Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CB Electronix needs to expand its capacity. It has two feasible alternatives under consideration. Both alternatives will have essentially infinite lives. Alternative 1: Construct a

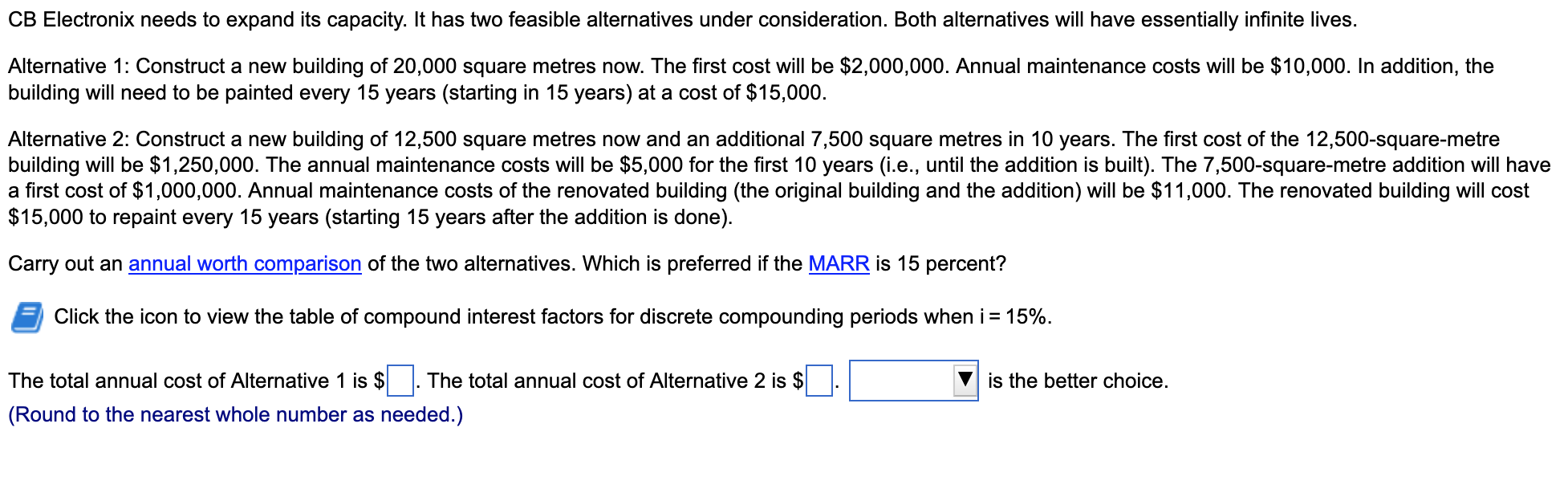

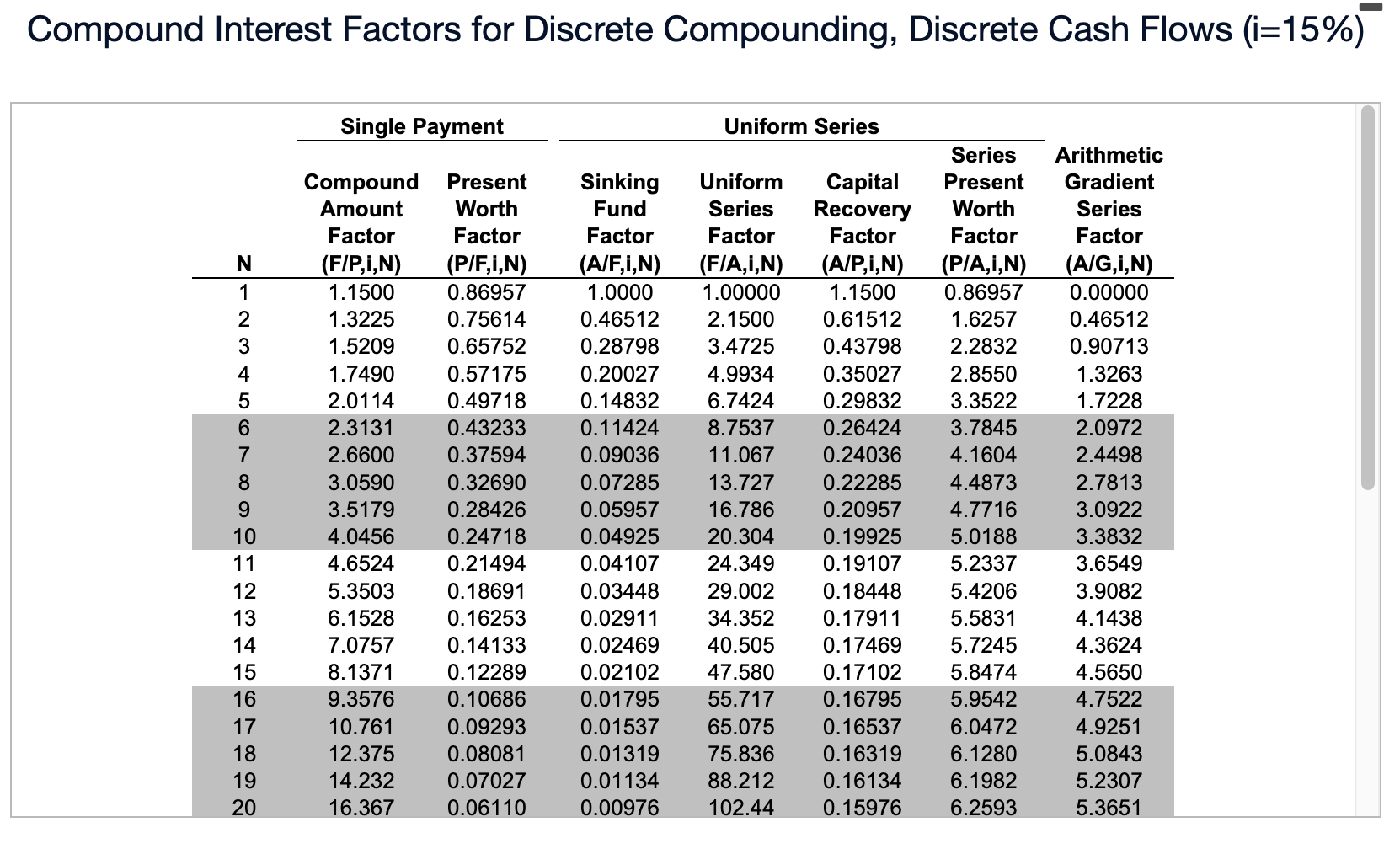

CB Electronix needs to expand its capacity. It has two feasible alternatives under consideration. Both alternatives will have essentially infinite lives. Alternative 1: Construct a new building of 20,000 square metres now. The first cost will be $2,000,000. Annual maintenance costs will be $10,000. In addition, the building will need to be painted every 15 years (starting in 15 years) at a cost of $15,000. Alternative 2: Construct a new building of 12,500 square metres now and an additional 7,500 square metres in 10 years. The first cost of the 12,500-square-metre building will be $1,250,000. The annual maintenance costs will be $5,000 for the first 10 years (i.e., until the addition is built). The 7,500 -square-metre addition will have a first cost of $1,000,000. Annual maintenance costs of the renovated building (the original building and the addition) will be $11,000. The renovated building will cost $15,000 to repaint every 15 years (starting 15 years after the addition is done). Carry out an of the two alternatives. Which is preferred if the is 15 percent? Click the icon to view the table of compound interest factors for discrete compounding periods when i=15%. The total annual cost of Alternative 1 is $ The total annual cost of Alternative 2 is $ is the better choice. (Round to the nearest whole number as needed.) Compound Interest Factors for Discrete Compounding, Discrete Cash Flows (i=15\%) CB Electronix needs to expand its capacity. It has two feasible alternatives under consideration. Both alternatives will have essentially infinite lives. Alternative 1: Construct a new building of 20,000 square metres now. The first cost will be $2,000,000. Annual maintenance costs will be $10,000. In addition, the building will need to be painted every 15 years (starting in 15 years) at a cost of $15,000. Alternative 2: Construct a new building of 12,500 square metres now and an additional 7,500 square metres in 10 years. The first cost of the 12,500-square-metre building will be $1,250,000. The annual maintenance costs will be $5,000 for the first 10 years (i.e., until the addition is built). The 7,500 -square-metre addition will have a first cost of $1,000,000. Annual maintenance costs of the renovated building (the original building and the addition) will be $11,000. The renovated building will cost $15,000 to repaint every 15 years (starting 15 years after the addition is done). Carry out an of the two alternatives. Which is preferred if the is 15 percent? Click the icon to view the table of compound interest factors for discrete compounding periods when i=15%. The total annual cost of Alternative 1 is $ The total annual cost of Alternative 2 is $ is the better choice. (Round to the nearest whole number as needed.) Compound Interest Factors for Discrete Compounding, Discrete Cash Flows (i=15\%)

