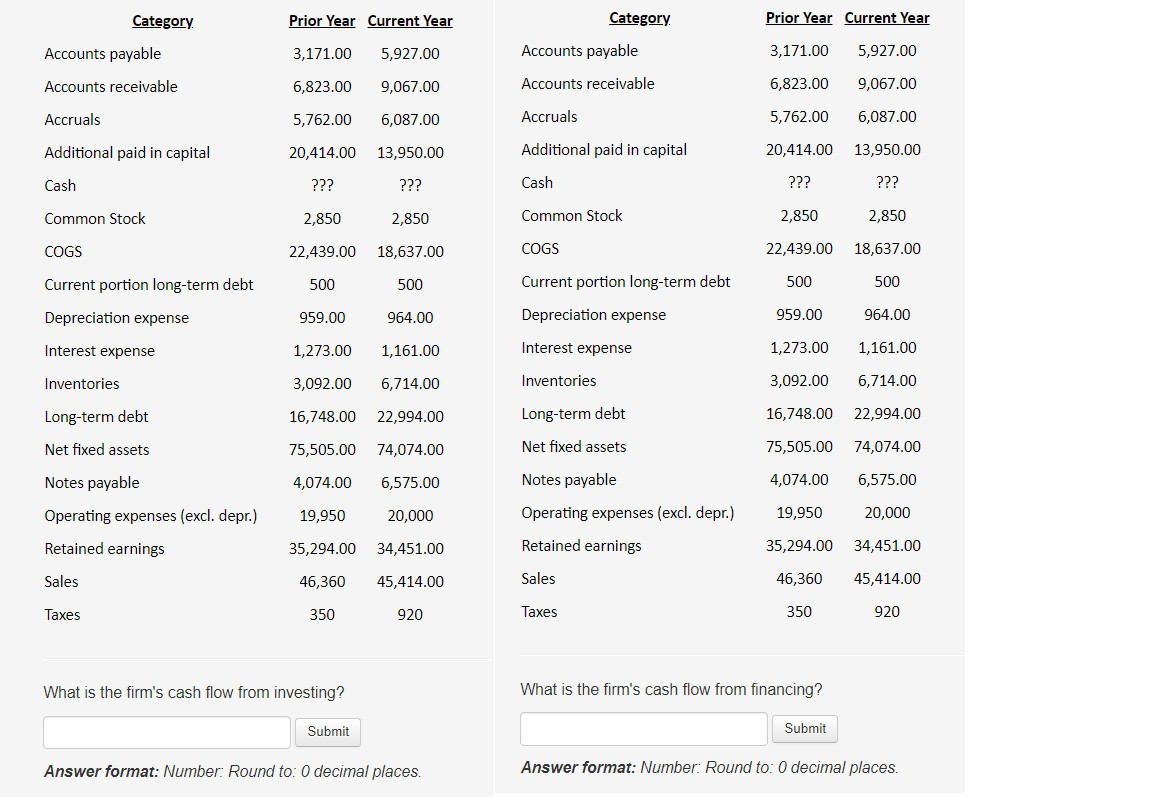

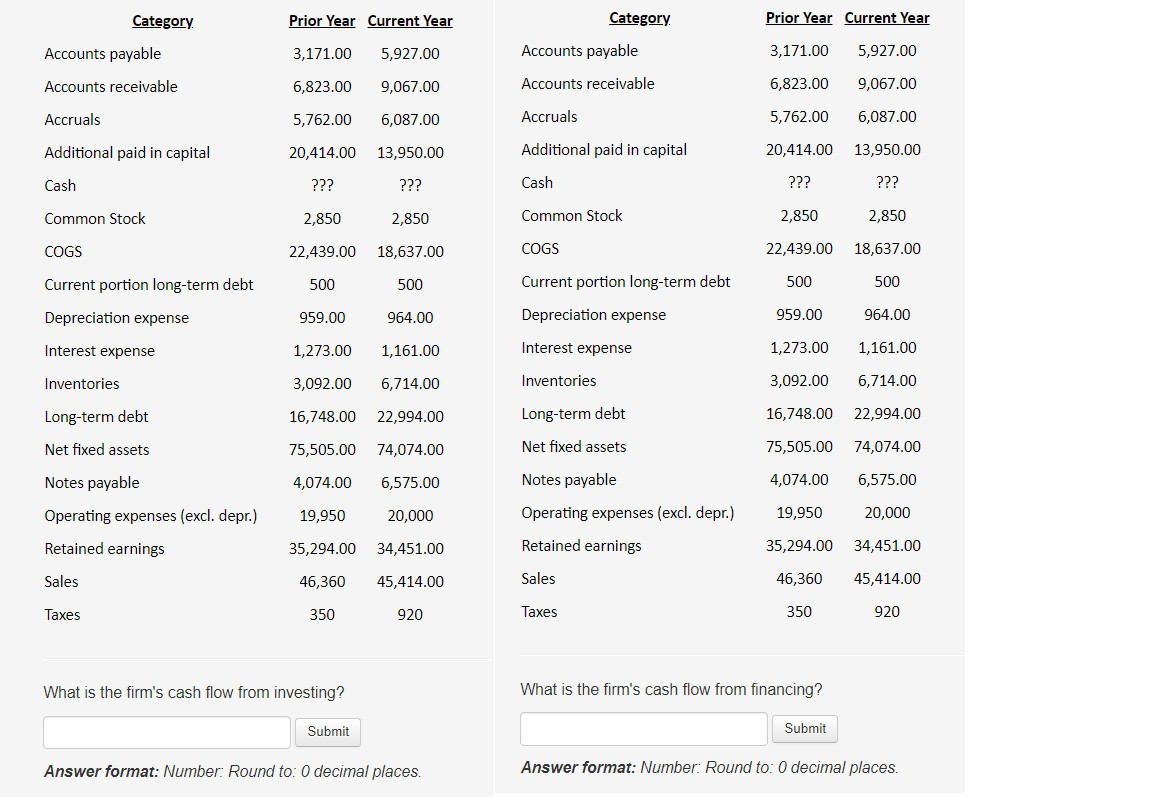

Category Prior Year Current Year Category Prior Year Current Year Accounts payable 3,171.00 5,927.00 Accounts payable 3,171.00 5,927.00 Accounts receivable 6,823.00 9,067.00 Accounts receivable 6,823.00 9,067.00 Accruals 5,762.00 6,087.00 Accruals 5,762.00 6,087.00 Additional paid in capital 20,414.00 13,950.00 Additional paid in capital 20,414.00 13,950.00 Cash ??? ??? Cash ??? ??? Common Stock 2,850 2,850 Common Stock 2,850 2,850 COGS 22,439.00 18,637.00 COGS 22,439.00 18,637.00 Current portion long-term debt 500 500 Current portion long-term debt 500 500 Depreciation expense 959.00 964.00 Depreciation expense 959.00 964.00 Interest expense 1,273.00 1,161.00 Interest expense 1,273.00 1,161.00 Inventories 3,092.00 6,714.00 Inventories 3,092.00 6,714.00 Long-term debt 16,748.00 22,994.00 Long-term debt 16,748.00 22,994.00 Net fixed assets 75,505.00 74,074.00 Net fixed assets 75,505.00 74,074.00 Notes payable 4,074.00 6,575.00 Notes payable 4,074.00 6,575.00 Operating expenses (excl. depr.) 19,950 20,000 Operating expenses (excl. depr.) 19,950 20,000 Retained earnings 35,294.00 34,451.00 Retained earnings 35,294.00 34,451.00 Sales 46,360 45,414.00 Sales 46,360 45,414.00 Taxes 350 920 Taxes 350 920 What is the firm's cash flow from investing? What is the firm's cash flow from financing? Submit Submit Answer format: Number: Round to: 0 decimal places. Answer