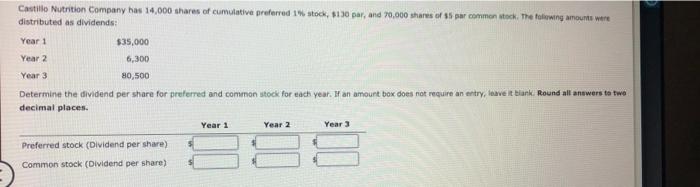

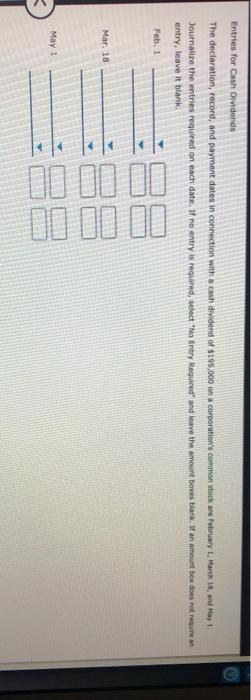

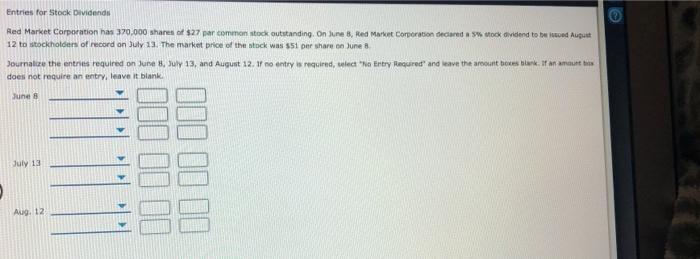

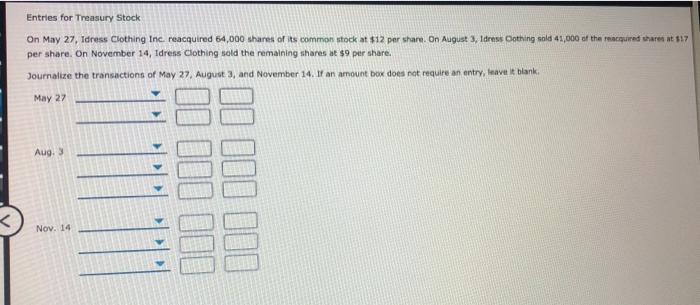

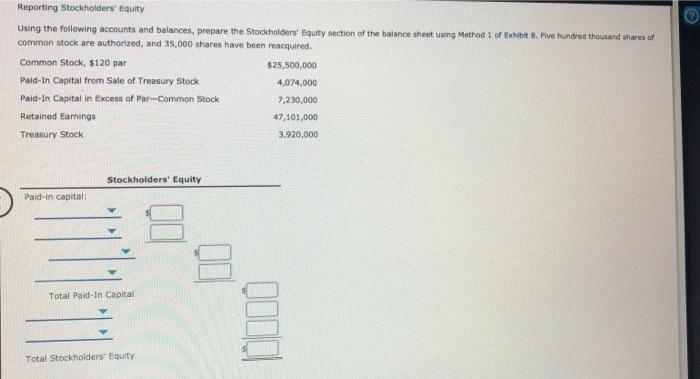

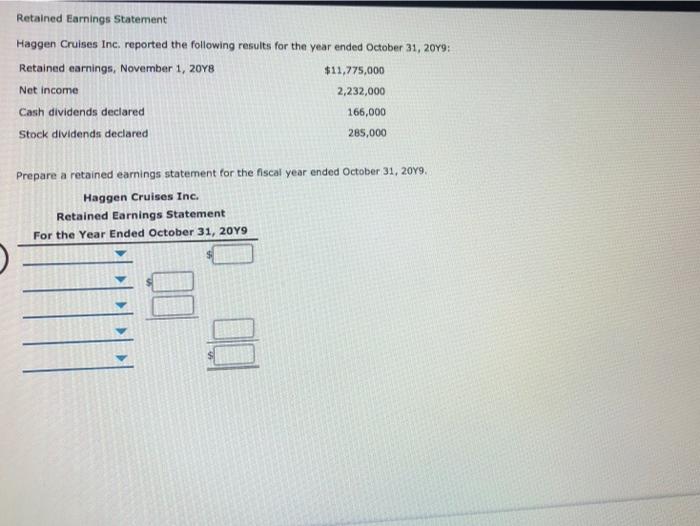

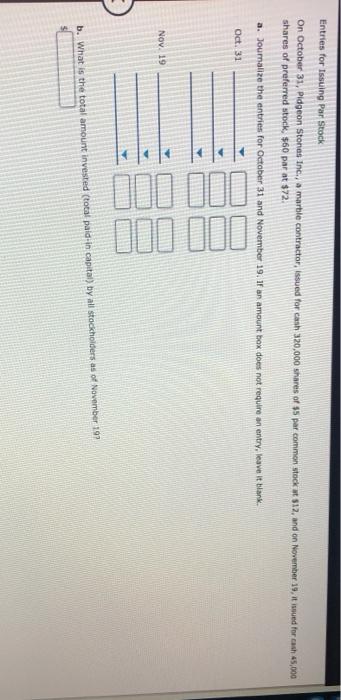

Castillo Nutrition Company has 14,000 shares of cumulative preferred 14 stock, 8130 par, and 70,000 shares of 35 per common stock. The following amounts were distributed as dividends: Year 1 $35,000 Year 2 6,300 Year 3 80,500 Determine the dividend per share for preferred and common stock for each year. If an amount box does not require an entry, leave it bank. Round all answers to two decimal places Year 1 Year 2 Year 3 Preferred stock (Dividend per share) Common stock (Dividend per share) Entries for Cash Dividends The declaration, record, and payment dates in connection with cash dividend of $195.000 on a corporations common stock are abeuary 1, March 16, und Mat Journalize the entries required on each date. If no entry is required, select 'No Entry Required and leave the amount boxes blank. If an amount box does not require entry, leave it blank Feb. 1 Mar. 18 May 1 Entries for Stock Dividends Red Market Corporation has 370,000 shares of $27 par common stock outstanding. On June 8, Red Market Corporation declared to dividend to be od August 12 to stockholders of record on July 13. The market price of the stock was 51 per share on June Journalize the entries required on June July 13, and August 12. 1 no entry required, utea "Na Entry Requred and leave the arcount boxes blank. If an amount tin does not require an entry leave it blank June July 13 11 11 10 11 11 110 Aug. 12 Entries for Treasury Stock On May 27, Idress Clothing Inc. reacquired 64,000 shares of its