Answered step by step

Verified Expert Solution

Question

1 Approved Answer

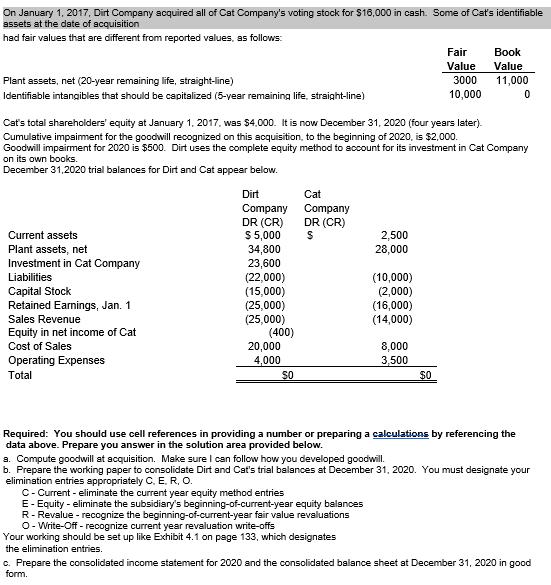

On January 1, 2017, Dirt Company acquired all of Cat Company's voting stock for $16,000 in cash. Some of Cats identifiable assets at the

On January 1, 2017, Dirt Company acquired all of Cat Company's voting stock for $16,000 in cash. Some of Cats identifiable assets at the date of acquisition had fair values that are different from reported values, as follows: Fair ook Value Value Plant assets, net (20-year remaining life, straight-line) 3000 11,000 Identifiable intangibles that should be capitalized (5-vesar remaining life, straight-line) 10,000 Cat's total shareholders' equity at January 1, 2017, was $4.000. It is now December 31, 2020 (four years later). Cumulative impaiment for the goodwill recognized on this acquisition, to the beginning of 2020, is $2,000. Goodwill impairment for 2020 is $500. Dirt uses the complete equity method to account for its investment in Cat Company on its own books. December 31,2020 trial balances for Dirt and Cat sppear below. Dirt Cat Company Company DR (CR) $ 5,000 34,800 23,600 (22,000) (15,000) (25,000) (25,000) (400) DR (CR) Current assets 2,500 28,000 Plant assets, net Investment in Cat Company Liabilities Capital Stock Retained Earnings, Jan. 1 Sales Revenue Equity in net income of Cat (10,000) (2,000) (16,000) (14,000) Cost of Sales Operating Expenses Total 20,000 4,000 SO 8,000 3,500 $0 Required: You should use cell references in providing a number or preparing a calculations by referencing the data above. Prepare you answer in the solution area provided below. a. Compute goodwill at acquisition. Make sure I can follow how you developed goodwill. b. Prepare the working paper to consolidate Dirt and Cat's trial balances at December 31, 2020. You must designate your elimination entries appropriately C. E. R, O. C- Current - eliminate the current year equity method entries E- Equity - eliminate the subsidiary's beginning-of-current-year equity balances R- Revalue - recognize the beginning-of-current-year fair value revaluations O- Write-Off - recognize current year revaluation write-offs Your working should be set up like Exhibit 4.1 on page 133, which designates the elimination entries. c. Prepare the consolidated income statement for 2020 and the consolidated balance sheet at December 31, 2020 in good form.

Step by Step Solution

★★★★★

3.44 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

Required solution of all three parts are given below Part A Computation of goodwill at acquisition C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started