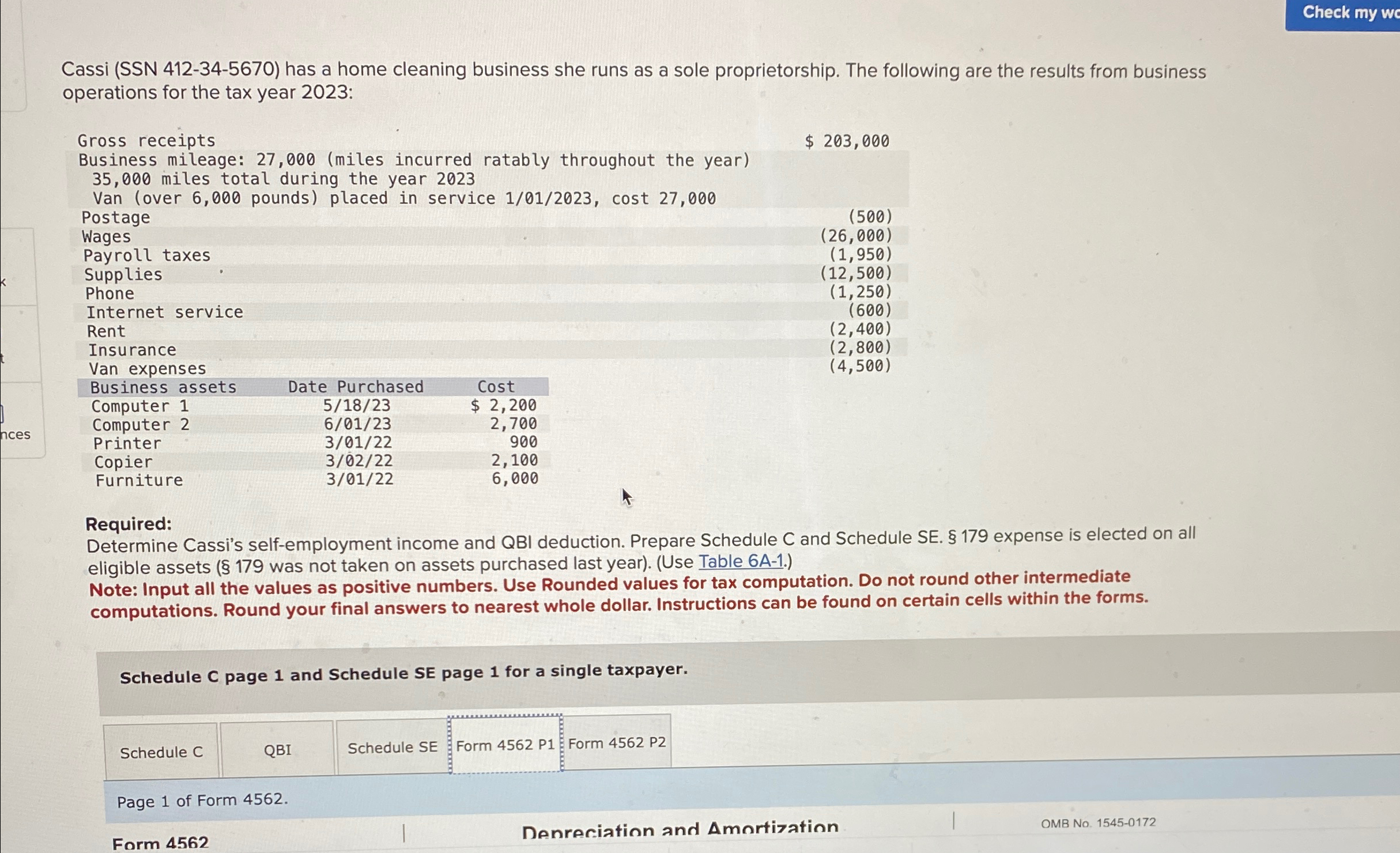

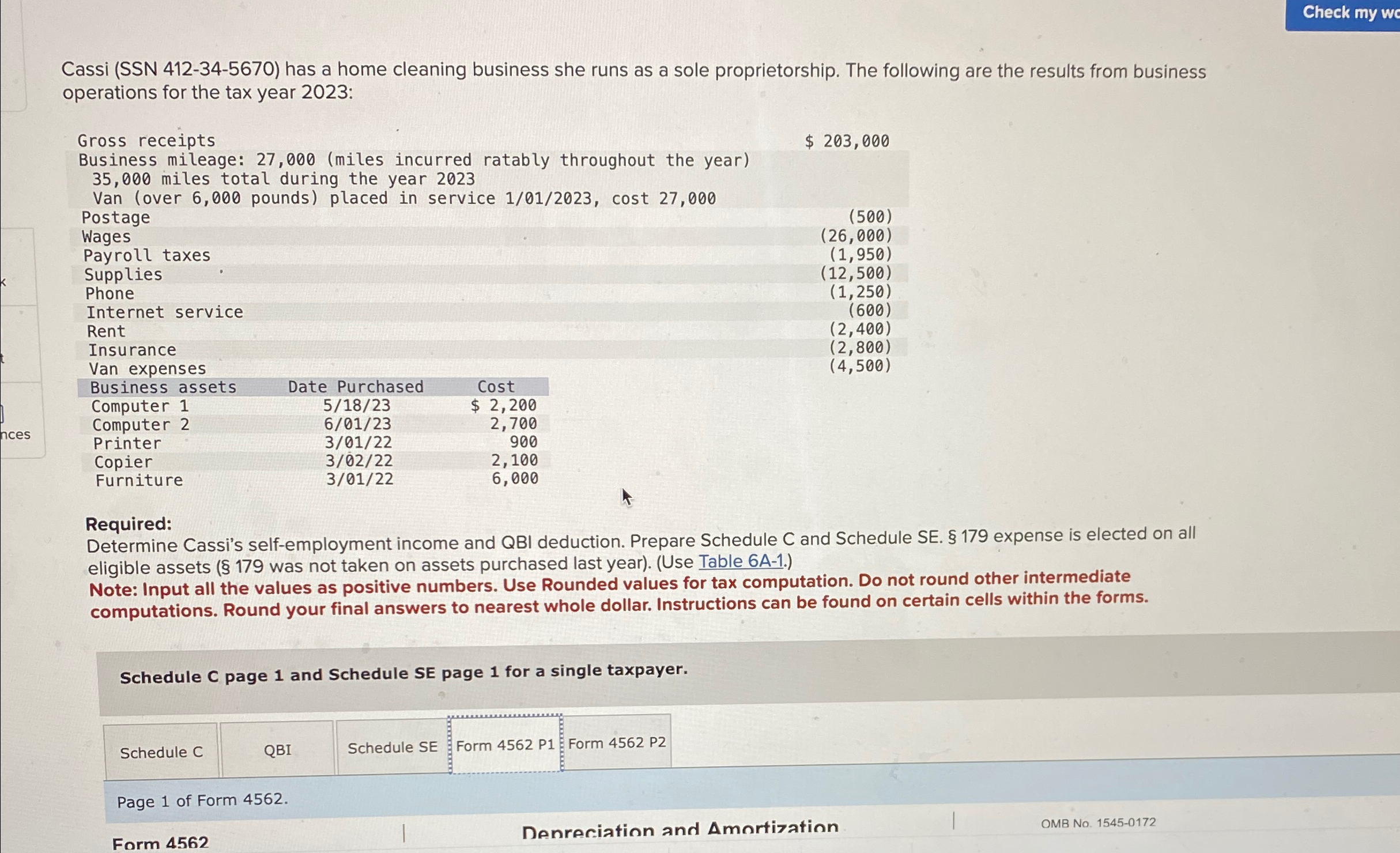

Cassi ( SSN 4 1 2 - 3 4 - 5 6 7 0 ) ?has a home cleaning business she runs as a sole

Cassi SSN ?has a home cleaning business she runs as a sole proprietorship. The following are the results from business operations for the tax year :

Required:

Determine Cassi's selfemployment income and QBI deduction. Prepare Schedule C and Schedule SE ?expense is elected on all eligible assets ?$ ?was not taken on assets purchased last yearUse Table A

Note: Input all the values as positive numbers. Use Rounded values for tax computation. Do not round other intermediate computations. Round your final answers to nearest whole dollar. Instructions can be found on certain cells within the forms.

Schedule C page ?and Schedule SE page ?for a single taxpayer.

Schedule C

QBI

Schedule SE

Form ?P

Form ?P

Page ?of Form

Form

Denreciation and Amnrtiation

OMB No

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started