Question

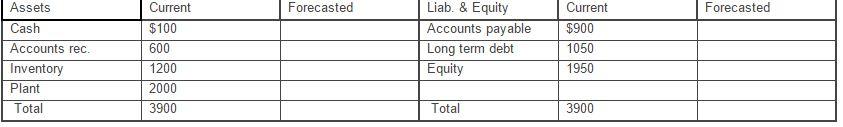

CCA ltd. has sales of $6,000 and the following balance sheet. Assume that all current assets and current liabilities change with sales and that sales

CCA ltd. has sales of $6,000 and the following balance sheet.

Assume that all current assets and current liabilities change with sales and that sales are expected to grow to $8,000.

a. Use the percent of sales forecasting method to forecast these values and enter them in the forecast column of the balance sheet above.

b. The net profit margin (what the firm earns on sales) is 8%. Forecast the new level of equity and enter it in the forecast column of the balance sheet above.

c. Complete the balance sheet. Does the firm require additional external financing hint EFR calculation)? If so, how much?

Liab. & Equity Accounts payable Long term debt Equity Assets Current Forecasted Current Forecasted Cash $100 $900 Accounts rec. 600 1050 Inventory 1200 1950 Plant 2000 Total 3900 Total 3900

Step by Step Solution

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Required solution Workings Current Sales 600000 Expected Sales 800000 Increase in sales 80006000 200...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635dedc008e3b_180056.pdf

180 KBs PDF File

635dedc008e3b_180056.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started