Answered step by step

Verified Expert Solution

Question

1 Approved Answer

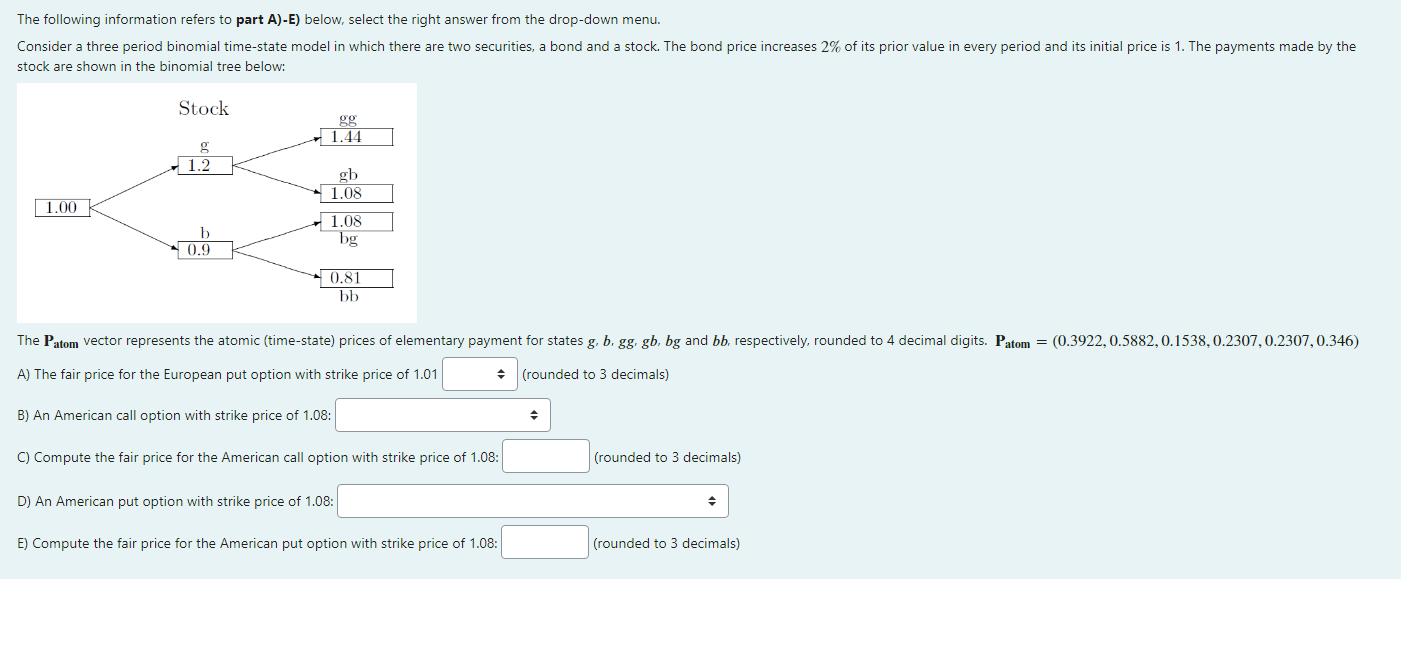

The following information refers to part A)-E) below, select the right answer from the drop-down menu. Consider a three period binomial time-state model in

The following information refers to part A)-E) below, select the right answer from the drop-down menu. Consider a three period binomial time-state model in which there are two securities, a bond and a stock. The bond price increases 2% of its prior value in every period and its initial price is 1. The payments made by the stock are shown in the binomial tree below: 1.00 Stock g 1.2 b 0.9 gg 1.44 gb 1.08 1.08 bg 0.81 bb The Patom vector represents the atomic (time-state) prices of elementary payment for states g. b. gg. gb. bg and bb. respectively, rounded to 4 decimal digits. Patom (0.3922, 0.5882, 0.1538, 0.2307, 0.2307, 0.346) A) The fair price for the European put option with strike price of 1.01. (rounded to 3 decimals) B) An American call option with strike price of 1.08: C) Compute the fair price for the American call option with strike price of 1.08: D) An American put option with strike price of 1.08: E) Compute the fair price for the American put option with strike price of 1.08: + (rounded to 3 decimals) (rounded to 3 decimals)

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

A An European option can only be exercised at maturity Therefore the only at time period 3 will it b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started