common stock at $12 per share. On August 3, Idress Clothing sold 45,000 of the racquired share at 117 per share. On November 14, Idress Clothing sold the remaining shares at $9 per share. Journalize the transactions of May 27 August 3, and November 14, 1 an amount box does not require an entry, leave it blank May 27 Aug. 110 111 10 Nov. 14 Reporting Stockholders Equity Using the following accounts and balances, prepare the Stockholders' Equity section of the balance sheet uung Method 1 of Exibit 8. Five Hundred thousand shares of common stock are authorized, and 35,000 shares have been reacquired. Common Stock, $120 par $25,500,000 Paid-in Capital from Sale of Treasury Stock 4,074,000 Pald-In Capital in Excess of Par-Common Stock 7,230,000 Retained Earnings 47,101,000 Treasury Stock 3.920,000 Stockholders' Equity Paid-in capital 00 Total Paid-In Capital Total Stockholders' Equity Retained Earnings Statement Haggen Cruises Inc. reported the following results for the year ended October 31, 2019: Retained earnings, November 1, 20Y8 $11,775,000 Net income 2,232,000 Cash dividends declared 166,000 Stock dividends declared 285,000 Prepare a retained earnings statement for the fiscal year ended October 31, 2019 Haggen Cruises Inc. Retained Earnings Statement For the Year Ended October 31, 2019 >> Entries for Issuing Par Stock On October 31, Pidgeon Stones Inc., a marble contractor, issued for cash 320,000 shares of $5 par common stock 512, and on November 19, it sued for cash 45,000 shares of preferred stock. $60 par at $72. a. Journalize the entries for October 31 and November 19. If an amount box does not require an entry leave it blank Oct. 31 101 100 NOV 19 101 b. What is the total amount invested (total paid in capital) by all stockholders as of November 192