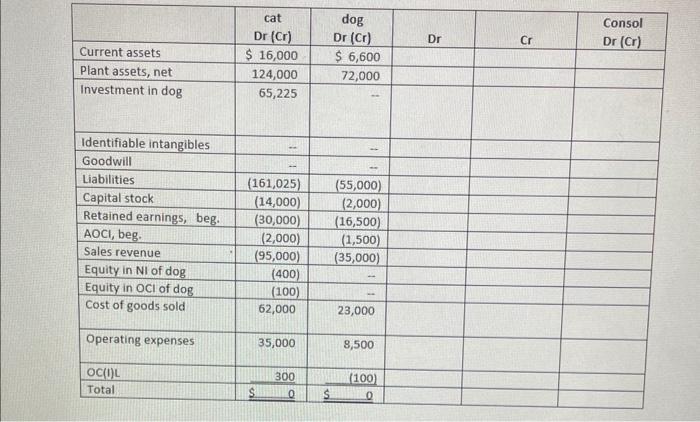

Cat Company acquired 100% of the voting stock of dog Company on January 1,2018 for $60,000. dog Company's book value at the date of acquisition totaled $8,000. dog had previously unrecorded identifiable intangibles with a total fair value of $20,000, and plant assets were overvalued by $15,000. All of dog's other identifiable net assets had book values that approximated fair value at the date of acquisition. The identifiable intangibles have an estimated life of 5 years as of the date of acquisition, and the plant assets have an estimated life of 20 years, straight-line. There is no goodwill impairment. It is now December 31,2020 (three years since the date of acquisition). The December 31,2020 |preclosing trial balances of both companies appear on the consolidation working paper below. cat uses the complete equity method to account for its investment in dog. Information on intercompany transactions is as follows: 1. dog sells merchandise to cat at a markup of 25% on cost. Cat's inventory at January 1, 2020 contains $875 in merchandise purchased from dog. Cat's inventory at December 31,2020 contains $1,125 in merchandise purchased from dog. Total sales from dog to cat during 2020 were $20,000. 2. cat sold plant assets to dog at a gain of $1,000 on January 1,2018 . The remaining life of the plant assets at the date of sale to dog was 5 years. Required a. Fill in the working paper below to consolidate the December 31, 2020 trial balances of cat and dog. Clearly label your eliminating entries (E), (R), (C), (O), and (I). b. Present the Consolidated Statement of Income and Comprehensive Income for 2020. c. journal entries for each eliminating entries E),(R),(C),(O), and (I). Cat Company acquired 100% of the voting stock of dog Company on January 1,2018 for $60,000. dog Company's book value at the date of acquisition totaled $8,000. dog had previously unrecorded identifiable intangibles with a total fair value of $20,000, and plant assets were overvalued by $15,000. All of dog's other identifiable net assets had book values that approximated fair value at the date of acquisition. The identifiable intangibles have an estimated life of 5 years as of the date of acquisition, and the plant assets have an estimated life of 20 years, straight-line. There is no goodwill impairment. It is now December 31,2020 (three years since the date of acquisition). The December 31,2020 |preclosing trial balances of both companies appear on the consolidation working paper below. cat uses the complete equity method to account for its investment in dog. Information on intercompany transactions is as follows: 1. dog sells merchandise to cat at a markup of 25% on cost. Cat's inventory at January 1, 2020 contains $875 in merchandise purchased from dog. Cat's inventory at December 31,2020 contains $1,125 in merchandise purchased from dog. Total sales from dog to cat during 2020 were $20,000. 2. cat sold plant assets to dog at a gain of $1,000 on January 1,2018 . The remaining life of the plant assets at the date of sale to dog was 5 years. Required a. Fill in the working paper below to consolidate the December 31, 2020 trial balances of cat and dog. Clearly label your eliminating entries (E), (R), (C), (O), and (I). b. Present the Consolidated Statement of Income and Comprehensive Income for 2020. c. journal entries for each eliminating entries E),(R),(C),(O), and (I)