Question

Casual Threads currently sells blue jeans and T-shirts. Management is considering adding fleece tops to its inventory to provide a cooler weather option. The tops

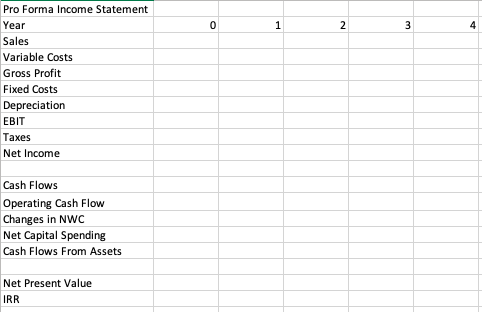

Casual Threads currently sells blue jeans and T-shirts. Management is considering adding fleece tops to its inventory to provide a cooler weather option. The tops would sell for $45 each with expected sales of 3,800 tops annually. By adding the fleece tops, management feels the firm will sell an additional 220 pairs of jeans at $59 a pair and 325 fewer T-shirts at $18 each. The variable cost per unit is $21 on the fleece tops, $36 on the jeans, and $9 on the T-shirts. Consider this a four-year project, for which a $100,000 capital investment will be made to manufacture the new item. This will generate depreciation expense of $25,000 a year. The fixed costs are $48,000 annually. The tax rate is 21 percent. If the company is applying a 20% discount rate, what is the project's operating cash flow and net present value? What is the internal rate of return?

(How would I do this in excel?)

Thank you so much!!

0 1 2 3 Pro Forma Income Statement Year Sales Variable costs Gross Profit Fixed Costs Depreciation EBIT Taxes Net Income Cash Flows Operating Cash Flow Changes in NWC Net Capital Spending Cash Flows From Assets Net Present Value IRRStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started