Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Catastrophe bonds are: Issued by insurers or reinsurers to institutional investors with high interest rates and principal and interest payments are made upfront at the

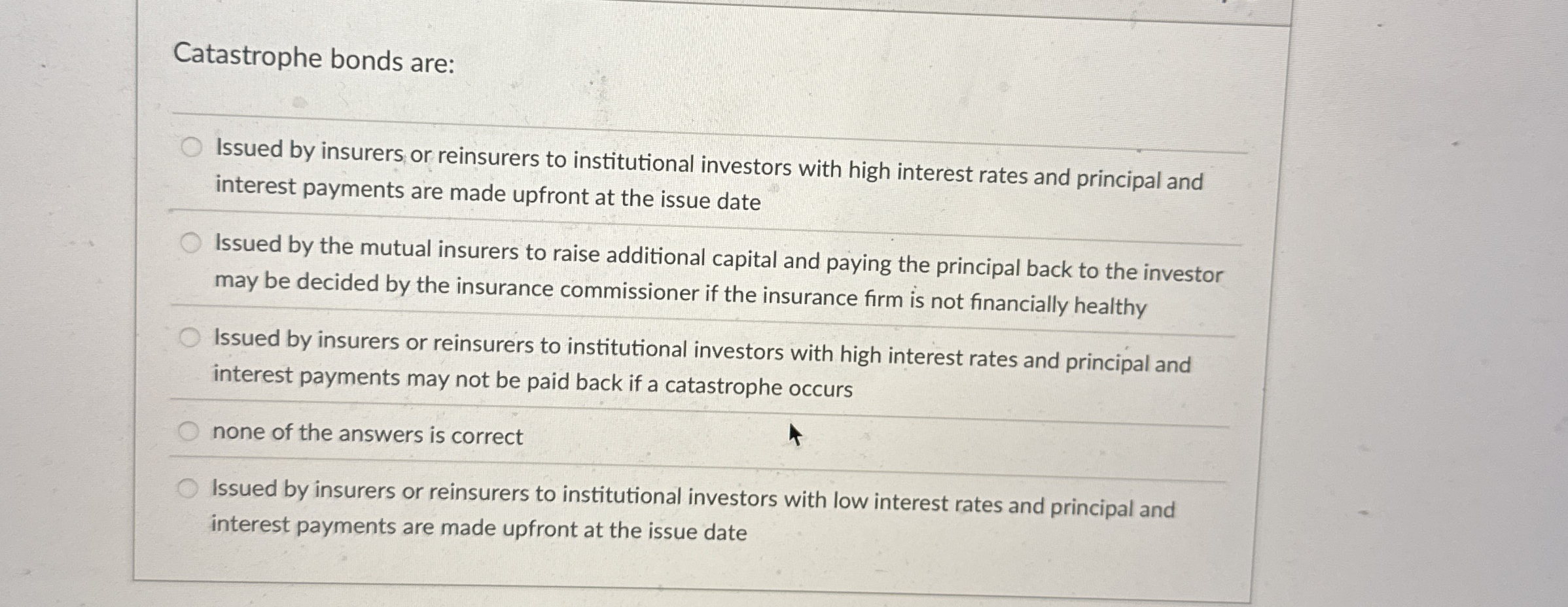

Catastrophe bonds are:

Issued by insurers or reinsurers to institutional investors with high interest rates and principal and

interest payments are made upfront at the issue date

Issued by the mutual insurers to raise additional capital and paying the principal back to the investor

may be decided by the insurance commissioner if the insurance firm is not financially healthy

Issued by insurers or reinsurers to institutional investors with high interest rates and principal and

interest payments may not be paid back if a catastrophe occurs

none of the answers is correct

Issued by insurers or reinsurers to institutional investors with low interest rates and principal and

interest payments are made upfront at the issue date

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started