Answered step by step

Verified Expert Solution

Question

1 Approved Answer

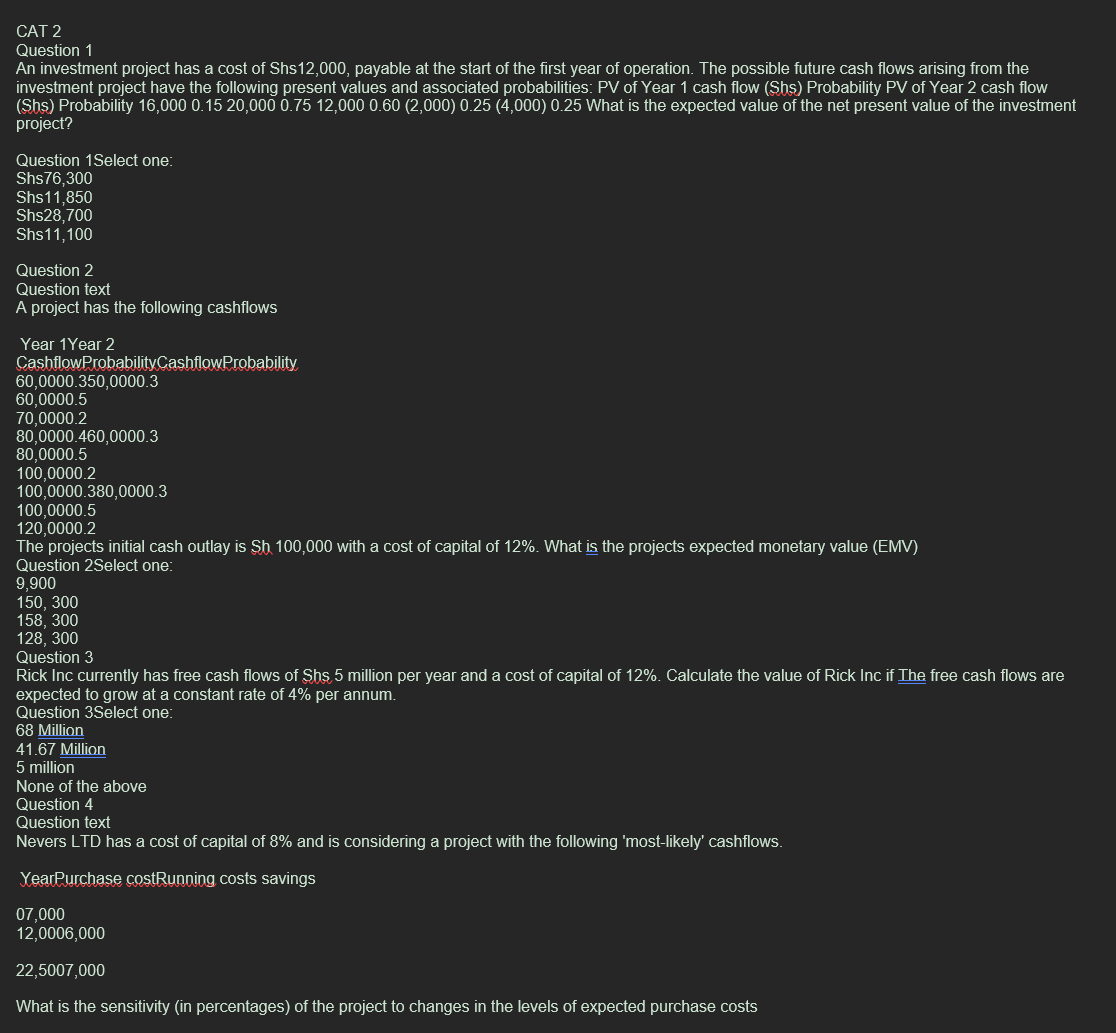

CAT 2 Question 1 An investment project has a cost of Shs 1 2 , 0 0 0 , payable at the start of the

CAT

Question

An investment project has a cost of Shs payable at the start of the first year of operation. The possible future cash filows arising from the

investment project have the following present values and associated probabilities: PV of Year cash flow Shs Probability PV of Year cash flow

Shs Probability What is the expected value of the net present value of the investment

project?

Question Select one:

Shs

Shs

Shs

Shs

Question

Question text

A project has the following cashflows

Year Year

CashflowProbabilityCashflowProbability

The projects initial cash outlay is Sh with a cost of capital of What is the projects expected monetary value EMV

Question Select one:

Question

Rick Inc currently has free cash flows of Shs million per year and a cost of capital of Calculate the value of Rick Inc if The free cash flows are

expected to grow at a constant rate of per annum.

Question Select one:

Million

Million

million

None of the above

Question

Question text

Nevers LTD has a cost of capital of and is considering a project with the following 'mostlikely' cashflows.

YearPurchase costRunning costs savings

What is the sensitivity in percentages of the project to changes in the levels of expected purchase costs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started