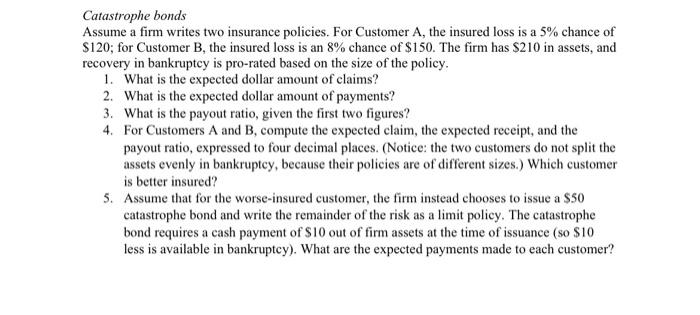

Catastrophe bonds Assume a firm writes two insurance policies. For Customer A, the insured loss is a 5% chance of $120; for Customer B, the insured loss is an 8% chance of $150. The firm has $210 in assets, and recovery in bankruptcy is pro-rated based on the size of the policy. 1. What is the expected dollar amount of claims? 2. What is the expected dollar amount of payments? 3. What is the payout ratio, given the first two figures? 4. For Customers A and B, compute the expected claim, the expected receipt, and the payout ratio, expressed to four decimal places. (Notice: the two customers do not split the assets evenly in bankruptcy, because their policies are of different sizes.) Which customer is better insured? 5. Assume that for the worse-insured customer, the firm instead chooses to issue a $50 catastrophe bond and write the remainder of the risk as a limit policy. The catastrophe bond requires a cash payment of $10 out of firm assets at the time of issuance (so $10 less is available in bankruptcy). What are the expected payments made to each customer? Catastrophe bonds Assume a firm writes two insurance policies. For Customer A, the insured loss is a 5% chance of $120; for Customer B, the insured loss is an 8% chance of $150. The firm has $210 in assets, and recovery in bankruptcy is pro-rated based on the size of the policy. 1. What is the expected dollar amount of claims? 2. What is the expected dollar amount of payments? 3. What is the payout ratio, given the first two figures? 4. For Customers A and B, compute the expected claim, the expected receipt, and the payout ratio, expressed to four decimal places. (Notice: the two customers do not split the assets evenly in bankruptcy, because their policies are of different sizes.) Which customer is better insured? 5. Assume that for the worse-insured customer, the firm instead chooses to issue a $50 catastrophe bond and write the remainder of the risk as a limit policy. The catastrophe bond requires a cash payment of $10 out of firm assets at the time of issuance (so $10 less is available in bankruptcy). What are the expected payments made to each customer