CB Electronix needs to expand its capacity. It has two feasible alternatives under consideration. Both alternatives will have essentially infinite lives. Alternative 1: Construct a new building of 20,000 square metres now. The first cost will be $2,000,000. Annual maintenance costs will be $10,000. In addition, the building will need to be painted every 15 years (starting in 15 years) at a cost of $15,000. Alternative 2: Construct a new building of 12,500 square metres now and an additional 7,500 square metres in 10 years. The first cost of the 12,500-square-metre building will be $1,250,000. The annual maintenance costs will be $5,000 for the first 10 years (i.e., until the addition is built). The 7,500 -square-metre addition will have a first cost of $1,000,000. Annual maintenance costs of the renovated building (the original building and the addition) will be $11,000. The renovated building will cost $15,000 to repaint every 15 years (starting 15 years after the addition is done). Carry out an of the two alternatives. Which is preferred if the is 15 percent? Click the icon to view the table of compound interest factors for discrete compounding periods when i=15%. The total annual cost of Alternative 1 is $ The total annual cost of Alternative 2 is $ is the better choice. (Round to the nearest whole number as needed.) Compound Interest Factors for Discrete Compounding, Discrete Cash Flows (i=15\%) CB Electronix needs to expand its capacity. It has two feasible alternatives under consideration. Both alternatives will have essentially infinite lives. Alternative 1: Construct a new building of 20,000 square metres now. The first cost will be $2,000,000. Annual maintenance costs will be $10,000. In addition, the building will need to be painted every 15 years (starting in 15 years) at a cost of $15,000. Alternative 2: Construct a new building of 12,500 square metres now and an additional 7,500 square metres in 10 years. The first cost of the 12,500-square-metre building will be $1,250,000. The annual maintenance costs will be $5,000 for the first 10 years (i.e., until the addition is built). The 7,500 -square-metre addition will have a first cost of $1,000,000. Annual maintenance costs of the renovated building (the original building and the addition) will be $11,000. The renovated building will cost $15,000 to repaint every 15 years (starting 15 years after the addition is done). Carry out an of the two alternatives. Which is preferred if the is 15 percent? Click the icon to view the table of compound interest factors for discrete compounding periods when i=15%. The total annual cost of Alternative 1 is $ The total annual cost of Alternative 2 is $ is the better choice. (Round to the nearest whole number as needed.) Compound Interest Factors for Discrete Compounding, Discrete Cash Flows (i=15\%) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started