Answered step by step

Verified Expert Solution

Question

1 Approved Answer

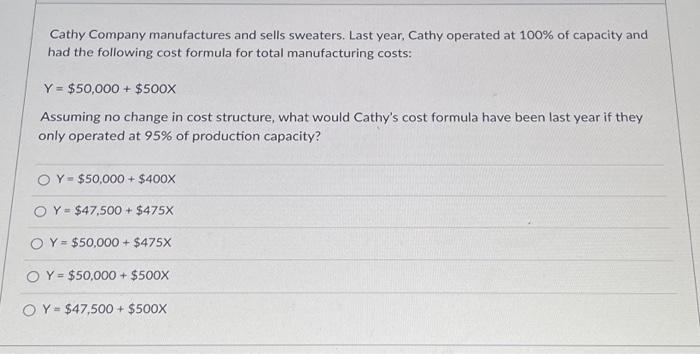

Cathy Company manufactures and sells sweaters. Last year, Cathy operated at 100% of capacity and had the following cost formula for total manufacturing costs:

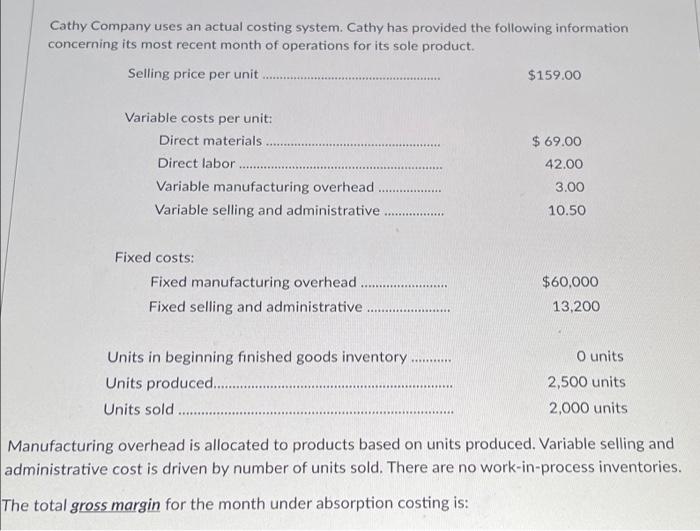

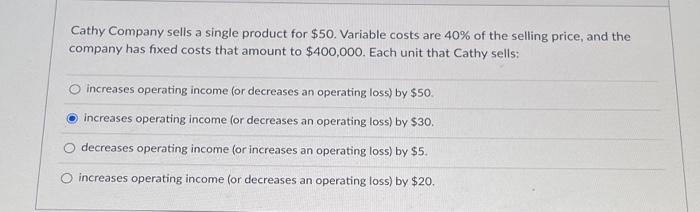

Cathy Company manufactures and sells sweaters. Last year, Cathy operated at 100% of capacity and had the following cost formula for total manufacturing costs: Y = $50,000+ $500X Assuming no change in cost structure, what would Cathy's cost formula have been last year if they only operated at 95% of production capacity? OY $50,000+ $400X OY $47,500 + $475X OY $50,000+ $475X OY $50,000 + $500X OY $47,500+ $500X Cathy Company uses an actual costing system. Cathy has provided the following information concerning its most recent month of operations for its sole product. Selling price per unit $159.00 Variable costs per unit: Direct materials $69.00 Direct labor 42.00 Variable manufacturing overhead 3.00 Variable selling and administrative 10.50 ****** Fixed manufacturing overhead $60,000 13,200 Fixed selling and administrative O units ********* Units in beginning finished goods inventory. Units produced.................. 2,500 units Units sold.................... 2,000 units Manufacturing overhead is allocated to products based on units produced. Variable selling and administrative cost is driven by number of units sold. There are no work-in-process inventories. The total gross margin for the month under absorption costing is: Fixed costs: Cathy Company sells a single product for $50. Variable costs are 40% of the selling price, and the company has fixed costs that amount to $400,000. Each unit that Cathy sells: increases operating income (or decreases an operating loss) by $50. increases operating income (or decreases an operating loss) by $30. decreases operating income (or increases an operating loss) by $5. increases operating income (or decreases an operating loss) by $20.

Step by Step Solution

★★★★★

3.50 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

1 At 95 capacity Y 50000500X Calculation 50000 is the fixed cost it remains same at all the levels V...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started