Answered step by step

Verified Expert Solution

Question

1 Approved Answer

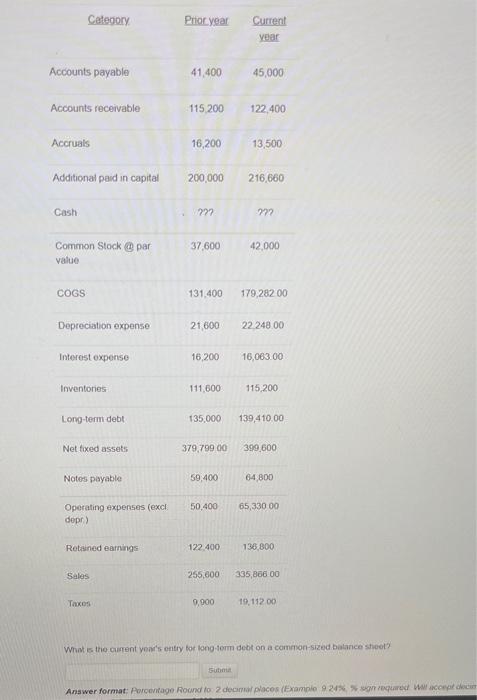

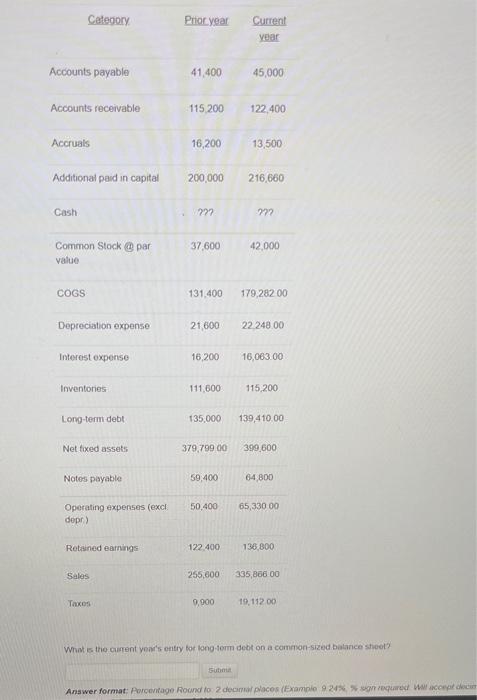

Category Proc year Current year Accounts payable 41,400 45,000 Accounts receivable 115 200 122.400 Accruals 16,200 13,500 Additional paid in capital 200,000 216,660 Cash 227

Category Proc year Current year Accounts payable 41,400 45,000 Accounts receivable 115 200 122.400 Accruals 16,200 13,500 Additional paid in capital 200,000 216,660 Cash 227 272 Common Stock par value 37.600 42.000 COGS 131.400 179,282 00 Depreciation expense 21600 22 248.00 Interest expenso 16,200 16,063.00 Inventores 111.600 115,200 Long-term debt 135,000 139,410.00 Net fixed assets 379,799.00 399,000 Notes payable 59 400 64.800 50,400 65,330 00 Operating expenses (excl depr) Retained earnings 122.400 136.800 Sales 255,000 335,866 00 Taxos 9,900 19, 112.00 What is the current year's only for long term debt on a common-sized balance shoot Sun Answer format: Porcentage Road to 2 decimal places (Example 924% required Wilcowa do Category Proc year Current year Accounts payable 41,400 45,000 Accounts receivable 115 200 122.400 Accruals 16,200 13,500 Additional paid in capital 200,000 216,660 Cash 227 272 Common Stock par value 37.600 42.000 COGS 131.400 179,282 00 Depreciation expense 21600 22 248.00 Interest expenso 16,200 16,063.00 Inventores 111.600 115,200 Long-term debt 135,000 139,410.00 Net fixed assets 379,799.00 399,000 Notes payable 59 400 64.800 50,400 65,330 00 Operating expenses (excl depr) Retained earnings 122.400 136.800 Sales 255,000 335,866 00 Taxos 9,900 19, 112.00 What is the current year's only for long term debt on a common-sized balance shoot Sun Answer format: Porcentage Road to 2 decimal places (Example 924% required Wilcowa do

Category Proc year Current year Accounts payable 41,400 45,000 Accounts receivable 115 200 122.400 Accruals 16,200 13,500 Additional paid in capital 200,000 216,660 Cash 227 272 Common Stock par value 37.600 42.000 COGS 131.400 179,282 00 Depreciation expense 21600 22 248.00 Interest expenso 16,200 16,063.00 Inventores 111.600 115,200 Long-term debt 135,000 139,410.00 Net fixed assets 379,799.00 399,000 Notes payable 59 400 64.800 50,400 65,330 00 Operating expenses (excl depr) Retained earnings 122.400 136.800 Sales 255,000 335,866 00 Taxos 9,900 19, 112.00 What is the current year's only for long term debt on a common-sized balance shoot Sun Answer format: Porcentage Road to 2 decimal places (Example 924% required Wilcowa do Category Proc year Current year Accounts payable 41,400 45,000 Accounts receivable 115 200 122.400 Accruals 16,200 13,500 Additional paid in capital 200,000 216,660 Cash 227 272 Common Stock par value 37.600 42.000 COGS 131.400 179,282 00 Depreciation expense 21600 22 248.00 Interest expenso 16,200 16,063.00 Inventores 111.600 115,200 Long-term debt 135,000 139,410.00 Net fixed assets 379,799.00 399,000 Notes payable 59 400 64.800 50,400 65,330 00 Operating expenses (excl depr) Retained earnings 122.400 136.800 Sales 255,000 335,866 00 Taxos 9,900 19, 112.00 What is the current year's only for long term debt on a common-sized balance shoot Sun Answer format: Porcentage Road to 2 decimal places (Example 924% required Wilcowa do

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started