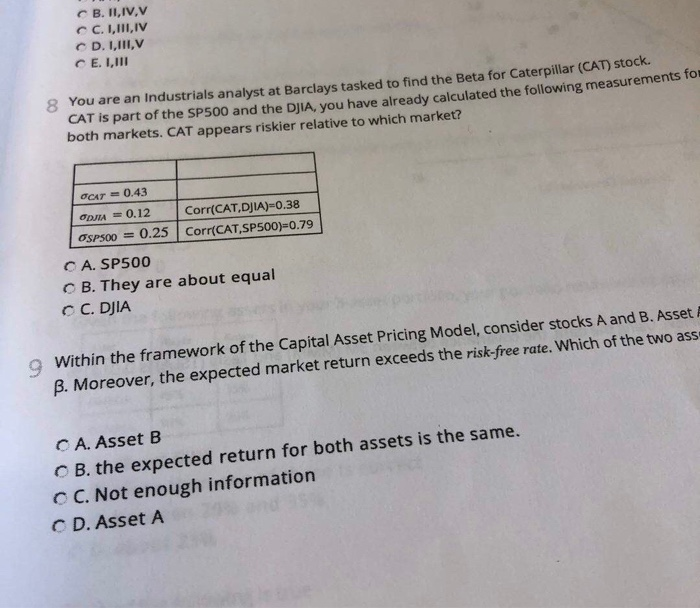

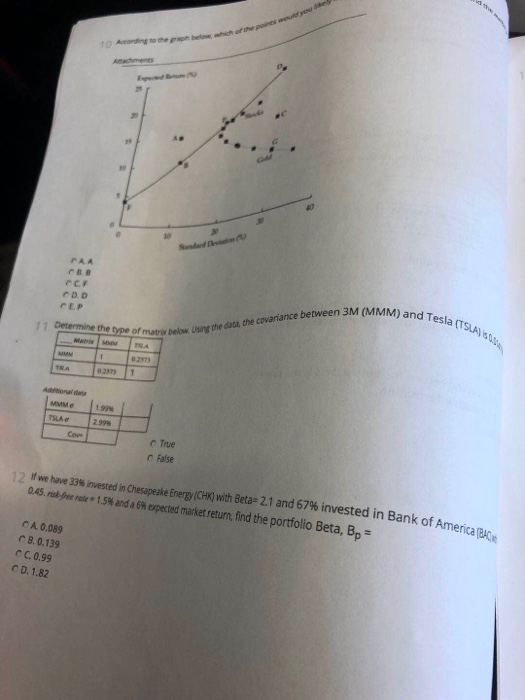

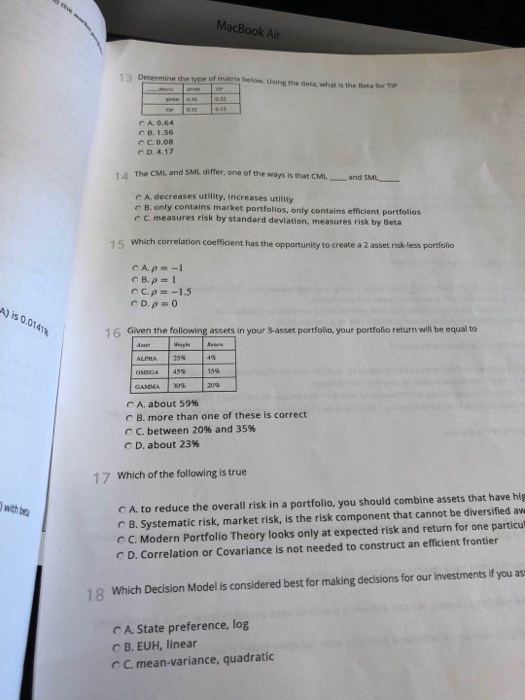

CB. II, IV, V CC. I,II,IV CD. I,III,V CE1,111 8 You are an Industrials analyst at Barclays tasked to find the Beta for Caterpillar (CAT) stock. CAT is part of the SP500 and the DIA, you have already calculated the following measuremens both markets. CAT appears riskier relative to which market? CAT = 0.43 ODJA = 0.12 Corr(CAT,DJIA)=0.38 SP500 = 0.25 Corr(CAT,SP500)=0.79 CA. SP500 B. They are about equal CC. DJIA Within the framework of the Capital Asset Pricing Model, consider stocks A and B. Asset B. Moreover, the expected market return exceeds the risk-free rate. Which of the two ass CA. Asset B OB. the expected return for both assets is the same. O C. Not enough information C D. Asset A CAA COD CEP and Tesla (TSLA the covariance between 3M (MMM)an Determine the type of s low. Using MA TA 1 MMM ITSLAG Com True false 12 If we have 33 invested in Chesapeake Energy ICHK) with Beta-2.1 and 67% invested in Bank of America 0.45. rofecrate 1.5% and a 6 expected market return, find the portfolio Beta, B Bank of America BA CA. 0.089 B. 0.139 CC. 0.99 CD. 1.82 MacBook Air arx below. Using the data what is the tets for CAO.GA 3.1.56 0.00 CD 4.17 The CML and SML differ, one of the ways is that CML and SML A decreases utility, increases utility CB only contains market portfolios, only contains efficient portfolios measures risk by standard deviation, measures risk by Beta 15 which correlation coefficient has the opportunity to create a 2 asset risk-less portfolio CAP = -1 CBp=1 CP= -1.5 CD.p=0 A) is 0.01414 16 Given the following assets in your 3-asset portfolio, your portfolio return will be equal to ALPHA 35 OCA 455 GAMMA 4% 156 2 A. about 59% CB. more than one of these is correct C. between 20% and 35% CD, about 23% 17 Which of the following is true CA. to reduce the overall risk in a portfolio, you should combine assets that have hig B. Systematic risk, market risk, is the risk component that cannot be diversified aw C. Modern Portfolio Theory looks only at expected risk and return for one particu D. Correlation or Covariance is not needed to construct an efficient frontier 18 Which Decision Model is considered best for making decisions for our investments if you as CA