format: Number: Round to: 0 decimal places. Category Prior Year Current Year Category Prior Year Current Year Accounts payable 3,171.00 5,927.00 Accounts payable 3,171.00 5,927.00 Accounts receivable 6,823.00 9,067.00 Accounts receivable 6,823.00 9,067.00 Accruals 5,762.00 6,087.00 Accruals 5,762.00 6,087.00 Additional paid in capital 20,414.00 13,950.00 Additional paid in capital 20,414.00 13,950.00 Cash ??? ??? Cash ??? ??? Common Stock 2,850 2,850 Common Stock 2,850 2,850 COGS 22,439.00 18,637.00 COGS 22,439.00 18,637.00 Current portion long-term debt 500 500 Current portion long-term debt 500 500 Depreciation expense 959.00 964.00 Depreciation expense 959.00 964.00 Interest expense 1,273.00 1,161.00 Interest expense 1,273.00 1,161.00 Inventories 3,092.00 6,714.00 Inventories 3,092.00 6,714.00 Long-term debt 16,748.00 22,994.00 Long-term debt 16,748.00 22,994.00 Net fixed assets 75,505.00 74,074.00 Net fixed assets 75,505.00 74,074.00 Notes payable 4,074.00 6,575.00 Notes payable 4,074.00 6,575.00 Operating expenses (excl. depr.) 19,950 20,000 Operating expenses (excl. depr.) 19,950 20,000 Retained earnings 35,294.00 34,451.00 Retained earnings 35,294.00 34,451.00 Sales 46,360 45,414.00 Sales 46,360 45,414.00 Taxes 350 920 Taxes 350 920 What is the firm's cash flow from investing? What is the firm's cash flow from financing? Submit Submit Answer format: Number: Round to: 0 decimal places. Answer format: Number: Round to: 0 decimal places