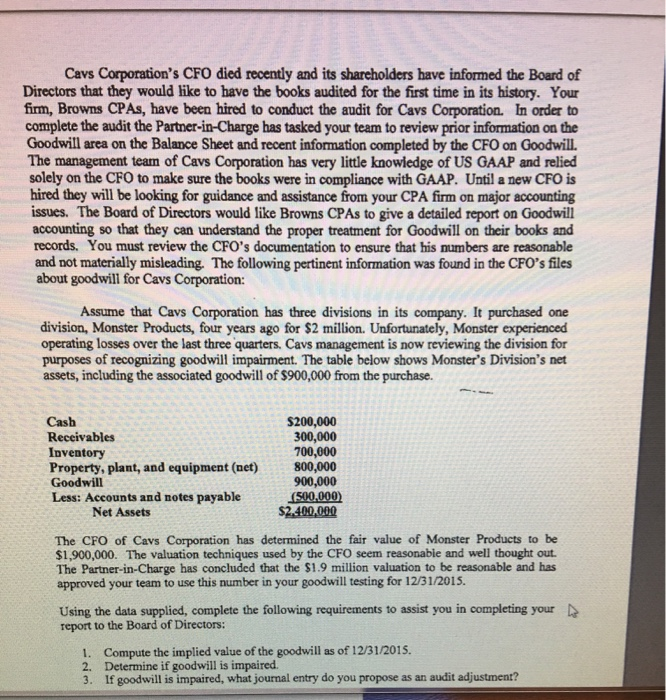

Cavs Corporation's CFO died recently and its shareholders have informed the Board of Directors that they would like to have the books audited for the first time in its history. Your fim, Browns CPAS, have been hired to conduct the audit for Cavs Corporation. In order to complete the audit the Partner-in-Charge has tasked your team to review prior information on the Goodwill area on the Balance Sheet and recent information completed by the CFO on Goodwill The management team of Cavs Corporation has very little knowiedge of US GAAP and relied solely on the CFO to make sure the books were in compliance with GAAP. Until a new CFO is hired they will be looking for guidance and assistance from your CPA firm on major accounting issues. The Board of Directors would like Browns CPAS to give a detailed report on Goodwill accounting so that they can understand the proper treatment for Goodwill on their books and records. You must review the CFO's documentation to ensure that his mumbers are reasonable and not materially misleading. The following pertinent information was found in the CFO's files about goodwill for Cavs Corporation: Assume that Cavs Corporation has three divisions in its company. It purchased one division, Monster Products, four years ago for $2 million. Unfortunately, Monster experienced operating losses over the last three quarters. Cavs management is now reviewing the division for purposes of recognizing goodwill impairment. The table below shows Monster's Division's net assets, including the associated goodwill of $900,000 from the purechase. $200,000 300,000 700,000 800,000 900,000 (500.000 $2.400,000 Cash Receivables Inventory Property, plant, and equipment (net) Goodwill Less: Accounts and notes payable Net Assets The CFO of Cavs Corporation has determined the fair value of Monster Products to be $1,900,000. The valuation techniques used by the CFO seem reasonable and well thought out The Partner-in-Charge has concluded that the $1.9 million valuation to be reasonable and has approved your team to use this number in your goodwill testing for 12/31/2015. Using the data supplied, complete the following requirements to assist you in completing your report to the Board of Directors: Compute the implied value of the goodwill as of 12/31/2015 1. 2. Determine if goodwill is impaired 3. If goodwill is impaired, what jourmal entry do you propose as an audit adjustment