State preference, log CB. EUH, linear OC mean-variance, quadratic CB. II, IV, V CC. I,II,IV CD. I,III,V CE1,111 8 You are an Industrials analyst at Barclays tasked to find the Beta for Caterpillar (CAT) stock. CAT is part of the SP500 and the DIA, you have already calculated the following measuremens both markets. CAT appears riskier relative to which market? CAT = 0.43 ODJA = 0.12 Corr(CAT,DJIA)=0.38 SP500 = 0.25 Corr(CAT,SP500)=0.79 CA. SP500 B. They are about equal CC. DJIA Within the framework of the Capital Asset Pricing Model, consider stocks A and B. Asset B. Moreover, the expected market return exceeds the risk-free rate. Which of the two ass CA. Asset B OB. the expected return for both assets is the same. O C. Not enough information C D. Asset A CAA COD CEP and Tesla (TSLA the covariance between 3M (MMM)an Determine the type of s low. Using MA TA 1 MMM ITSLAG Com True false 12 If we have 33 invested in Chesapeake Energy ICHK) with Beta-2.1 and 67% invested in Bank of America 0.45. rofecrate 1.5% and a 6 expected market return, find the portfolio Beta, B Bank of America BA CA. 0.089 B. 0.139 CC. 0.99 CD. 1.82 MacBook Air arx below. Using the data what is the tets for CAO.GA 3.1.56 0.00 CD 4.17 The CML and SML differ, one of the ways is that CML and SML A decreases utility, increases utility CB only contains market portfolios, only contains efficient portfolios measures risk by standard deviation, measures risk by Beta 15 which correlation coefficient has the opportunity to create a 2 asset risk-less portfolio CAP = -1 CBp=1 CP= -1.5 CD.p=0 A) is 0.01414 16 Given the following assets in your 3-asset portfolio, your portfolio return will be equal to ALPHA 35 OCA 455 GAMMA 4% 156 2 A. about 59% CB. more than one of these is correct C. between 20% and 35% CD, about 23% 17 Which of the following is true CA. to reduce the overall risk in a portfolio, you should combine assets that have hig B. Systematic risk, market risk, is the risk component that cannot be diversified aw C. Modern Portfolio Theory looks only at expected risk and return for one particu D. Correlation or Covariance is not needed to construct an efficient frontier 18 Which Decision Model is considered best for making decisions for our investments if you as CA State preference, log CB. EUH, linear OC mean-variance, quadratic