Castan Properties plc is considering building a small shop on a disused site. The company would occupy this shop to hire out and sell

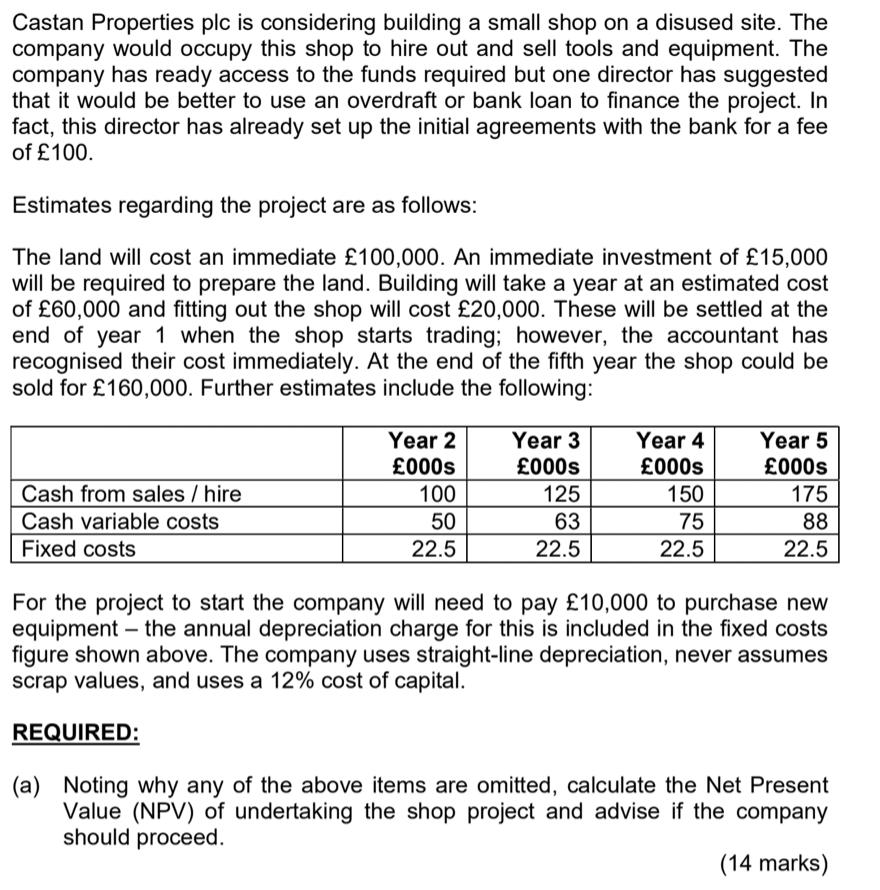

Castan Properties plc is considering building a small shop on a disused site. The company would occupy this shop to hire out and sell tools and equipment. The company has ready access to the funds required but one director has suggested that it would be better to use an overdraft or bank loan to finance the project. In fact, this director has already set up the initial agreements with the bank for a fee of 100. Estimates regarding the project are as follows: The land will cost an immediate 100,000. An immediate investment of 15,000 will be required to prepare the land. Building will take a year at an estimated cost of 60,000 and fitting out the shop will cost 20,000. These will be settled at the end of year 1 when the shop starts trading; however, the accountant has recognised their cost immediately. At the end of the fifth year the shop could be sold for 160,000. Further estimates include the following: Cash from sales / hire Cash variable costs Fixed costs Year 2 000s REQUIRED: 100 50 22.5 Year 3 000s 125 63 22.5 Year 4 000s 150 75 22.5 Year 5 000s 175 88 22.5 For the project to start the company will need to pay 10,000 to purchase new equipment the annual depreciation charge for this is included in the fixed costs figure shown above. The company uses straight-line depreciation, never assumes scrap values, and uses a 12% cost of capital. (a) Noting why any of the above items are omitted, calculate the Net Present Value (NPV) of undertaking the shop project and advise if the company should proceed. (14 marks)

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started