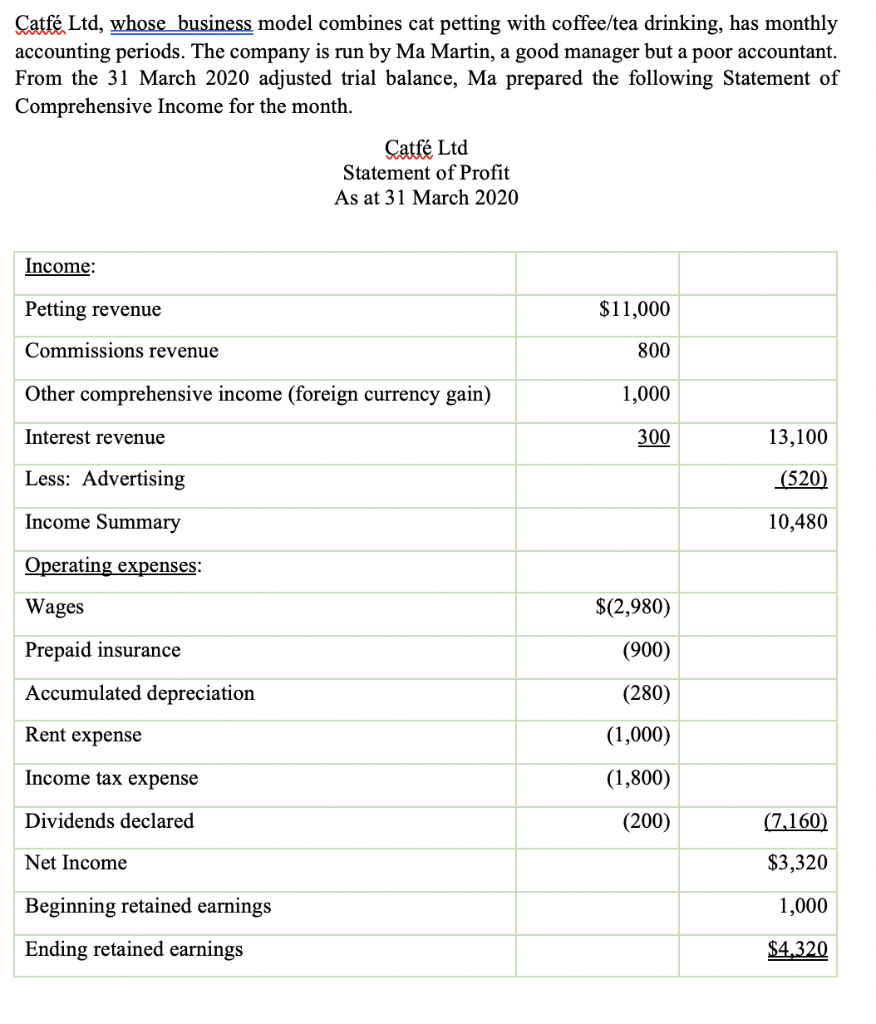

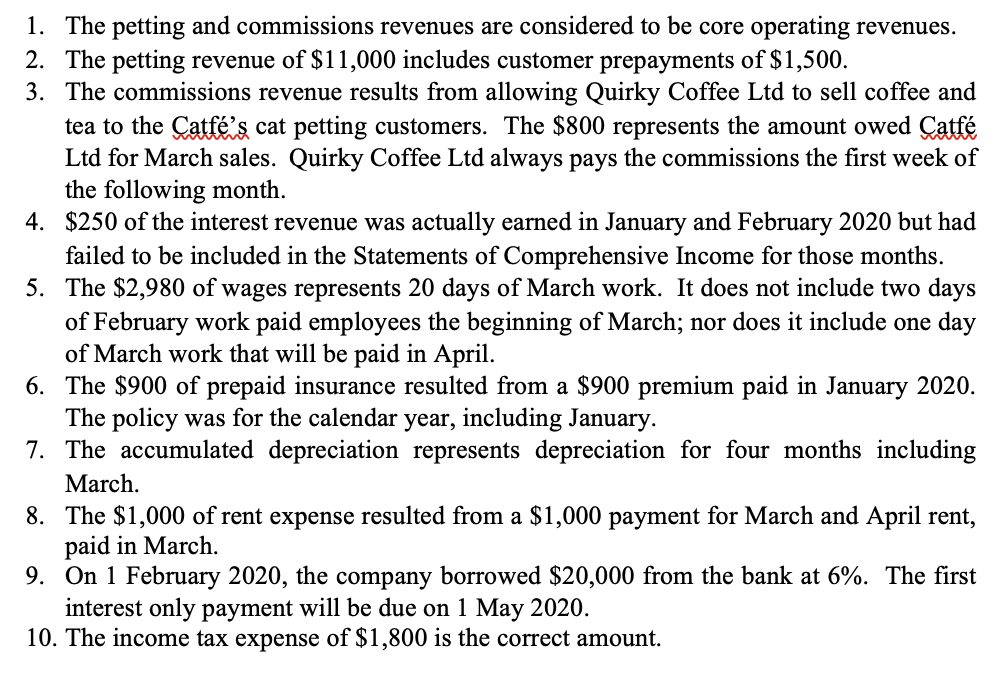

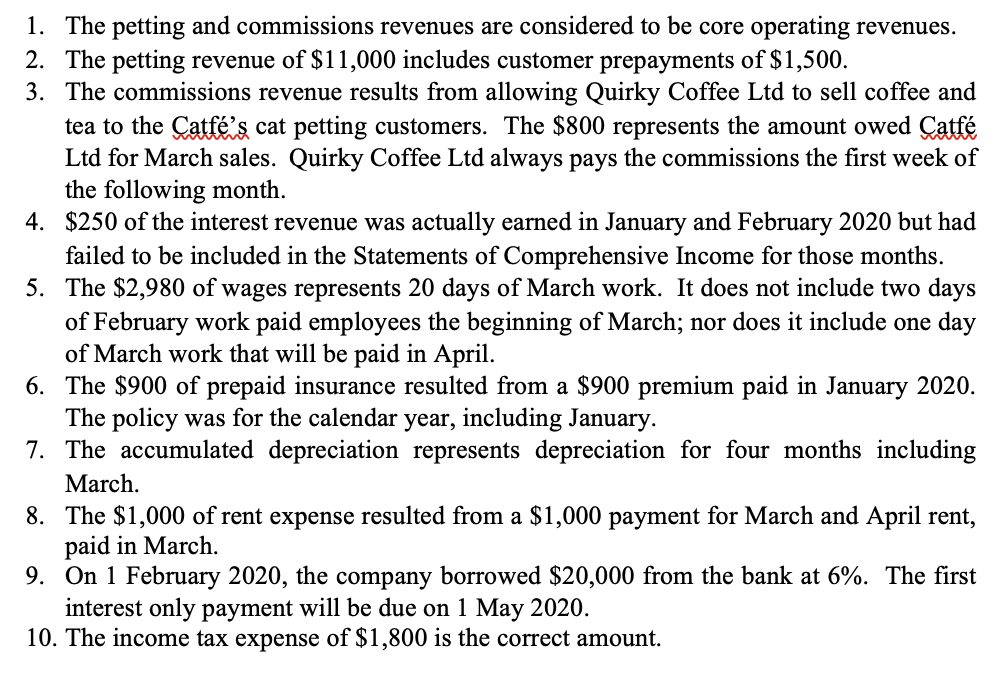

Catf Ltd, whose business model combines cat petting with coffee/tea drinking, has monthly accounting periods. The company is run by Ma Martin, a good manager but a poor accountant. From the 31 March 2020 adjusted trial balance, Ma prepared the following Statement of Comprehensive Income for the month. Catf Ltd Statement of Profit As at 31 March 2020 Income: Petting revenue $11,000 Commissions revenue 800 Other comprehensive income (foreign currency gain) 1,000 Interest revenue 300 13,100 Less: Advertising (520) Income Summary 10,480 Operating expenses: Wages $(2,980) Prepaid insurance (900) Accumulated depreciation (280) Rent expense (1,000) Income tax expense (1,800) Dividends declared (200) (7,160) $3,320 Net Income Beginning retained earnings 1,000 Ending retained earnings $4,320 You know that the Statement of Comprehensive Income has not been properly prepared and suspect that the adjusted trial balance also contains errors. Your goal is to prepare a correct Statement of Comprehensive Income for the month of March, 1. The petting and commissions revenues are considered to be core operating revenues. 2. The petting revenue of $11,000 includes customer prepayments of $1,500. 3. The commissions revenue results from allowing Quirky Coffee Ltd to sell coffee and tea to the Catf's cat petting customers. The $800 represents the amount owed Catf Ltd for March sales. Quirky Coffee Ltd always pays the commissions the first week of the following month. 4. $250 of the interest revenue was actually earned in January and February 2020 but had failed to be included in the Statements of Comprehensive Income for those months. 5. The $2,980 of wages represents 20 days of March work. It does not include two days of February work paid employees the beginning of March; nor does it include one day of March work that will be paid in April. 6. The $900 of prepaid insurance resulted from a $900 premium paid in January 2020. The policy was for the calendar year, including January. 7. The accumulated depreciation represents depreciation for four months including March. 8. The $1,000 of rent expense resulted from a $1,000 payment for March and April rent, paid in March. 9. On 1 February 2020, the company borrowed $20,000 from the bank at 6%. The first interest only payment will be due on 1 May 2020. 10. The income tax expense of $1,800 is the correct amount